TOP 5 Crypto Staking Platforms to Invest in 2026

TL;DR: Staking in 2026 rewards locked tokens with crypto yield, but platform reputation, fees, lock-ups, and supported asset coverage define net outcomes. Binance stands out for

In this section you will find articles on a wide variety of topics. All of them have an in-depth analysis from our experts, giving their opinion and vision.

The world of cryptocurrencies and blockchain can be confusing and complicated for those who are new to the topic. That is why our team of professionals seeks to inform in a detailed yet easy to understand way.

The articles in this section will range from topics related to the most important cryptocurrency, Bitcoin, to current issues.

If you want to know all the details of a given topic, from the perspective of our experts, this is your place.

TL;DR: Staking in 2026 rewards locked tokens with crypto yield, but platform reputation, fees, lock-ups, and supported asset coverage define net outcomes. Binance stands out for

TL;DR Jurien Timmer from Fidelity warns that Bitcoin could face a crypto winter in 2026, with declines potentially reaching between $13,000 and $23,000. The historical four-year

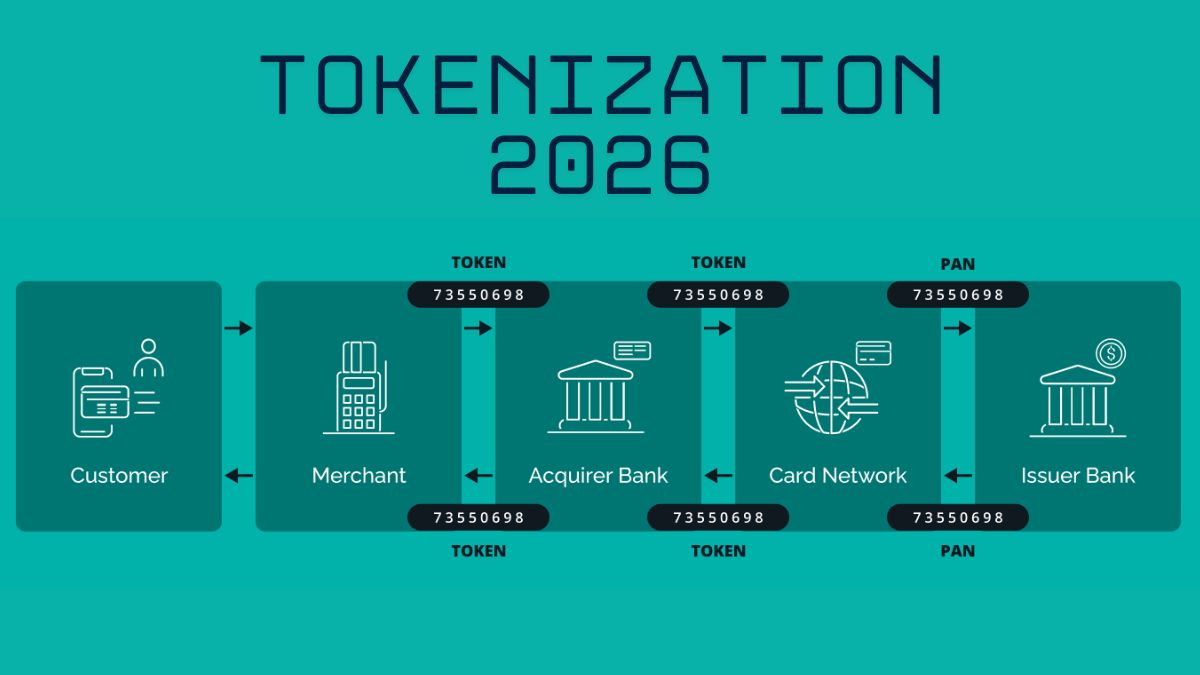

TL;DR Tokenization is moving beyond the pilot phase and into traditional finance. 2026 is shaping up as a turning point driven by the convergence of regulation,

TL;DR: Grayscale says 2026 accelerates an institutional model, with dispersion rising as protocols with compliance readiness outperform weaker narratives. Macro drivers include scarce digital commodities; the

TL;DR Exchanges have evolved to prioritize simplicity and fast onboarding, offering clear interfaces, quick swaps, and a variety of payment methods. ChangeNOW tops the list thanks

TL;DR The NFT market is undergoing a reinvention, moving away from speculation and transforming into digital infrastructure across multiple industries, redefining its role in Web3. NFTs

TL;DR Stablecoins are moving from trading tools to financial infrastructure in 2026, with revenue opportunities in routing, coordination, and settlement across on-chain and off-chain systems. Nick

TL;DR Developers plan two 2026 upgrades, Glamsterdam and Hegota, and want a predictable twice yearly release cadence to reduce uncertainty. Glamsterdam targets H1 2026, focusing on

TL;DR 2026 could mark a turning point for DePIN, as these networks address real gaps in connectivity, energy, and data across emerging markets where traditional infrastructure

TL;DR: AI spending looks durable into 2026, but chip shortages, mild deflation, and weaker funding quality could cap growth; crypto-AI saw 282 funded projects in 2025.

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy