TL;DR

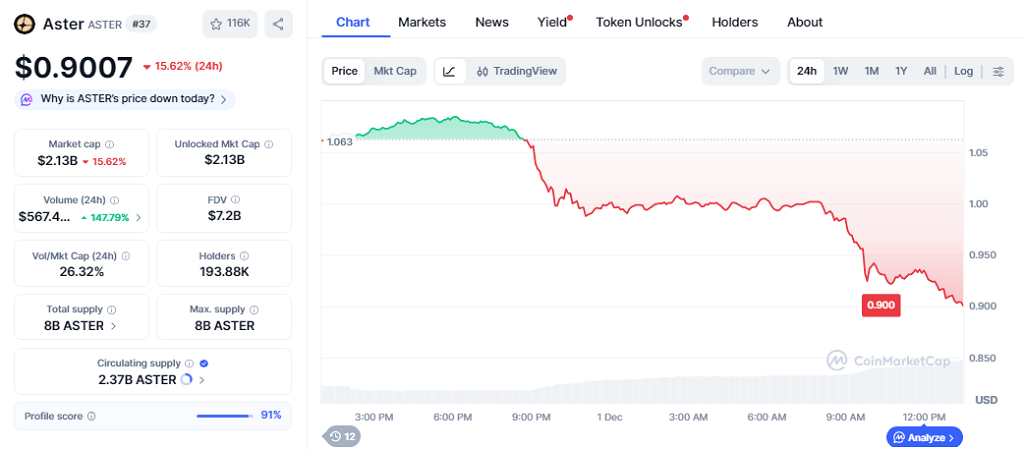

- ASTER is trading below $1.00 after failing to hold critical support, now testing the $0.93–$0.94 zone.

- Technical indicators show rare oversold levels, but the persistent bearish trend limits potential for a strong rebound.

- Bulls must reclaim $1.07–$1.08 soon, or lower liquidity areas could be targeted by sellers, increasing the risk of further downside.

ASTER faces increasing pressure as it trades under the key $1.00 support. The token has dropped to approximately $0.9007 after a sharp rejection from its descending trendline, continuing a series of lower highs. Traders and analysts are closely monitoring this level, as it may define ASTER’s short-term movement amid broader market fluctuations. The token’s market cap currently stands at $2.13 billion, while trading volumes remain moderate and indicate cautious investor behavior.

$ASTER / Aster

— Ardi (@ArdiNSC) December 1, 2025

Holding onto its support by a thread. Price just flushed straight back into the same support block that’s been defending the breakdown of the chart up, but this time it did it while rejecting the descending trendline again. That keeps momentum decisively bearish… https://t.co/qX9fPjyDvx pic.twitter.com/xWEWlKKvaM

Support Zone Under Pressure

ASTER is hovering near $0.9007, below the $1.00–$1.03 range that has historically acted as strong support. This zone has previously stopped price breakdowns, but the current move shows renewed bearish momentum.

Technical analysis shows repeated rejection from the descending trendline, keeping the market in a bearish structure. The $0.93–$0.94 area, corresponding to the 78.6% Fibonacci retracement, is being closely watched. Traders are observing whether this support can hold or if deeper corrections may follow. Additional market data highlights weaker trading interest across smaller exchanges.

Indicators such as the Relative Strength Index (RSI) signal that ASTER is in oversold territory, a condition seen only a few times this month. While some traders expect a short-term bounce, the ongoing downtrend reduces the likelihood of a strong recovery.

Bounce Requires Structural Change

For any bullish rebound to be meaningful, ASTER must reclaim the $1.07–$1.08 range. This would challenge the mid-range resistance that has capped gains for several weeks. Further overhead resistance exists between $1.11–$1.13, meaning that each bounce may remain temporary until these levels are breached.

If bulls fail to recover key levels, lower highs may continue, applying further pressure on buyers. Market sentiment has weakened, with ASTER falling from over $1.40 to under $1.00. Recent events, including Binance week and upcoming token burns, have not altered the trend. Scheduled buybacks on December 10 may provide temporary support, but investors remain cautious. Analysts also note that volatility could increase in the next few sessions as liquidity fluctuates.

ASTER’s near-term outlook depends on holding $1.00 and regaining higher ranges.