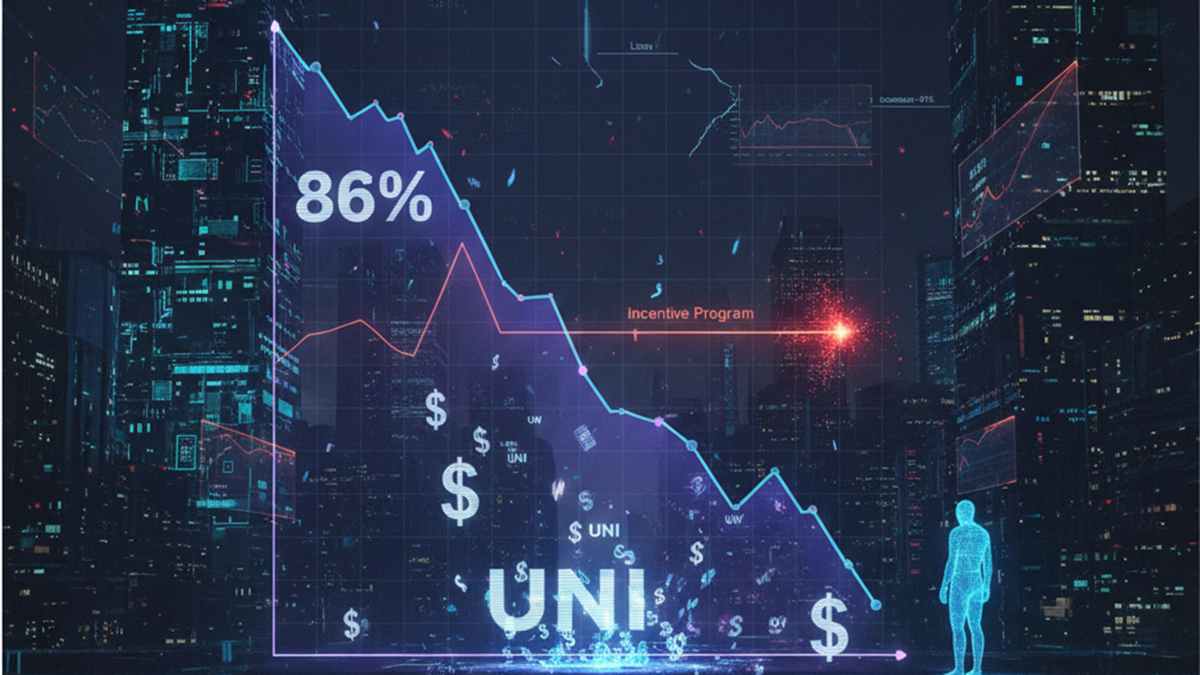

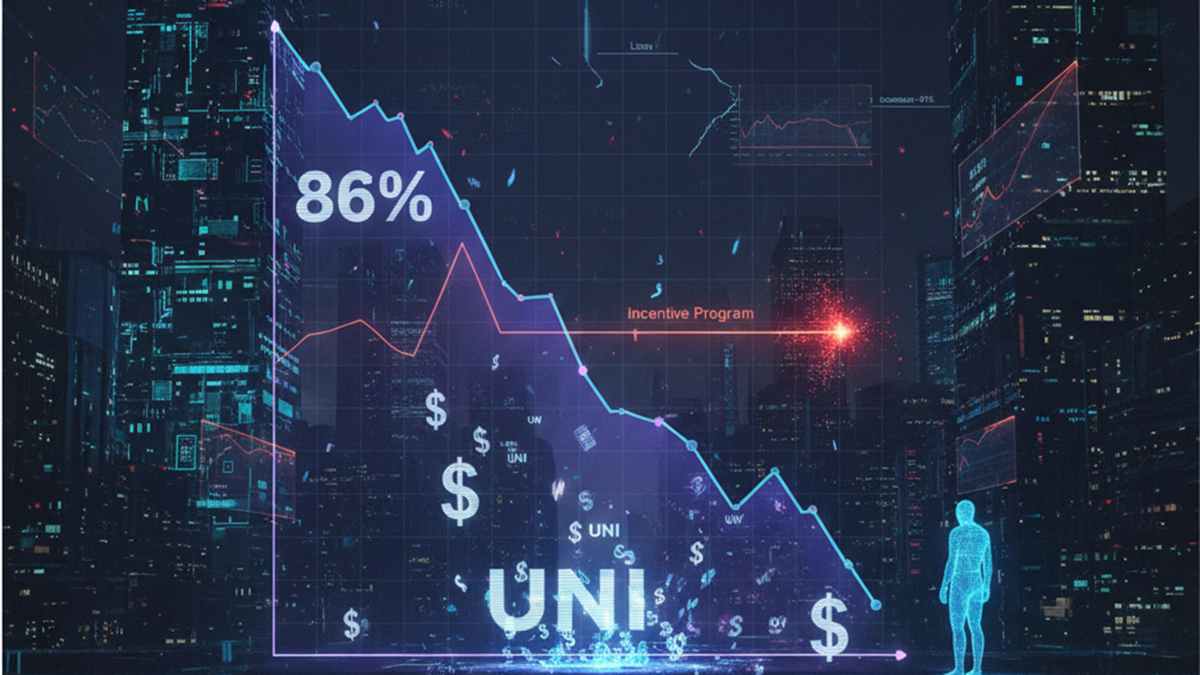

DeFi Shakeout: Unichain’s TVL Plunges 86% After Incentive Program Expiry

TL;DR Unichain’s Total Value Locked (TVL) plummeted 86% from its all-time high. The decline is attributed to the end of the $21 million incentive program and

Decentralized finance, known as DeFi, is emerging as the evolution of the obsolete traditional finance, these DeFi provide an extra of decentralization, transparency and security.

In this section you will find the latest news related to decentralized finance, new projects, partnerships and everything you need to be informed of that happens around you.

Without the need to trust third parties, more secure, transparent and without borders, DeFi will give a lot to talk about and from Crypto Economy we will tell you about it.

TL;DR Unichain’s Total Value Locked (TVL) plummeted 86% from its all-time high. The decline is attributed to the end of the $21 million incentive program and

TL;DR Uniswap integrated the Monad Layer 1 to deliver faster swaps, lower costs, and an infrastructure built to handle high-volume activity without friction. The Monad network

TL;DR Last Wednesday, November 26, DWF Labs, one of the leading cryptocurrency market makers and Web3 investment firms, announced the creation of a $75 million fund

TL;DR: Mutuum Finance reaches 95% of Phase 6 allocation with tripled presale growth, signaling strong investor confidence. Transparent allocation and active community engagement enhance market standing

TL;DR Yearn Finance disclosed an incident in the yUSND vault that resulted in a 5.2% loss caused by the forced conversion of rETH in a market

TL;DR Treehouse launched a buyback program for its TREE token, reinvesting 50% of tETH fees to strengthen demand and align incentives with token holders. The purchased

TL;DR: Krak now offers a Mastercard debit card with 1% cashback and multi-asset spending. Users in select regions can set up salary deposits, directing paychecks straight

TL;DR Magma’s launch allows users to obtain gMON by staking MON, creating a liquid asset that continues generating DeFi rewards. The public sale of MON on

TL;DR The value of loans on DeFi protocols grew 55% in Q3, surpassing the 2021 peak by over $4 billion. Plasma, Bitfinex’s new blockchain ecosystem, and

TL;DR Robinhood, the Fintech giant, is laying the groundwork to direct the traditional financial system towards a permissionless ecosystem. The company recently unveiled a three-phase roadmap,

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy