AI Becomes Core Portfolio Infrastructure, Crypto Still Marginal for Family Offices

TL;DR AI leads: 65% of 333 family offices prioritize AI now or later; 17% cite crypto and digital assets as a key theme. Crypto stays marginal:

The blockchain technology has its place in each of the different markets and it is interesting to be up-to-date with the novelties that occur in them.

That is why from Crypto-Economy we bring the selection of the most relevant news of the different markets that have come into contact with blockchain and cryptocurrencies.

If you want to be the first to find out about the latest news related to the different markets, do not forget to visit our section.

TL;DR AI leads: 65% of 333 family offices prioritize AI now or later; 17% cite crypto and digital assets as a key theme. Crypto stays marginal:

TL;DR Bitcoin inflows: Bitcoin ETFs added over $561 million as BTC rebounded toward $78,600, with major issuers driving renewed institutional demand. Ethereum accumulation: ETH ETFs saw

TL;DR Market Outflows: Digital asset products saw $1.7 billion in weekly withdrawals, pushing global YTD flows to a $1 billion outflow as sentiment weakened amid a

TL;DR Prediction markets are capturing speculative demand once dominated by altcoins, offering short-duration, outcome-based exposure that is fully settled on-chain. Gen Z participation continues to rise

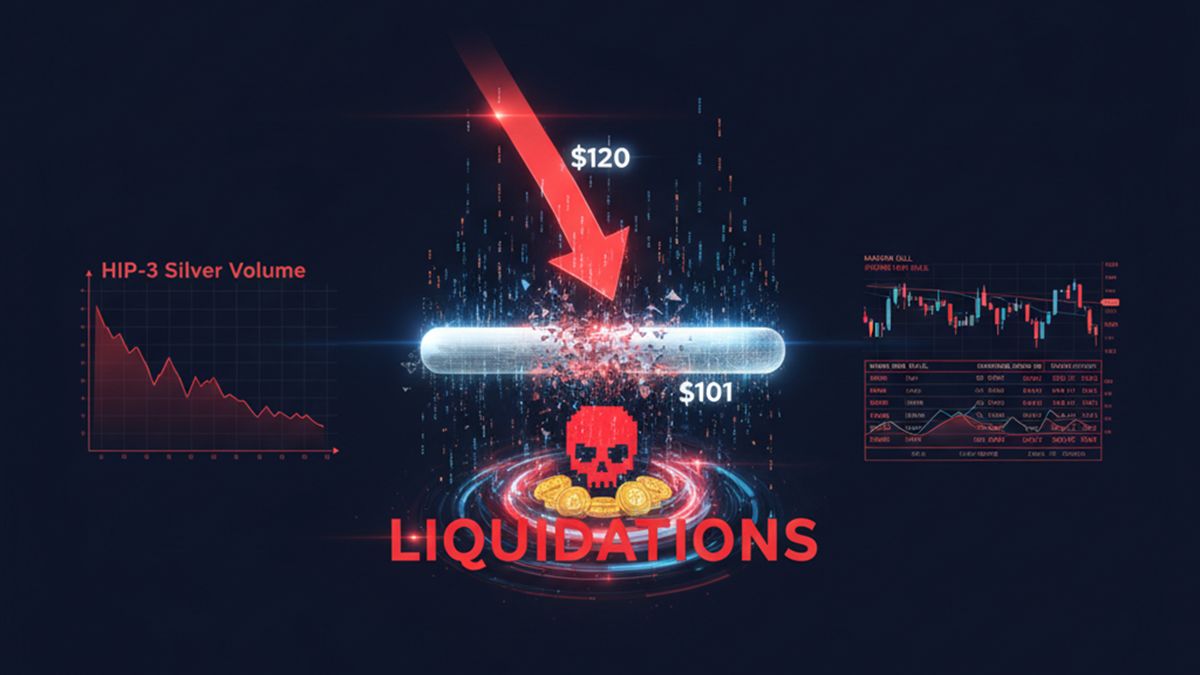

TL;DR: The price of silver suffered a sudden crash from $120 to $101 per ounce. A whale on the Hyperliquid platform lost over $8.99 million in

TL;DR U.S.-listed spot Bitcoin and Ethereum ETFs saw nearly $1 billion in outflows in a single session. BTC dropped below $85,000 and ETH to $2,700. The

TL;DR Bitcoin fell 2.1% and is trading at $88,000. Trading volume rose 4.2% to $42.9 billion. The broader market followed the same trend. The crypto market

TL;DR Wall Street warns the SEC that crypto exemptions could destabilize markets and hurt investor protection. They argue regulation should be based on economic activity, not

TL;DR Investors are piling into tokenized gold, with Paxos Gold (PAXG) seeing record January inflows. Surging physical gold prices above $5,300 drive value and demand for

TL;DR CME reported record crypto activity in Q4, led by ETH, SOL, and XRP futures. The exchange is shifting to 24/7 trading and launching new altcoin

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy