TL;DR

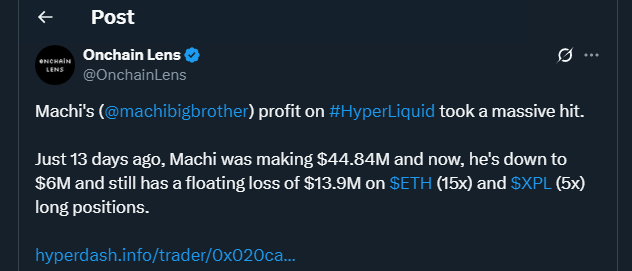

- Jeffrey Huang, aka Machi Big Brother, is experiencing a floating loss of nearly $9 million on his leveraged XPL token position on Hyperliquid, down from a $44 million profit just 13 days ago.

- Despite this, his overall account remains profitable with combined PnL above $11.6 million.

- Whale activity shows continued confidence in XPL, but upcoming token unlocks could increase selling pressure.

Taiwanese music star and crypto investor Jeffrey Huang, widely known as Machi Big Brother, is facing a substantial floating loss on his Hyperliquid account. Blockchain data shows Huang’s account “0x020c,” also recognized for holding rare Bored Ape Yacht Club NFTs, is down roughly $8.7 million on a 5x leveraged long position in the Plasma (XPL) token.

This sharp decline comes after a peak profit of around $44 million only 13 days ago. The leveraged trade, which bets on XPL price appreciation, has a liquidation threshold set at $0.5366. Huang has continued holding despite funding fees exceeding $115,000. Simultaneously, he maintains a 15x leveraged Ether position worth $1.2 million in funding costs, now showing about $534,000 in unrealized gains, with liquidation at $3,836.

Machi Big Brother’s account remains profitable overall, with total combined profit and loss above $11.6 million. This comes after his recent exit from a $25 million Hyperliquid HYPE position at a $4.45 million loss, following warnings from Maelstrom, the family office fund of BitMEX co-founder Arthur Hayes, regarding upcoming token unlocks.

Whales Bet On Plasma Token’s Recovery

Despite Huang’s floating loss, other large investors are actively adding to their XPL holdings. Data from Nansen shows whale wallets acquired $1.16 million worth of XPL tokens over the past week while $3.83 million left exchanges. Whale wallet “0xd80D” alone purchased $31 million in XPL, bringing total holdings to over $40.2 million, according to Lookonchain.

Upcoming Token Unlocks May Trigger Market Volatility

Market watchers are cautiously observing as Plasma’s vesting schedule is set to release $90 million worth of XPL tokens on Oct. 25, marking the month’s third-largest token unlock by value, per CryptoRank data. Analysts note that these unlocks could put additional selling pressure on XPL, potentially affecting the market despite ongoing whale confidence and bullish bets.

Huang’s strategy reflects a broader trend among high-profile investors in the crypto space, showing continued optimism in leveraged positions even amid short-term losses. Traders remain focused on XPL’s potential price recovery and the wider implications of large-scale token movements across decentralized platforms globally.