TL;DR

- MEI Pharma has unveiled a $100 million Litecoin treasury plan in collaboration with Titan Partners Group and crypto giant GSR.

- Litecoin creator Charlie Lee will join MEI’s Board, reinforcing the project’s credibility and long-term vision.

- The Litecoin Foundation has also invested, strengthening Litecoin’s push for wider institutional adoption as its daily trading volume jumps nearly 96% to $1.88 billion.

MEI Pharma has confirmed a transformative private placement worth over $100 million to build the first institutional-grade Litecoin treasury. This bold strategy marks a turning point for the Nasdaq-listed company, positioning LTC alongside traditional assets on its balance sheet. Titan Partners Group and GSR, a leading crypto capital markets firm, are key players in structuring this significant commitment.

Charlie Lee Joins Board To Guide Treasury Evolution

Charlie Lee, the pioneering mind behind Litecoin, will become part of MEI’s Board of Directors. Since creating Litecoin in 2011, Lee has driven continuous innovation in crypto, from SegWit activation to supporting the Lightning Network. His leadership is expected to be instrumental as MEI transitions its treasury strategy to include LTC at scale, offering shareholders a fresh vision for sustainable digital value growth.

The Litecoin Foundation, sharing the mission to expand global Litecoin adoption, has also secured a stake in MEI Pharma. This investment aligns with the foundation’s goal to push real-world use cases for LTC, which currently processes leading transaction volumes on major payment platforms like BitPay.

Institutional Backing Strengthens Litecoin’s Role

GSR’s involvement provides deep capital markets expertise and institutional structure, offering MEI the capability to manage digital assets securely and strategically. GSR’s US Chief Strategy Officer, Joshua Riezman, highlights that this plan shows growing institutional faith in Litecoin’s resilience and compliance status.

Quynh Ho, Head of Venture Investment at GSR, emphasized that the new structure helps bridge a long-standing gap by providing a secure gateway for institutions to gain LTC exposure. GSR’s wider presence, including its backing of Polygon’s Katana protocol, shows its confidence in nurturing robust crypto ecosystems that can evolve alongside market demand for decentralized solutions and institutional-grade products.

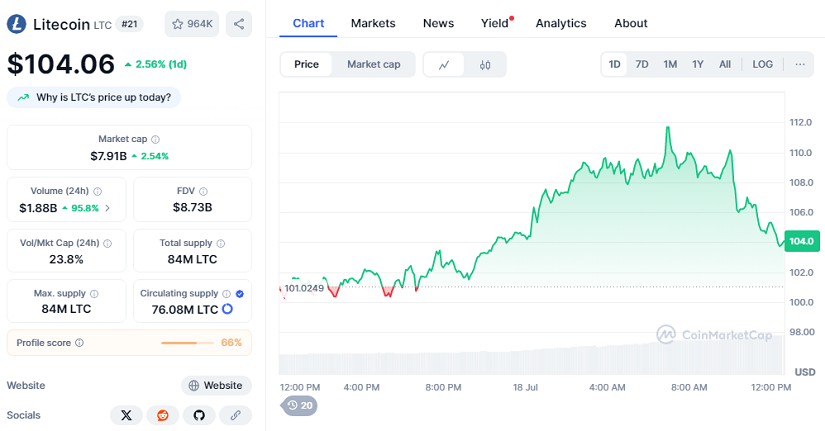

At the time of writing, Litecoin trades at $104.06, up 2.56% over the last 24 hours. The coin’s market capitalization stands at $7.19 billion with a notable 24-hour trading volume of $1.88 billion, marking an increase of 95.8%. With the new treasury strategy, Litecoin’s role in institutional finance could gain meaningful traction, reinforcing its status as a trusted, low-cost, and accessible network for millions.