TL;DR

- Pi Network’s token suffered a steep collapse, losing almost half its value within hours as leveraged futures liquidations cascaded through thin liquidity pools.

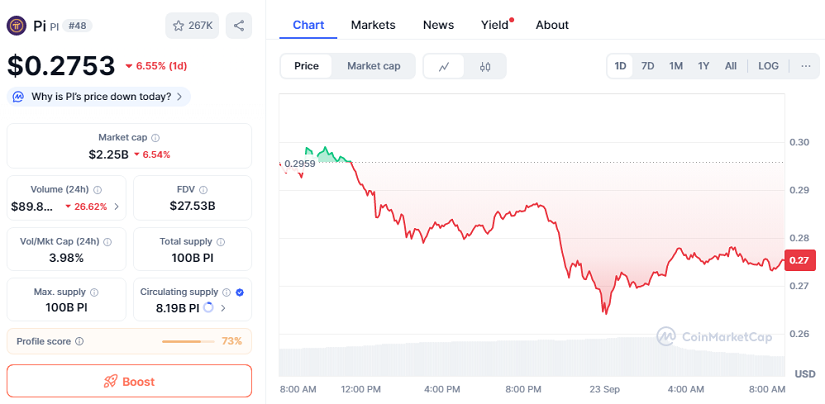

- The coin now trades near $0.2753, down 6.55% in the last 24 hours, with a market cap of $2.25 billion and daily volume above $89 million.

- Analysts stress that unmigrated supply, shaky sentiment, and doubts about exchange-traded PI remain core risks, though some see room for recovery if structural issues are addressed.

The Pi Network token experienced one of its harshest weeks since trading began, plunging nearly 50% in a short window before stabilizing near $0.2753. Daily losses remain significant at -6.55%, while volume dropped by more than 26% to $89 million, underscoring the fragility of liquidity across exchanges. Despite these headwinds, the project still boasts a $2.25 billion market capitalization, highlighting both investor interest and the lingering uncertainty surrounding its long-term path.

Pi Liquidations And The Leverage Trap

Market observers argue that the crash was amplified by cascading futures liquidations, with traders caught on the wrong side of leveraged bets. Initial selling pressure started with relatively small trades but quickly spiraled into a wave of forced exits, overwhelming Pi’s thin order books.

The presence of billions of unmigrated tokens continues to shadow the market. This overhang leaves Pi more vulnerable to sudden drawdowns compared with assets like Bitcoin, which benefit from deeper liquidity and broader adoption. While some traders argue Pi often mirrors Bitcoin’s price movements, the severity of its corrections tends to be sharper, reinforcing concerns about its current market structure.

Founders’ Appearance Fails To Calm The Market

Ironically, the selloff coincided with the first public appearance of Pi Network’s founders at an event in Seoul. Hopes that their visibility might boost confidence were quickly dashed, as the token kept sliding despite attempts to highlight progress within the ecosystem.

Critics point to a core disconnect: while Pi positions itself as a project rooted in grassroots adoption, many long-time miners remain skeptical about the legitimacy of exchange-traded PI. Without broader trust and actual circulation, price discovery risks being driven mainly by speculation and leverage.

Still, some in the crypto sector take a more optimistic stance. They argue that volatility, while painful, is part of the natural evolution of digital assets. Pi’s large user base, coupled with increasing pressure to migrate tokens, could create opportunities for stabilization once speculative excess is flushed out.

For now, the token stands at a crossroads. Unless liquidity improves and supply bottlenecks are resolved, further downside risk cannot be ruled out.