TL;DR

- Memecoins experienced a sharp pullback, with the sector’s market capitalization falling to $58.17 billion, down roughly 1.55% in the last 24 hours.

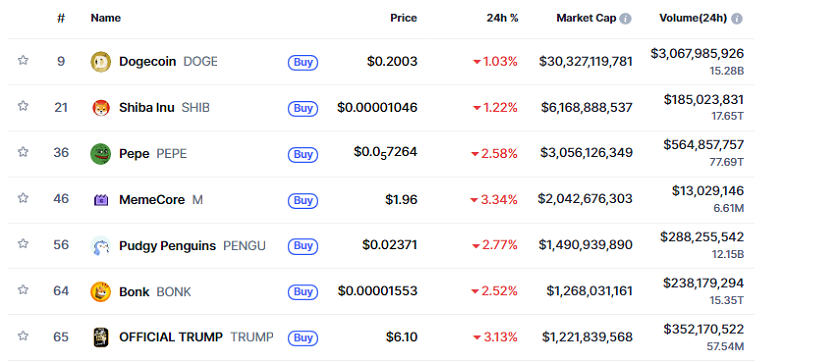

- Top tokens including Dogecoin, Shiba Inu, and Pepe continue to trade in the red.

- Despite a brief rebound, retail interest in meme-based cryptocurrencies shows signs of cooling after months of sustained growth fueled by Solana and BNB Chain activity.

The memecoin sector has seen a significant decline, wiping out recent gains as the broader crypto market attempts to stabilize. On Saturday, the market capitalization of meme tokens dropped to $44 billion, marking nearly a 40% fall from Friday’s $72 billion peak. By Sunday, the sector partially recovered to $53 billion, reflecting a level last observed in July before a summer rally driven by Solana-based memecoins. Trading volumes and investor sentiment remain under pressure, with many retail traders showing cautious behavior amid ongoing market volatility.

Over the past four months, the memecoin market consistently held above $60 billion, fueled by strong retail demand and active trading on chains like Solana and BNB. Recent losses, however, have indicated a slowdown in momentum, with the sector currently hovering around $58.17 billion. Trading volume for the past 24 hours dropped to $8 billion, an 8.44% decrease, highlighting reduced market activity and selective investor participation.

Top Memecoins Continue to Post Losses

Leading memecoins remain under pressure. Dogecoin is trading at $0.2003 with a 1.03% decline over 24 hours, Shiba Inu at $0.00001046 is down 1.22%, and Pepe at $0.0007264 dropped 2.58%. Other notable tokens including MemeCore, Pudgy Penguins, Bonk, OFFICIAL TRUMP, SPX6900, FLOKI, dogwifhat, and Fartcoin all recorded losses between 0.66% and 3.34%. The combined market cap of the top 10 memecoins represents over 82% of the total sector value, around $47 billion.

Other Crypto Sectors Show Faster Stabilization

In contrast, several other sectors recovered more quickly after the market dip. NFTs bounced back after losing roughly $1.2 billion during the sell-off, regaining 10% the following day. Cryptocurrency ETFs also attracted inflows, with spot Bitcoin ETFs recording $102 million and Ether ETFs $236 million in net gains. More established cryptocurrencies like Bitcoin and Ether have similarly recovered, trading at $111,637 and $4,051 respectively, after brief declines. Overall market resilience shows potential for more positive momentum, although caution remains essential among investors.

While the memecoin market faces challenges, overall market liquidity remains healthy, suggesting that these tokens could stabilize in the coming weeks. Analysts note that renewed investor interest in meme-based tokens might return once broader crypto markets regain momentum.