TL;DR

- NFT sales dropped 63% during the first quarter of 2025, falling from $4.1 billion to $1.5 billion.

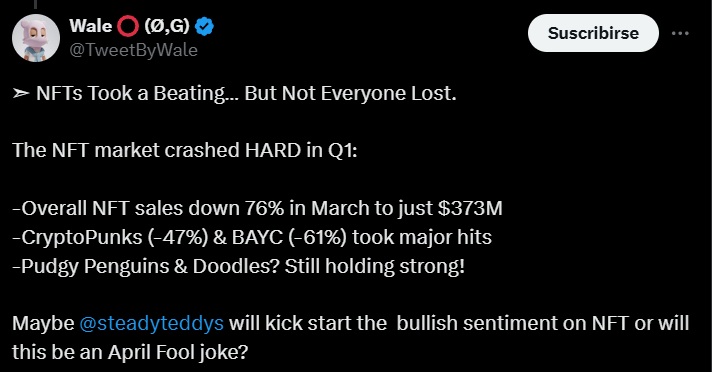

- Pudgy Penguins, Doodles, and Milady Maker grew despite the downturn, while CryptoPunks and BAYC suffered major declines.

- Bitcoin NFTs saw an increase in average price, but sales plummeted by 79%.

The NFT market experienced a sharp decline in the first quarter of 2025, with sales dropping 63% compared to the same period last year.

Trading volume fell from $4.1 billion in 2024 to $1.5 billion in the first three months of this year. March was the hardest-hit month, with a 76% drop from the previous year. Despite the overall downturn, some collections managed to grow, while others that previously led the sector suffered significant losses in sales volume.

For example, Pudgy Penguins stood out with $72 million in transactions, driven by a 13% increase in demand. Doodles also expanded, with sales rising from $22.6 million to $32 million. Its partnership with McDonald’s helped extend its reach and attract new buyers. Milady Maker recorded the highest growth, with a 58% increase in revenue during the quarter.

Major Setback for the Most Popular NFT Collections

In contrast, CryptoPunks and Bored Ape Yacht Club performed far worse. CryptoPunks saw a 47% drop in sales throughout 2024. During the first quarter of last year, buyers spent $114 million on these NFTs, but trading activity declined in the following months. BAYC, which had previously dominated the market, saw its sales volume shrink by 61%, falling from $78 million to $29.8 million in Q1 2025.

The Bitcoin NFT market showed mixed results. While prices rose, reaching an average of $633.24—surpassing $559.05 in 2024 and $63.45 in 2023—sales volume plummeted by 79%. In Q1 2024, transactions totaled $1.4 billion, but this year the figure dropped to $291 million. Charlie Hu, co-founder of Bitlayer, noted that interest in Bitcoin Ordinals, which had previously driven the market, has declined significantly.

The performance of the NFT market in the first quarter reflects ongoing shifts in its dynamics. While some collections continue to attract buyers, others have lost relevance.