Morpho is an innovative decentralized finance (DeFi) protocol designed to optimize lending and borrowing markets. Built on top of established liquidity pools, it enhances efficiency by matching lenders and borrowers directly whenever possible, while still relying on underlying protocols for security and liquidity.

This dual-layer approach allows the protocol to deliver improved interest rates and capital efficiency without sacrificing the reliability of existing DeFi infrastructure. By bridging peer-to-peer matching with protocol-level guarantees, the platform has positioned itself as a forward-looking solution in the evolving DeFi landscape.

The Role of the MORPHO Token

At the heart of the ecosystem lies the MORPHO token, which plays a central role in governance and community participation. Token holders can propose and vote on protocol upgrades, fee structures, and strategic initiatives, ensuring that the platform evolves in a decentralized and transparent manner.

Beyond governance, the token also serves as a mechanism to align incentives between users, developers, and liquidity providers. This alignment fosters long-term sustainability and encourages active participation in the protocol’s growth.

Why Morpho Matters for the Future

As the cryptocurrency market matures, protocols like Morpho highlight the shift toward efficiency-driven innovation. Its ability to enhance yield opportunities for lenders while reducing costs for borrowers makes it a compelling project to watch.

Moreover, the token’s governance model reflects the broader trend of community-driven ecosystems, where decision-making power is distributed rather than centralized. These qualities make the protocol a strong candidate for long-term relevance in the DeFi sector.

Setting the Stage for 2025–2030

With growing institutional interest in DeFi and increasing demand for efficient lending solutions, Morpho’s trajectory between 2025 and 2030 will be closely followed by investors and analysts alike. Understanding its fundamentals is essential before exploring potential price scenarios in the years ahead.

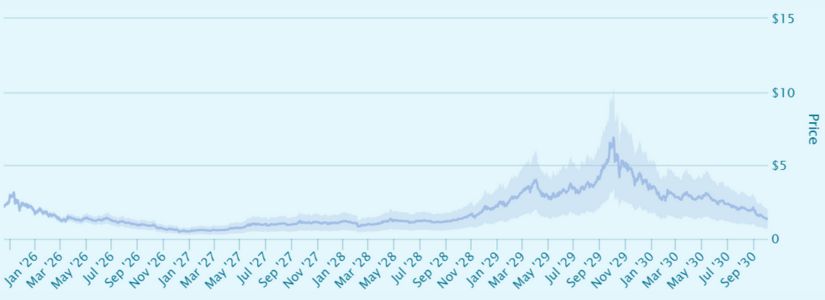

MORPHO Price Prediction 2025 – 2030

Morpho Price Outlook for 2025

According to data from CoinCodex, MORPHO’s price action in 2025 is expected to remain within a relatively modest trading channel, fluctuating between $1.33 and $1.90. This projection suggests an average annualized price of $1.49, which translates into a potential return on investment of -0.75%. This outlook highlights opportunities for traders who may seek to capitalize on downward momentum through short positions.

On the other hand, alternative technical forecasts present a more optimistic scenario for 2025. Analysts suggest that the token could continue its upward trajectory, potentially reaching a peak price of $3.40 during the year. The average price is projected at $2.83, with the lowest expected level around $2.26.

How Morpho Could Perform in 2026

CoinDataFlow’s latest experimental simulation suggests that MORPHO could see modest gains in 2026, with its value potentially rising by 9.17% to reach around $2.06 under favorable conditions. Throughout the year, the token’s price is expected to fluctuate within a broad range, from a low of $0.466 up to $2.06.

In contrast, some technical analysts outline a more optimistic path for the token during the same period. If the token manages to hold support levels between $2.10 and $2.20, it could establish the foundation for a stronger rally. Breakout structures point toward potential upside targets of $3.80, with consolidation phases anticipated above $2.90.

Projected Trends for Morpho in 2027

DigitalCoinPrice analysts project that by 2027, MORPHO could begin the year at $5.56 and trade near $6.76. This forecast represents a significant increase compared to the previous year’s levels, signaling growing confidence in the token’s long-term potential. Such an upward move would mark a notable step in the protocol’s market development.

Meanwhile, other expert forecasts point to an even more ambitious outlook for the token in 2027. Technical analysis suggests that with continued capital inflows into the crypto sector, the token could reach a peak price of $7.17 during the year. Under this scenario, the average trading value is expected to hover around $6.61.

Analyzing Morpho’s Market Potential in 2028

Forecasts for 2028 suggest that MORPHO could trade within a channel ranging from $1.85 to $2.68, with an average annualized price near $2.00. If realized, this scenario would represent a potential ROI of 37.99%, signaling a notable improvement compared to earlier years.

At the same time, more optimistic technical models point toward a broader upward trajectory for the token in 2028. Analysts indicate that a broadening channel could push the token’s value as high as $5.40, with Bollinger midline support around $4.20 serving as a key stabilizing level.

What to Expect from Morpho by 2029

Experimental simulations for Morpho’s 2029 outlook indicate a strong potential for growth, with the token’s value projected to climb by 264.98% under the most favorable conditions. In this scenario, the token could reach as high as $6.89, while trading activity throughout the year is expected to fluctuate between $2.18 and $6.89.

At the same time, other forecasts present a more ambitious trajectory for the token in 2029, driven by continued adoption and increasing regulatory clarity. Analysts suggest that the token could achieve a peak price of $10.95, with a potential low of $9.81 and an average value converging around $10.38.

Long-Term Morpho Forecast for 2030

Analyst projections for 2030 indicate that MORPHO could maintain steady growth, with forecasts suggesting the token may cross the $9.46 mark during the year. Price expectations also include a potential minimum of $8.95 and a maximum of $10.33, reflecting a relatively stable trading range compared to earlier years.

Other technical perspectives present a slightly different scenario, with the token projected to reach highs near $8.50 while averaging around $6.00 throughout 2030. These models emphasize the importance of maintaining key support levels above $4.00, which could serve as a foundation for long-term resilience.

Conclusion

Morpho stands out as a DeFi protocol that blends efficiency, security, and community-driven governance, making it a project with strong long-term potential. From 2025 through 2030, forecasts highlight both conservative and bullish scenarios, reflecting the volatility and opportunity within the crypto market. While predictions vary, Morpho’s fundamentals and adoption trends suggest it will remain a significant player in decentralized finance as the sector continues to mature.

The Price Predictions published in this article are based on estimates made by industry professionals, they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.