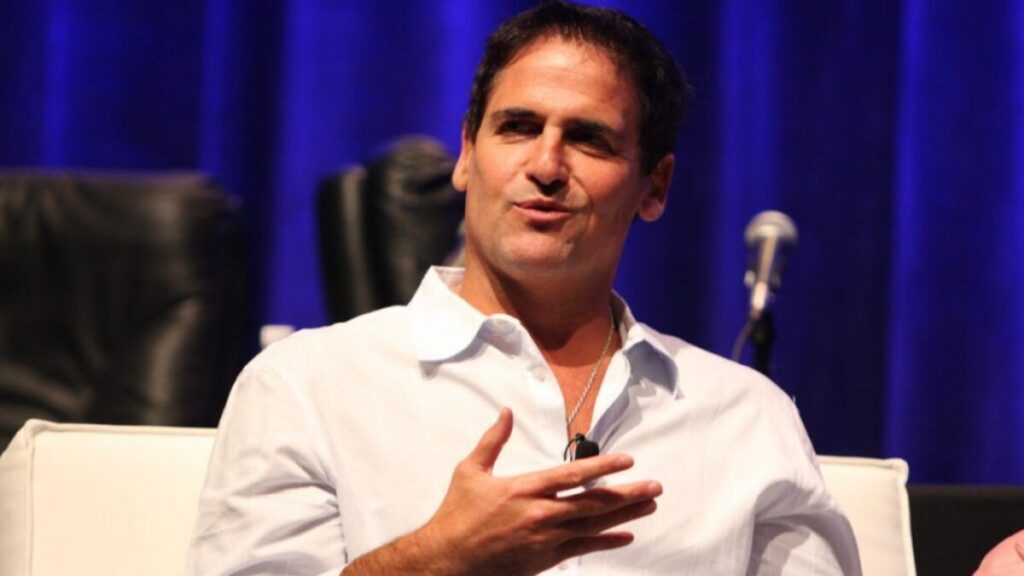

Mark Cuban has joined the list of many analysts to call out the SEC for its failure to provide clear guidelines regarding the registration process. The billionaire recently tweeted that no such registration exists in the SEC’s Framework for Investment Contract Analysis of Digital Assets. Therefore, it becomes nearly impossible to understand what is security and what is not. However, a step-by-step outline might not be provided, but the document does highlight the requirements for firms under US federal securities laws.

This is an SEC WEB PAGE about the howey test and tokens that often conflicts with what @SEC_Enforcement has said publicly. It's worth a read to get more clarity on what may or may not be a security https://t.co/m5E9V0Pd18

Unfortunately none of the elements presented in this… https://t.co/iZ9Gn5SADK pic.twitter.com/kGHgsZkOaH

— Mark Cuban (@mcuban) June 11, 2023

These requirements include the need to disclose necessary information, which might be required by investors to make informed decisions along with a series of other important managerial decisions that play a fundamental role in boosting the overall success of a company.

Mark Cuban further mentioned that several other sectors within the finance industry have received more significant levels of transparency from the SEC. Instead of regarding stock loans as securities or filing petitions against brokers and banks, the regulator is deeply involved in a comment process.

Mark Cuban Defends the Crypto Industry

Cuban and others within the crypto space have argued that the SEC must adopt a similar approach toward cryptocurrencies. The main purpose of doing so would be to determine what aspects of crypto are securities and what are not.

At the same time, the SEC also met with an unfavorable response from US Senator, Cynthia Lummis, who grilled the regulator for failing to provide a robust legal framework, along with the least possible guidance for crypto firms. The Senator said,

“The SEC has failed to provide a path for digital asset exchanges to register, and even worse has failed to provide adequate legal guidance on what differentiates a security from a commodity. The SEC’s continued reliance on regulation by enforcement continues to harm consumers.”

My statement on the SEC suing Coinbase, inc. https://t.co/5KNEM0IPSV pic.twitter.com/EgRIxrIcjj

— Senator Cynthia Lummis (@SenLummis) June 6, 2023

Despite severe backlash on how the SEC has not provided clear guidelines for the crypto industry, it is still a matter of conjecture whether or not the SEC would listen. Just last week, the chair of the SEC, Gary Gensler, stated that a proper registration process already exists, and the proper clarity exists that would enable them to know how to register.

However, these comments were made as retaliation against the claims of Coinbase and Robinhood. These two crypto firms argued that they tried to register with the SEC, but the regulator had rejected all attempts of doing so. Similarly, the SEC’s filing against Binance and Coinbase has sent jolts throughout the crypto space. The SEC claims that these firms allegedly violated the securities law by offering tokens that are deemed to be securities. Currently, the SEC considers almost 68 cryptocurrencies to be securities.