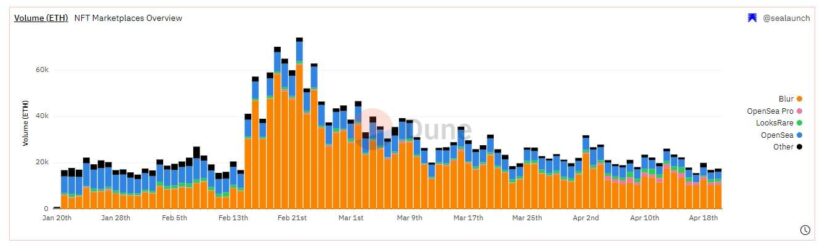

Leading non-fungible tokens (NFT) marketplaces including OpenSea and Blur among others have witnessed a sharp decline in the number of daily users and sales over the last week. In addition, the number of unique users across top NFT marketplaces have also dropped to new lows not seen since July 2021.

This comes amidst a downturn in the broader crypto market as concerns of a stubbornly high inflation fanned fears of higher-for-longer interest rates. Bitcoin (BTC) plunged below the psychological level of $30K and Ethereum (ETH) slipped below the $2,000 mark for the first time since April 13.

Other major altcoins experienced steeper declines with increasing potential that the Fed could push the economy into a recession with another set of rate hikes. Growing market fears pushed investors to move away from riskier assets.

NFTs Sales Take A Hit

According to analytics platform Dune, sales across NFT marketplaces have taken a hit over the last seven days, with 16,149 sales recorded on April 19. The last time the number of sales was that low was in November, 2021, with 12,910 sales.

The report compiled by NFT researcher SeaLaunch also revealed the number of unique users across leading marketplaces including Blur, OpenSea and LooksRare dropped to 7,805 on April 19. The number of unique users across NFT marketplaces hasn’t been that low since July, 2021, when the number of unique users on the top NFT marketplaces was recorded at 7,455.

As per the data, Blur has experienced a sharp drop in the number of sales, this week, with approximately 5,688 sales on Thursday, posting its lowest daily sales count in the past 90 days. In the same time frame, the number of Blur daily unique users also nosedived.

Meanwhile, the number of daily traders on OpenSea spiralled downwards, hitting 10,640 on April 18. The daily trader count on the platform hasn’t fallen below 10,000 since July 2021.

there's been an incredible drop off in unique NFT buyers/sellers in the last week

less than 10k wallets now on all platforms

(h/t @SeaLaunch_ ) pic.twitter.com/pkem6v8rOe

— Giancarlo (@GiancarloChaux) April 20, 2023

Why Are NFT Sales Falling?

It remains unclear as to why daily users and sales have taken a hit across NFT marketplaces. However, there has been an observable decrease in activity across marketplaces and users. It seems the recent meltdown is largely due to the macroeconomic factors including such as high gas prices and tax payment liquidity issues. In respose to the sudden downtrend, NFT data and research platform, SeaLaunch said,

“We analysed in the past the type of users of each NFT marketplace according to their trading in the NFT market. Interestingly, all type of users (from heavy traders to “normal” nft traders) are decaying activity at same pace.”

4/ We analysed in the past the type of users of each NFT marketplace according to their trading in the NFT market.

Interestingly, all type of users (from heavy traders to "normal" nft traders) are decaying activity at same pace.

Source: https://t.co/ZSpTmGl9Qs pic.twitter.com/9Ca8RBPdbl

— sealaunch.xyz (@SeaLaunch_) April 20, 2023

Furthermore, SeaLaunch reported there are other factors as well that have likely contributed to the recent plunge. Asset rotation due to tax payments and meme coins boom in the last few days are two major factors responsible for the worst performance in terms of users and sales on most NFT Marketplaces in the last 365 days.