Mutuum Finance (MUTM) has been featured in recent crypto coverage. According to project materials, the token sale is in “Phase 6,” and the project lists a token price of $0.035 for that phase. The project also states earlier phases were priced lower, including $0.01 in its first phase.

The project reports that it has raised $16,500,000 since the token sale began and that total holders have reached 16,620. It also states that Phase 6 is partly filled and that later phases may have higher listed prices, including a stated Phase 7 price of $0.04.

The project has also referenced an intended initial listing price of $0.06 at launch, but actual listing prices and market performance can differ materially from expectations. This context raises a common question among market observers: could Mutuum Finance (MUTM) reach $5 by 2026?

Mutuum Finance Token Sale Updates

Mutuum Finance says it is building a lending and borrowing protocol on Ethereum, with two markets described as pooled liquidity (P2C) and customizable peer-to-peer (P2P) loans.

In the project’s description, lenders deposit assets into smart contracts to earn yield, while borrowers access liquidity through overcollateralized loans without selling their crypto holdings.

The project states it has completed a CertiK audit with a 90/100 score and has announced a $50,000 bug bounty program. It has also described a dashboard “leaderboard” tied to marketing incentives for larger holders.

Mutuum Finance has also said it is preparing to launch a stablecoin and a Layer-2 rollout. These plans are project-reported and may change, and their impact depends on execution and adoption.

Market Context: Comparing a 2026 Target to Past Cycles

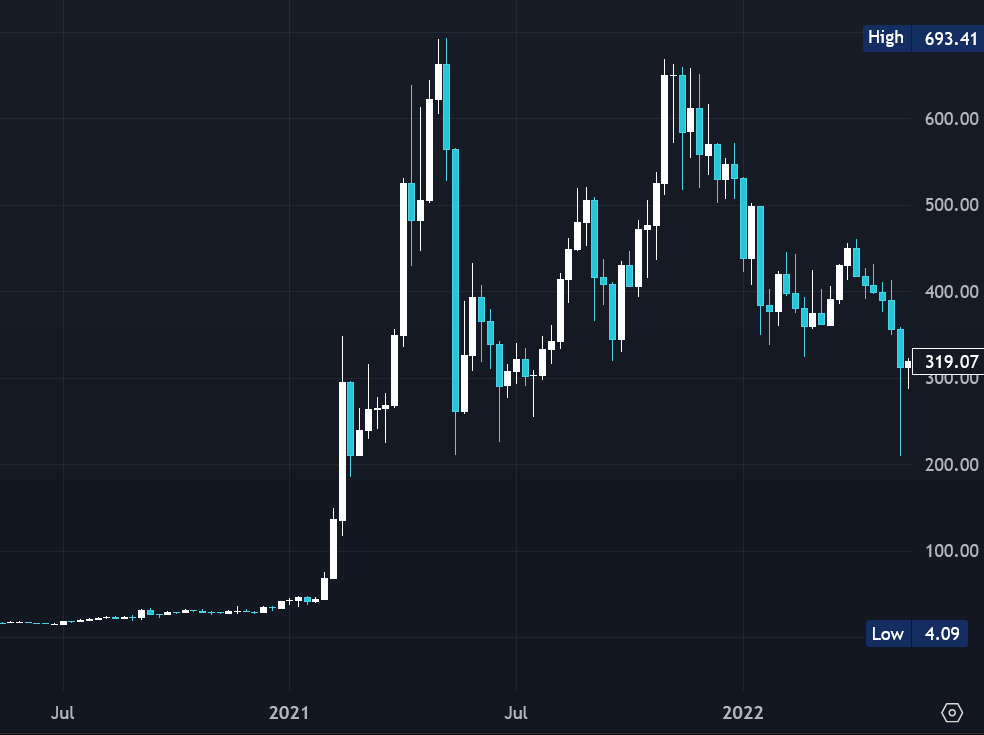

Speculation about whether MUTM can reach $5 in 2026 is sometimes framed by looking at historical moves in other assets. For example, Binance Coin (BNB) saw large price increases during the 2020–2021 cycle, including a move from around $15 in 2020 to above $600 in 2021. Such moves are not typical, and they occurred under specific market conditions.

Using the project’s stated Phase 6 price of $0.035, a move to $5 would imply a very large increase. However, simple unit-price comparisons do not account for factors such as circulating supply, market capitalization, liquidity, token distribution, product adoption, or broader market conditions.

More broadly, tokens associated with product delivery may perform differently from purely speculative assets, but there is no reliable rule that a specific project will outperform. Any forward-looking target for 2026 should be treated as highly uncertain.

Utility Claims and Community Programs

Mutuum Finance has described community programs including a giveaway and leaderboard-based incentives. As described by the project, participation requirements may include wallet submission, task completion, and a minimum token-sale allocation; readers should review official terms carefully and consider the associated risks.

The project has also highlighted its bug bounty as part of its security posture. Audits and bounties can reduce certain risks, but they do not eliminate the possibility of vulnerabilities or losses.

Tying Back to the 2026 Outlook

Mutuum Finance (MUTM) has reported fundraising progress, a completed audit, and plans for additional products. Whether those developments translate into sustained use and market demand remains uncertain and depends on execution, competition, regulation, and broader market cycles.

A $5 price target for 2026 is speculative and should not be treated as a forecast.

For more information about Mutuum Finance (MUTM), readers can refer to the project’s materials:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

This article contains information about a cryptocurrency token sale. This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.