TL;DR

- MicroStrategy purchased 397 Bitcoin for $45.6 million.

- The firm now holds 641,205 Bitcoin in total.

- The firm reports a 26.1% yield for 2025.

Strategy has purchased an additional 397 Bitcoin. The transaction occurred on November 2nd, with a total value of 45.6 million dollars. The company paid an average of 114,771 dollars for each unit of the digital currency. This acquisition continues the firm’s established pattern of allocating capital to Bitcoin.

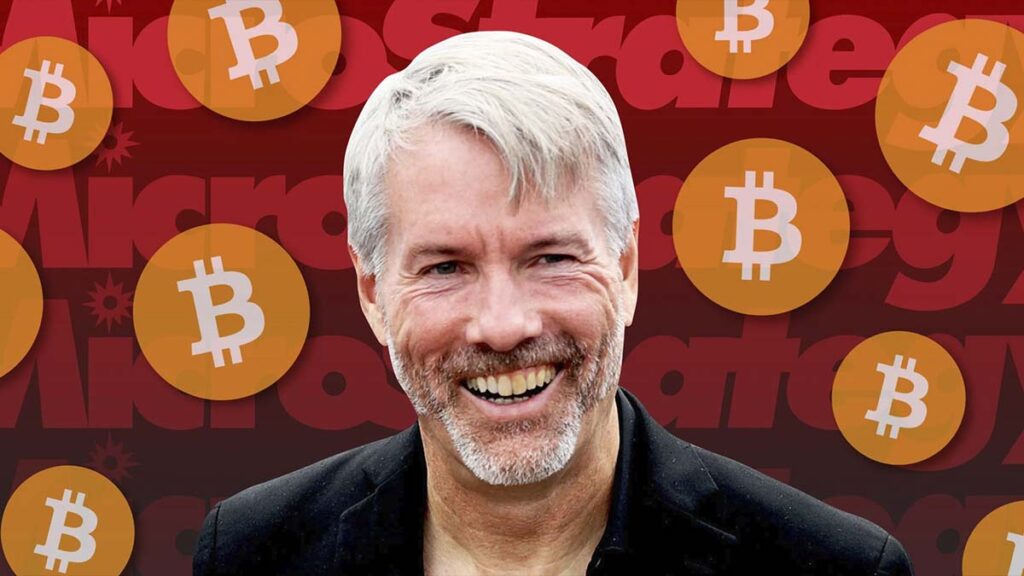

The company’s founder, Michael Saylor, announced the purchase on his social media account. He reported that the corporate strategy has generated a 26.1 percent Bitcoin yield for the year 2025. Strategy now holds 641,205 Bitcoin in its treasury. The total cost for this position is approximately 47.49 billion dollars, with an average purchase price of 74,057 dollars per coin.

Strategy has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/gEuzDaloRb

— Michael Saylor (@saylor) November 3, 2025

A Consistent Treasury Strategy

This latest transaction reinforces the company’s steadfast approach to corporate treasury management. The strategy involves using company funds to acquire Bitcoin as a primary reserve asset. This action took place as the market price for Bitcoin moved below 108,000 dollars. The firm has a history of making purchases during periods of price fluctuation.

Saylor has repeatedly stated his view that Bitcoin serves as a long-term store of value. The company’s repeated acquisitions demonstrate a commitment to this principle. The firm treats short-term market dips as opportunities to increase its holdings.

In the current environment, BTC is down in a correction phase after recent highs, driven by macroeconomic uncertainty and increased long-term holder selling — over 405,000 BTC sold in the past 30 days.

Despite short-term volatility, Bitcoin remains dominant in the crypto market with 58.3% market share, maintaining its position as the leading digital asset. The next potential support zone lies around $105,000 USD, while resistance remains near $111,000 USD, suggesting a potential rebound if buying pressure strengthens.