TL;DR:

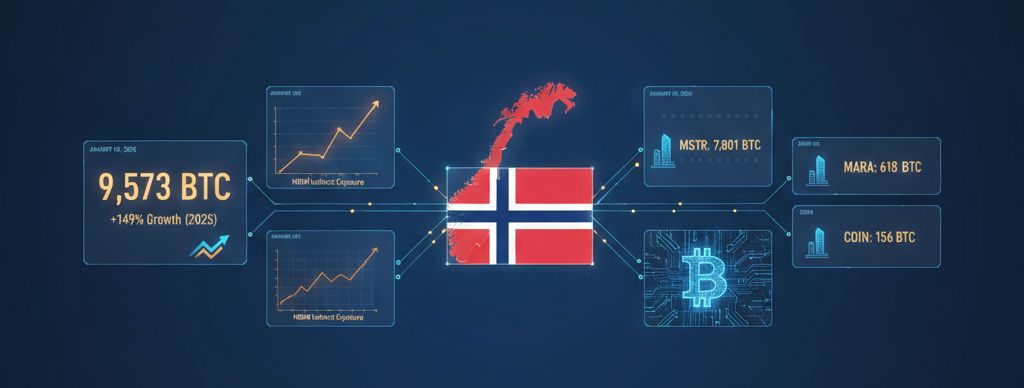

- The Norwegian sovereign wealth fund increased its indirect holdings by 149% during the last fiscal year.

- The total figure amounts to 9,573 BTC, valued at approximately $837 million.

- MicroStrategy leads the exposure, contributing 81% of the assets linked to the cryptocurrency.

The world’s largest sovereign wealth fund has reinforced its presence in the digital asset sector. K33 Research revealed that Norway’s indirect Bitcoin exposure experienced a 149% growth during 2025, reaching a total of 9,573 BTC.

While it is true that Norges Bank Investment Management (NBIM) does not acquire the cryptocurrency directly, its global diversification strategy has led it to own key stakes in companies that do. Companies such as MicroStrategy, MARA, Metaplanet, Coinbase, and Block are part of the portfolio driving this trend.

K33’s Head of Research, Vetle Lunde, noted that this figure is equivalent to approximately 8.5 billion Norwegian kroner ($837 million). However, analysts suggest that this increase is not necessarily a deliberate decision, but rather a consequence of the aggressive BTC accumulation by the companies in which the fund invests.

Institutional Adoption and Portfolio Diversification

The impact of Norway’s indirect Bitcoin exposure is a clear example of how this asset is inevitably penetrating traditional finance. Although the total weighting remains at a modest 0.04% of the fund’s total value, the steady growth reflects an underlying institutional adoption that transcends short-term price volatility.

In the breakdown by company, MicroStrategy leads the portfolio, contributing 7,801 BTC of the total. Furthermore, the investment in the Japanese firm Metaplanet stands out, where the fund holds 1.69% of the shares, representing a geographically and operationally diversified bet within the crypto ecosystem.

In summary, while markets face fluctuations, the Norwegian sovereign wealth fund continues to increase its digital footprint passively. Investors should monitor how these indirect holdings evolve in 2026, as they consolidate Bitcoin as an intrinsic component of the most robust and diversified institutional portfolios on the planet.