TL;DR

- Movement Network has announced a $38 million buyback of MOVE tokens after uncovering improper activity by a market maker operating on Binance.

- The buyback program, financed with recovered USDT, will run over the next three months as a strategy to restore market confidence.

- This swift response reinforces the project’s commitment to transparency, security, and the broader vision of decentralized crypto development.

In a decisive and values-driven move, the Movement Network Foundation has unveiled a $38 million buyback of MOVE tokens following a serious breach of contract by a market maker operating within the MOVE/USDT pair on Binance. The issue, initially flagged by Binance, highlights the vital role of vigilance and collaboration within the crypto ecosystem and the need for immediate response mechanisms.

The foundation revealed that the market maker had been offloading large amounts of MOVE without providing the agreed liquidity, undermining the token’s stability and breaking investor trust. Upon discovering the situation, the foundation swiftly severed ties and used recovered USDT funds to support an open market repurchase of MOVE tokens through Binance.

A Strategic Plan to Rebuild Trust

The buyback will take place on Binance over a three-month period, with the repurchased tokens being periodically transferred to Movement’s Strategic Reserve. The goal is not only to support price stability but also to reinforce a sense of security among both retail and institutional investors.

This case underscores the importance of proactive oversight, even within decentralized networks. Although buybacks often provide short-term price boosts, when coupled with stronger internal controls and transparency, they can lead to long-term improvements in reputation and ecosystem resilience across the board.

Movement Network: Speed, Innovation, and Expansion

Despite the controversy, Movement Network continues to strengthen its position in the blockchain industry. Its modular infrastructure powered by MoveVM enables high-performance rollups that connect seamlessly with both the Move and Ethereum ecosystems. The recent launch of its Public Mainnet Beta introduced Cornucopia, an incentivized liquidity bootstrapping program that has already locked over $250 million in total value.

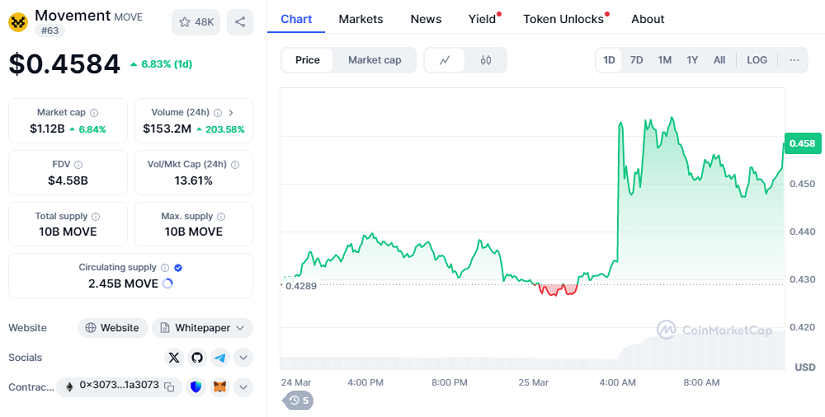

Currently, MOVE is trading around $0.4584 (+6.83%), with a market capitalization of $1.2 billion, and is backed by major investors such as Polychain Capital and Binance Labs. Interestingly, Donald Trump’s World Liberty Financial holds over $3.4 million in MOVE, according to Arkham Intelligence data, signaling growing institutional interest in the token.

Rather than showing weakness, Movement Network has demonstrated that solid projects with long-term vision can turn adversity into opportunity, reinforcing the case for decentralized finance as a resilient and evolving force in today’s markets.