TL;DR

- Octra Labs launches a $20 million public OCT token sale on December 18.

- Sale uses a fair, pro-rata allocation model with immediate token liquidity.

- OCT targets a $2 billion fully diluted valuation, far above current trading.

Octra Labs, a privacy-oriented blockchain project, prepares a public sale of its Omnity Convertible Token (OCT) on the Sonar platform from 18 December, with a target raise of $20 million. The team uses an allocation model with a fixed sale price and a commitment-based deposit system, and presents the event as a way to deepen decentralization and broaden the base of onchain holders.

The sale design assigns OCT proportionally according to funds each participant deposits. Large tickets do not receive special discounts or private tranches, which keeps terms aligned between wallets of different sizes. All tokens sold in the event remain fully liquid after distribution, without vesting schedules or cliff periods, an element that may attract traders who avoid long lockups.

Organizers also define a clear path for any unsold share of the pool. If demand falls short of the full $20 million allocation, Octra Labs plans to remove remaining OCT from circulation through burns rather than hold those units in a treasury. In the opposite case, strong participation could draw extra supply from reserves, within the limits announced for the program. Together, pricing, pro-rata allocation and burn rules build a simple structure that markets can model.

Investor interest already starts to build around the event

Funds such as Big Brain Holdings and Finality Capital Partners track the sale and share views on social channels. Commentary from those desks concentrates on two elements: a higher valuation level for OCT compared with the previous round and a stronger push toward decentralization through a public, rules-based sale instead of informal over-the-counter placements.

The team links the raise to a broader plan for the network. A more dispersed holder base may support security and liquidity for the underlying privacy chain, while a higher fully diluted valuation sends a clear signal on how early backers and new entrants currently price future cash flows and protocol usage. Double the valuation versus the last financing step reflects higher confidence in privacy blockchain projects in general and in Octra Labs in particular.

Did you know? Very few crypto projects reach a $2 billion fully diluted valuation during early stages of their token life. That level places OCT in a small group of assets where markets assign large potential to future fee revenue, network usage and demand for privacy tools.

Valuation, trading data and supply profile for OCT

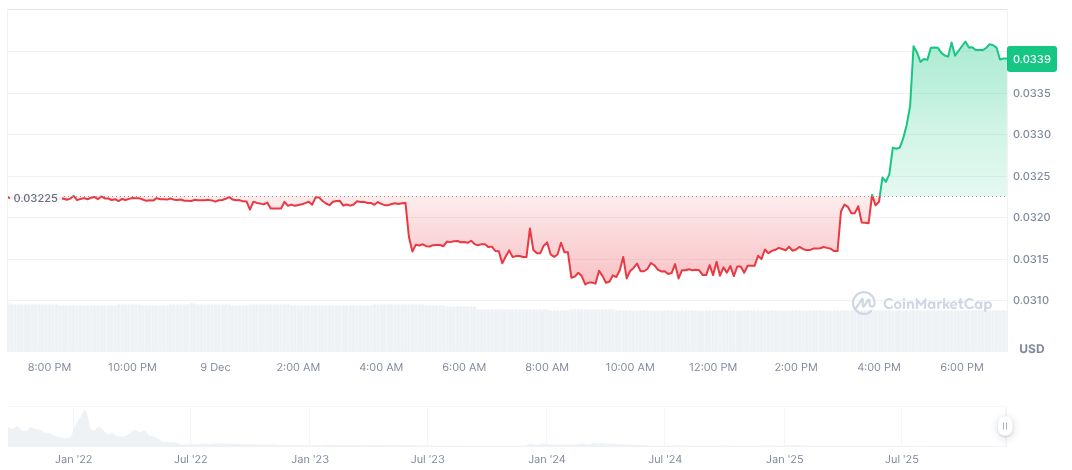

Away from primary markets, secondary data on OCT paints a more modest picture for now. According to recent price feeds, OCT trades around $0.03 with a market capitalization near $3.39 million and zero share of overall market dominance. All 100 million OCT sit in circulation, which means current supply already reflects the full token count and does not hide future dilution behind large locked tranches.

Daily trading volume recently declined by about 12.44% to roughly $71,637, yet the token price still climbed around 5.11% in the same period. That combination points to cautious buying interest in a relatively thin market, where modest order flow can move price without large capital deployment. Traders who study order books around the Sonar sale will likely track how volume and volatility react as the event date approaches.

A $2 billion valuation figure for OCT stands far above today’s market capitalization and implies a steep gap between current trading levels and the value Octra Labs aims to anchor through the sale. For early buyers, the difference between spot metrics and target valuation frames the risk–reward profile: upside depends on execution of the privacy network and real demand for its tools, while downside reflects the possibility that secondary markets fail to adjust toward the implied level after the raise.