TL;DR

- Native Markets secured the USDH ticker for Hyperliquid’s stablecoin after a competitive governance vote involving Paxos and Ethena.

- The decision came with strong validator backing and heavy support on prediction markets.

- A phased rollout plan has been announced, featuring reserve strategies involving BlackRock and Superstate, with early minting limits to ensure stability before opening broader market access.

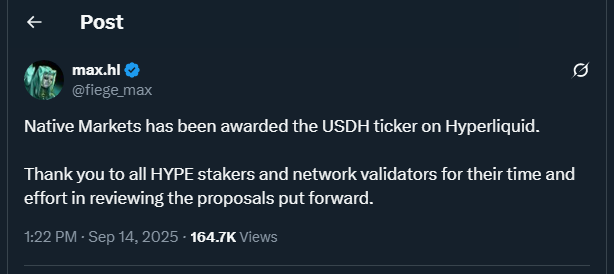

The race to control the ticker for Hyperliquid’s USDH stablecoin has ended with Native Markets emerging victorious. After weeks of debate and shifting proposals, validators and prediction markets tipped the balance in favor of Native’s bid, giving them the green light to lead Hyperliquid’s entry into the stablecoin arena.

Competition was intense. Paxos tried to sway votes with a last-minute proposal highlighting PayPal and Venmo integration, zero-cost on/off ramps, and a $20 million incentive program. Ethena, once considered a strong contender, withdrew days before the final tally, citing concerns over the reliance on non-native infrastructure. Despite the bold efforts from rivals, validator alignment and credible backers ultimately secured Native Markets the win.

Paxos Fails To Capture Momentum

Paxos’ revised pitch promised long-term revenue sharing capped at 5% and committed to funneling USDH income toward Hyperliquid until $1 billion in total value locked is reached. While attractive on paper, the initiative lacked traction among validators, with many critics pointing to the compressed request-for-proposal process and perceived structural advantages favoring Native Markets.

By the time the vote closed, prediction platform Myriad showed strong odds in Native’s favor, reinforcing confidence that their approach offered both immediate execution capacity and long-term ecosystem synergy.

Phased Rollout And Institutional Backing

Native Markets has laid out a detailed plan beginning with a Hyperliquid Improvement Proposal submission. The initial rollout will include capped minting and redemption trials, limited to $800 per user, designed to stress-test mechanisms before broader access. Once validated, a USDH/USDC spot market will be opened, paving the way for expanded circulation.

Reserves will be anchored in cash and US Treasuries managed by BlackRock, while tokenized on-chain assets are set to run through Superstate and Stripe’s Bridge infrastructure. Yield generated from these reserves will be split between Hyperliquid’s Assistance Fund and broader ecosystem development, ensuring sustainable growth.

Native Markets’ credibility is further bolstered by investors and advisors with backgrounds at Uniswap Labs, Paradigm, and Polychain, alongside early support from validator groups such as CMI Trading. With the Treasury projecting the stablecoin market to surpass $2 trillion by 2028, Hyperliquid’s decision to back a native solution reflects both strategic foresight and a commitment to positioning USDH as a cornerstone of decentralized liquidity.