TL;DR

- Bitcoin leads the migration of capital to digital, driven by figures such as Michael Saylor.

- Bitcoin’s resistance to external factors makes it a safe haven from the volatility of traditional assets.

- Companies like MicroStrategy see significant growth in their Bitcoin investments, while major investors continue to accumulate the cryptocurrency at a frenetic pace.

The growth and influence of Bitcoin (BTC) on the global financial landscape is undeniable.

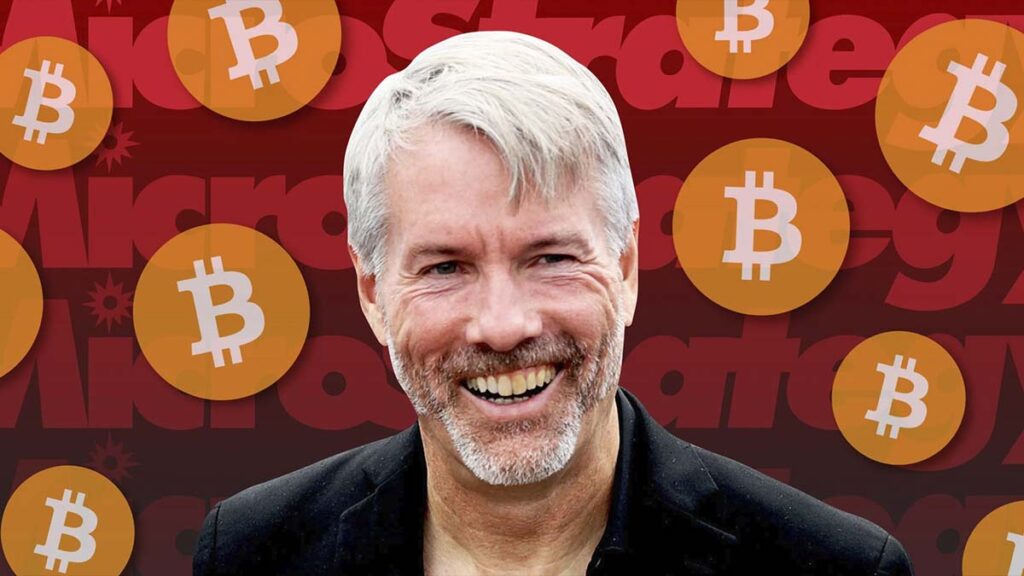

Michael Saylor, founder of MicroStrategy and Bitcoin advocate, has highlighted the importance of this cryptocurrency as a vehicle for the digital transformation of capital.

In a recent interview with Fox Business, Saylor explained how Bitcoin is attracting the attention of investors and corporations, driving a growing flow of capital from 20th century analog assets into the digital economy.

#Bitcoin represents the digital transformation of capital. Money is flowing out of 20th century analog assets into the digital economy at an increasing rate. $BTC is digital property protected & transmitted by digital power. pic.twitter.com/yJV6IF1scF

— Michael Saylor⚡️ (@saylor) February 15, 2024

Saylor emphasizes that Bitcoin not only represents a way to preserve and increase capital, but also symbolizes the transition to a new financial era, where digital assets play a fundamental role.

This phenomenon is reflected in the growth of Bitcoin exchange-traded funds (ETFs) and the growing accumulation of the cryptocurrency by large investors.

The founder of MicroStrategy highlights Bitcoin’s resilience in the face of external factors such as weather, war, and supply chain disruptions.

This feature contrasts with the vulnerabilities of traditional analog assets, reinforcing the perception of Bitcoin as a safe haven for capital in times of uncertainty.

MicroStrategy has experienced significant growth in the value of its Bitcoin investments

With more than 190,000 Bitcoins in its portfolio, the company has surpassed $10 billion in digital asset value, generating a profit of more than $4 billion.

Additionally, recent data reveals strategic accumulation of Bitcoin by influential investors, known as “whales,” who have acquired more than 100,000 BTC in the last ten days, surpassing $5 billion in total investment value.

The rise of Bitcoin is marking a significant shift in the way capital is perceived and managed in the global economy.

With its ability to preserve and increase value, its resistance to external events and its appeal as a digital asset, Bitcoin is establishing itself as a key component in the transformation towards an increasingly digitalized economy.