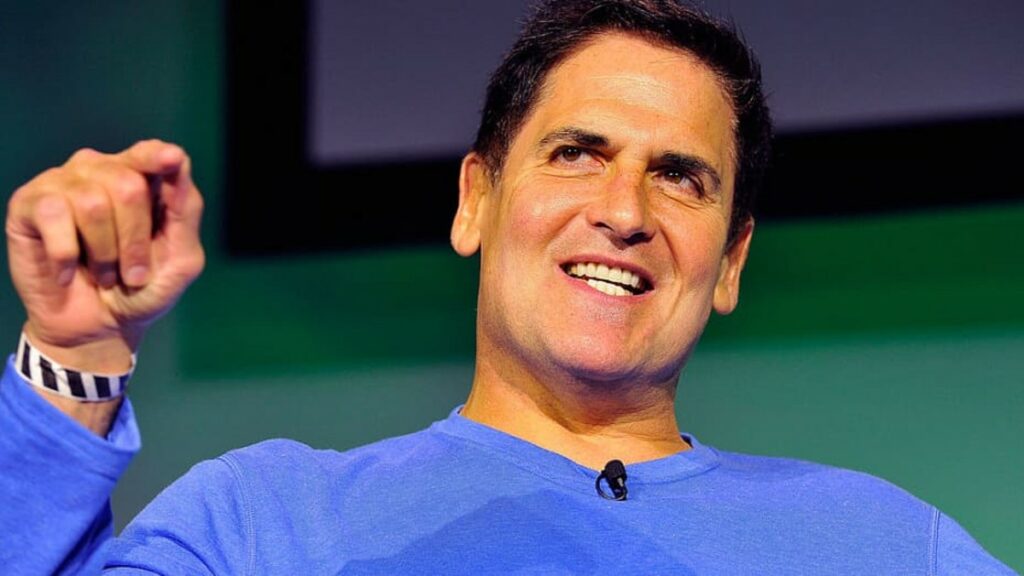

Mark Cuban, the renowned crypto advocate, entrepreneur, and owner of the Dallas Mavericks basketball team, has recently expressed his dissatisfaction with the United States Securities and Exchange Commission’s (SEC) approach to regulating cryptocurrencies. In a strongly-worded critique on Twitter, he highlighted what he perceives as the ineffectiveness and flaws in the SEC’s current stance.

You should read up on how Japan deals with regulation. https://t.co/yHCVwZAqvG

When FTX crashed, NO ONE IN FTX JAPAN LOST MONEY.

If the USA/SEC had followed their example by setting clear regulations that required the separation of customer and business funds and clear… https://t.co/Msvn9o9PCU

— Mark Cuban (@mcuban) July 4, 2023

The American billionaire argues that the SEC’s outdated and rigid regulations surrounding cryptocurrencies are hindering innovation and growth in the industry, thereby leaving the United States behind in the global digital economy.

Furthermore, Cuban spoke about the achievement of Japanese regulators who have fully embraced the digital ecosystem with effective regulation. He went further to point out that no business associated with FTX Japan experienced any financial losses as a result of the collapse of the FTX Exchange.

In his words “Japan protected their FTX customers and not the SEC”.

John, there is no singular voice for the industry. As you have heard me say I’m fine with regs

The Japanese are clear and specific to the point there are quite a few regulated exchanges that are operational and trading tokens.

Some choose not to work in Japan and that is…

— Mark Cuban (@mcuban) July 5, 2023

Mark Cuban Faults SEC for Crypto Classification

Another particular point of contention for Cuban is the SEC’s classification of cryptocurrencies as securities. While he acknowledges that some tokens may indeed fall under this category, he argues that many others have unique utility and should be treated differently.

By labeling all cryptocurrencies as securities, Cuban said the SEC is stifling their potential and limiting opportunities for entrepreneurs and investors alike.

Additionally, Cuban criticizes the SEC’s slow pace in providing clarity and guidance on crypto regulatory matters. He suggests that the agency should prioritize creating a transparent and flexible framework that promotes responsible innovation while protecting investors. By doing so, the industry would be able to flourish, and individuals and businesses would have a clearer understanding of the rules governing their activities.

To counter the SEC’s conservative approach, the 65-year old philanthropist proposes a more proactive and collaborative approach to regulation. He advocates for engaging with industry experts, technologists, and entrepreneurs to gain insights into the unique characteristics of cryptocurrencies.

Recall that just recently Ripple and XRP advocate John E. Deaton said the US regulator has lost its way. Deaton in a series of tweets argues that the regulator would rather maintain a lack of clarity for the industry just to keep its options open and insulate itself.