TL;DR

- Jupiter allocated $150 million in USDC to JLP Loans, allowing users to use their liquidity tokens as collateral to access credit.

- JUP’s price rose 25.6% over the week, and daily trading volume jumped 175% to $342 million following the announcement of the new lending system.

- Unlike other protocols, Jupiter avoids forced liquidations on open markets by backing loans with an internal pool of assets.

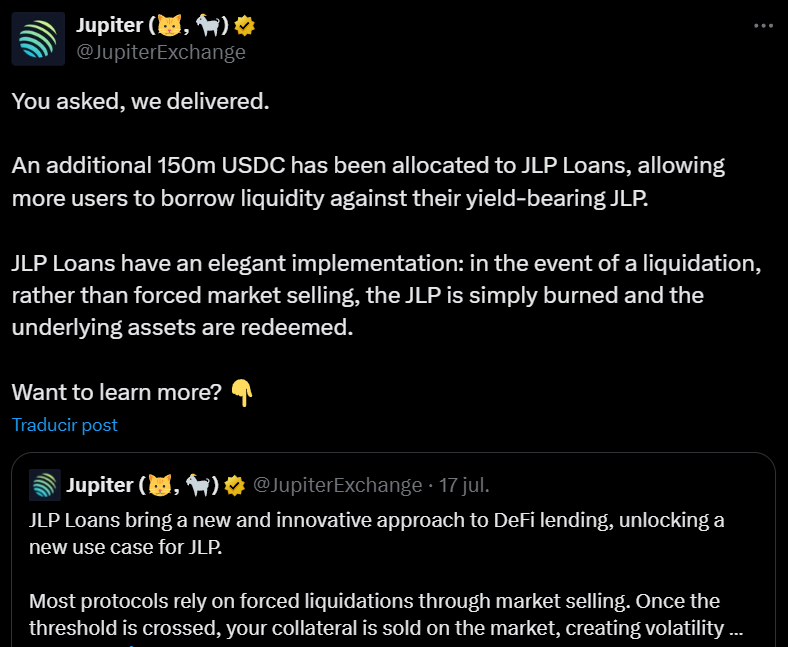

Jupiter assigned $150 million in USDC to its new lending feature within the JLP system, a mechanism that lets users lock their liquidity tokens as collateral to borrow funds.

The announcement pushed the price of Jupiter (JUP) up by 3% in a single day, with the token now trading around $0.6209 and showing a weekly gain of 25.6%. Trading volume also spiked, nearly tripling in 24 hours to surpass $342 million — a 175% increase.

How Do Jupiter Loans Work?

The main difference between JLP Loans and other DeFi lending systems lies in how they handle liquidations. Instead of selling off assets when collateral value drops, the protocol holds a reserve of assets that directly backs the loans. This structure reduces market pressure and prevents liquidations from impacting broader token prices. This technical design has been well received by users and has boosted broader interest in the token and its ecosystem.

Since hitting a low of $0.30 in April, JUP has recovered 110%. While still far from its all-time high of $2.04 in January 2024, technical indicators suggest a favorable outlook. If the price breaks above $0.70, it could push toward $0.85 and eventually aim for $1 — a level with strong psychological resistance.

Jupiter closed the second quarter with strong metrics and steady growth. In recent months, it surpassed 8 million active wallets, reached $142 billion in transaction volume, and collected $82.4 million in fees. Alongside the launch of its lending feature, the platform also integrated trading and liquidity provision, making it more appealing for users seeking returns across multiple fronts within the Solana ecosystem.

Its total value locked also saw a sharp increase, jumping from $2.1 billion to $3 billion in just one month. In a market where Ethereum is eyeing $4,000 and Solana is approaching $300, Jupiter is showing standout performance