TL;DR

- Onyx launches Goliath, a Layer-1 blockchain designed for financial institutions, with a capacity of up to 24,000 transactions per second and based on a Proof-of-Stake (PoS) consensus model, making it more efficient and sustainable.

- Interoperability with traditional networks, allowing integration with existing banking infrastructures and improving blockchain adoption in the financial sector.

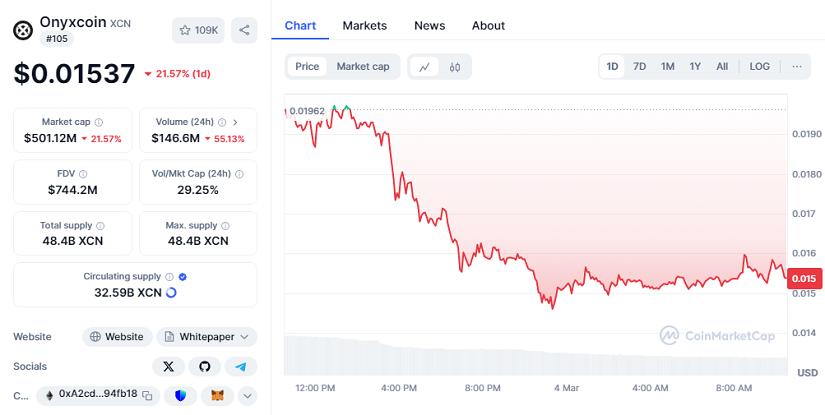

- The token XCN faces difficulties despite the announcement, with a drop of more than 21%, reflecting the volatility of the crypto market amidst macroeconomic tensions.

Onyx has unveiled Goliath, a high-speed blockchain created for financial institutions that promises to transform the industry with a scalable, secure, and efficient infrastructure. Its main attraction is the ability to process up to 24,000 transactions per second (TPS), similar to traditional payment networks like Visa, but with the advantages of blockchain technology. This innovative solution could potentially redefine the way large financial entities manage payments and digital transactions effectively and securely.

A Technological Leap for the Financial Sector

Goliath is based on a Proof-of-Stake (PoS) consensus model, a more environmentally friendly and efficient system compared to Proof-of-Work (PoW). Instead of relying on high energy demand, PoS allows validators to be selected based on the number of tokens staked, reducing costs and the carbon footprint. This is key to attracting large institutions seeking blockchain solutions without compromising sustainability.

Additionally, Goliath’s interoperability with traditional financial infrastructures means that banks and other industry players will be able to integrate it without the need to rebuild their systems from scratch. This feature could accelerate blockchain adoption in banking and cross-border payments, providing greater security and speed for transactions.

Challenges in the Crypto Market

Despite the announcement, the Onyxcoin (XCN) token has experienced a drop of over 21% in the past 24 hours, reflecting the volatility and instability of the crypto market amid global economic uncertainty. In February, XCN suffered a 50% loss, and although the launch of Goliath could bring new opportunities, investors remain cautious.

Goliath’s roadmap includes the launch of a testnet in the third quarter of 2025, with the implementation of the mainnet in the first quarter of 2026. In the meantime, Onyx will continue to develop its ecosystem, including a rewards program in its Layer-3 XCN Ledger, incentivizing user participation with assets like WETH and USDT.

Onyx’s challenge will be to convince investors and financial institutions that Goliath can compete with other blockchain solutions. With its focus on speed, scalability, and sustainability, the project could become a key reference in the institutional adoption of blockchain technology. However, only time will tell if it will manage to consolidate itself in such a highly competitive market.