TL;DR

- ZachXBT’s investigation reveals how a trader generated $20 million in profits through high-leverage trades on Hyperliquid and GMX.

- The funds used are suspected to originate from illicit activities, raising concerns in the crypto community about the security of decentralized platforms.

- Despite the controversy, Hyperliquid continues to grow, recording a trading volume of $4.49 billion in the past seven days.

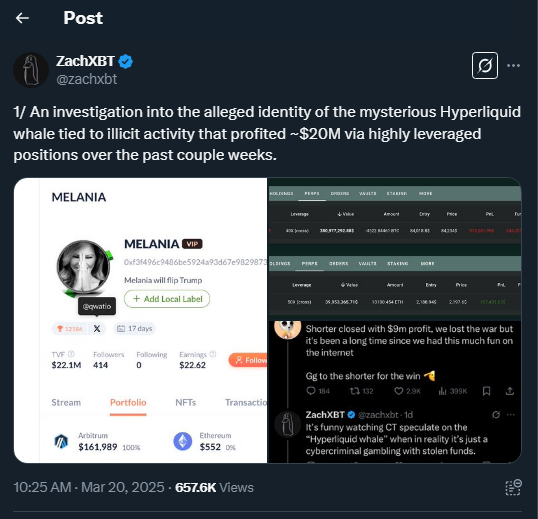

On-chain investigator ZachXBT has uncovered how a trader managed to earn $20 million in profits through highly leveraged trades on the Hyperliquid and GMX platforms. According to his report published on March 18, 2025, this individual used multiple addresses, including 0xe4d3 and 0xf3F4, to execute long and short positions in crypto assets such as Bitcoin and Ethereum with remarkable precision and volume.

The news has caused a stir in the community, as some suspect that the funds used in these trades originate from fraudulent activities. ZachXBT has hinted that the trader could be linked to previous scams, underscoring the inherent risks of the financial anonymity provided by these platforms.

Financial Success or a Dangerous Game?

A crucial part of ZachXBT’s investigation is the possible connection between these funds and phishing schemes, as well as online gambling platforms such as Roobet and Gamdom. Historically, the crypto community has been vulnerable to such practices, and this case is no exception.

However, while some see this situation as a warning, others consider the profits earned as proof of the potential of algorithmic trading in decentralized markets. Platforms like Hyperliquid are designed to allow unrestricted access, which has been key to their exponential growth. Additionally, this incident raises questions about whether decentralized exchanges should implement stronger security protocols to prevent illicit actors from exploiting loopholes for financial gain.

Market Impact and Future Outlook

Despite the controversy, Hyperliquid continues to establish itself as one of the most active trading platforms, with a weekly trading volume of $4.49 billion and revenue of $68.5 million.

As for the market, Ethereum (ETH) is currently priced at $1,983.95, down 1.81% in the last 24 hours, while Bitcoin remains stable in the $60,000 range. Analysts suggest that regulation may tighten, but they also highlight that blockchain technology will continue evolving to enhance the security and transparency of the crypto ecosystem.

ZachXBT’s investigation once again demonstrates the importance of vigilance in decentralized markets but also highlights the potential of these spaces to generate significant financial opportunities. The key will be balancing innovation with user protection.