TL;DR

- Mt. Gox has moved 11,501 BTC, valued at approximately $905 million, to an unidentified wallet, suggesting a possible advancement in creditor repayments.

- Despite the large amount transferred, Bitcoin’s price impact was temporary, with a quick recovery after a brief 2.4% drop.

- The exchange still holds $2.8 billion in Bitcoin, with a repayment deadline extended until October 2025.

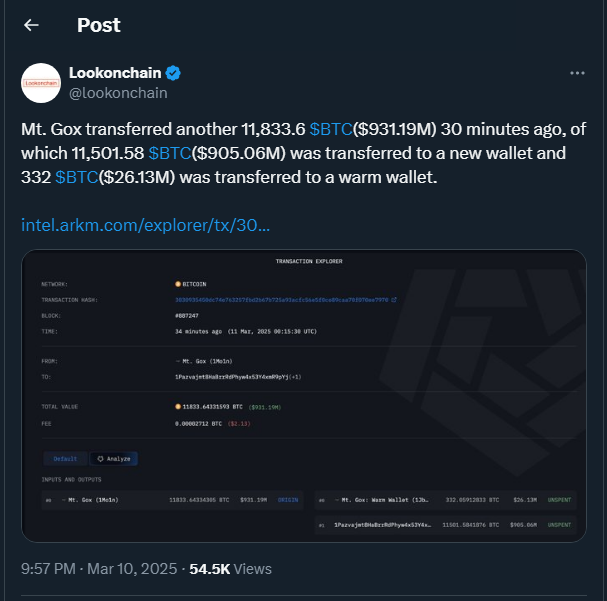

The defunct cryptocurrency exchange Mt. Gox has executed another significant Bitcoin movement, sending 11,501 BTC, equivalent to approximately $905 million, to an unmarked wallet, according to data from Arkham Intelligence. This transaction is part of a series of recent moves, suggesting that the repayment process for creditors is progressing after years of uncertainty.

Market Impact and Investor Response

The movement of such a large amount of Bitcoin typically sparks speculation in the market. On this occasion, Bitcoin’s price dropped 2.4% shortly after the transaction, reaching a low of $76,784. However, in less than an hour, the cryptocurrency regained its value and stabilized around $79,275. Industry analysts, including Arthur Hayes, founder of Maelstrom, have noted that such fluctuations are normal and that Bitcoin could experience a correction before entering another bullish phase.

These massive movements are not new in the crypto ecosystem, and over time, the market has learned to absorb these fluctuations with greater maturity. While concerns about potential selling pressure persist, the fact that Bitcoin quickly recovered its level reinforces confidence in the strength of the digital asset. The entry of institutions and large capital has helped mitigate the effects of these transfers, further solidifying Bitcoin as a strong and decentralized store of value.

The Long Road to Creditor Repayments

Mt. Gox, which once handled 70% of global Bitcoin transactions, collapsed in 2014 after the hack of 850,000 BTC. Since then, thousands of creditors have been waiting to recover their funds. Although the repayment process began in July 2024, Mt. Gox delayed the payment deadline until October 31, 2025.

Despite the delays, recent movements suggest that the process is advancing. Additionally, part of the transferred funds has been sent to custody wallets like BitGo, reinforcing expectations that creditors might receive their funds sooner than anticipated.

The crypto ecosystem has once again demonstrated its resilience. Unlike past cycles, where uncertainty from such events could negatively impact the market, confidence in Bitcoin and decentralization continues to grow. With each Mt. Gox movement, the industry moves closer to resolving one of the longest-running sagas in cryptocurrency history.