TL;DR

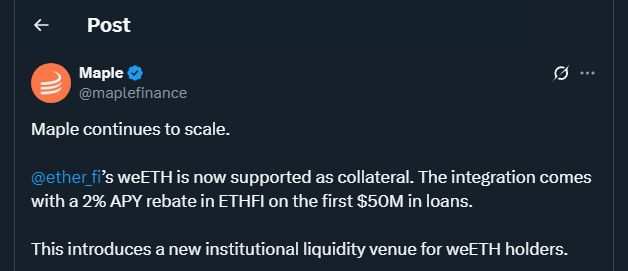

- Maple Finance has integrated EtherFi’s weETH as collateral for institutional loans, marking a major advancement in decentralized finance.

- The initiative allows borrowers to access USDC loans without giving up staking yields.

- Loans must be a minimum of $5 million with a two-month term, offering institutional players a powerful new tool in Ethereum’s evolving financial infrastructure.

Maple Finance has joined forces with EtherFi to launch a lending product that enables institutions to secure USDC loans backed by weETH, EtherFi’s restaked Ethereum token. The move bridges the gap between Ethereum restaking and professional credit markets, offering institutional investors new ways to access liquidity while keeping their staking positions intact.

Strategic Expansion Connects Staked ETH With Credit Markets

The partnership introduces weETH as a new form of collateral on Maple’s decentralized lending platform. By doing so, borrowers can tap into the value of their staked Ethereum holdings without forfeiting staking rewards, a feature increasingly in demand among crypto treasuries, funds, and other capital allocators.

A major component of the rollout is a limited-time incentive: a 2% ETHFI rebate for the first $50 million in loans backed by weETH. Each loan must exceed $5 million and is set to a two-month term, with the requirement that borrowers post collateral worth more than the loan amount. This model is intended to bring credit efficiency to Ethereum’s expanding restaking layer.

Institutional Demand for Liquid Restaking Gains Traction

EtherFi’s weETH currently ranks among the most widely used restaked assets in DeFi, with over $5.3 billion in circulation and tens of thousands of holders. Around 75% of weETH is already deployed as collateral across major platforms such as Aave, suggesting a rising appetite for using restaked assets in capital strategies.

Maple Finance, now managing over $2.7 billion in assets, has seen rapid growth in 2025. Its token, SYRUP, has surged 70% in the past month, currently trading near $0.57. EtherFi, meanwhile, commands over $6.4 billion in total value locked, solidifying its status as one of Ethereum’s top-tier restaking protocols.

This new integration follows Maple’s recent collaboration with Lido Finance to enable loans backed by stETH. Together, these efforts signal a growing alignment between liquid staking and institutional lending. The increased interoperability between restaked assets and credit platforms may accelerate the development of scalable, yield-enhanced DeFi credit markets, unlocking more capital efficiency for the ecosystem and providing sophisticated investors with broader, more flexible collateral options tailored to their portfolio needs.