Some traders are monitoring early-stage crypto projects that have been drawing attention this week, including Paydax Protocol (PDP), ASTER, and Plasma (XPL). Paydax is currently conducting a token sale; project materials list a token price of $0.015 at the time of writing.

Context: high-growth narratives and Paydax (PDP)

Early-stage tokens are often discussed in terms of outsized upside, but outcomes are uncertain and risks can be material. Paydax Protocol (PDP) describes itself as an on-chain lending protocol focused on improving access to liquidity.

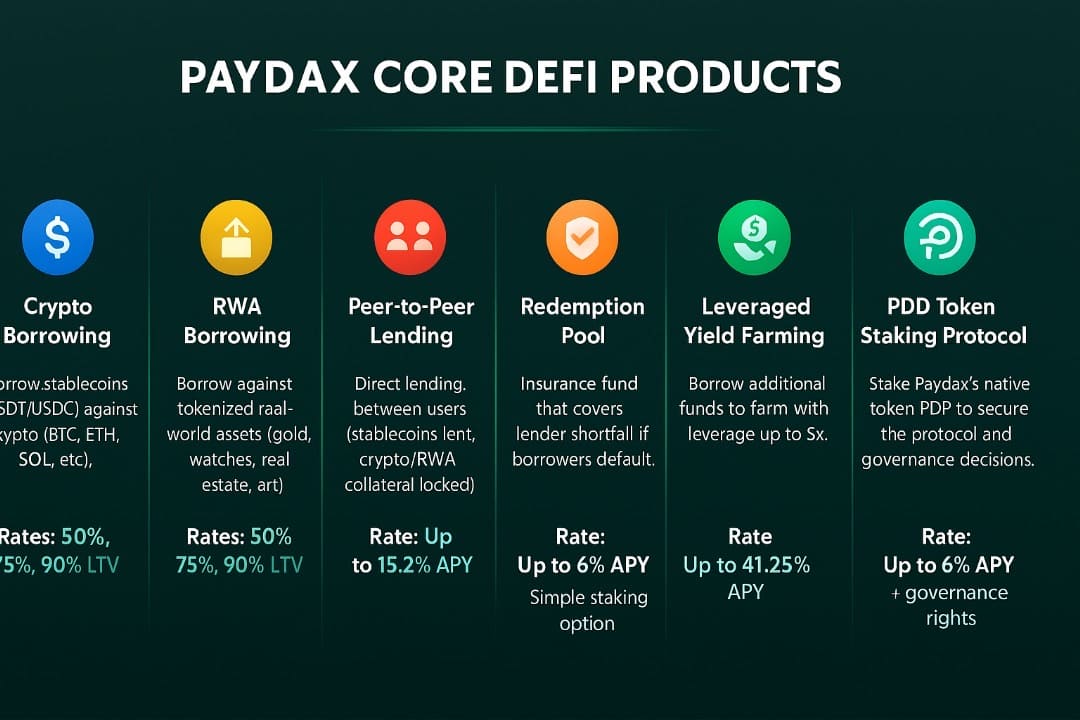

According to the project, Paydax enables users to borrow assets such as USDT or BTC using cryptocurrency and other assets as collateral. The team also says the protocol supports 15+ types of collateral, including governance tokens and tokenized real-world assets such as gold.

Paydax further states that its system is transparent and on-chain, and it has been marketed as “The People’s DeFi Bank.” These are project claims and should be assessed alongside the usual risks associated with DeFi protocols, smart contracts, and collateralized borrowing.

Recent developments around Plasma (XPL) and ASTER

Plasma (XPL) launched its mainnet beta and native token on Sept. 25. After the launch, some community members raised concerns about token transfers to exchanges. On-chain tracker ManaMoon posted wallet-flow information that contributed to the discussion; the underlying allegations are not confirmed by this outlet.

ASTER has also been discussed in connection with a planned supply distribution event. A social-media post referenced a 4% supply airdrop, and some market participants have speculated about potential sell pressure. Such market impacts are uncertain and depend on a range of factors.

Paydax’s team has pointed to community updates such as AMAs as part of its communications approach. Separately, the project describes the PDP token as having multiple intended uses within its ecosystem, including:

- Using PDP as collateral within the protocol (as described by the project)

- Token-based fee settings for borrowing (project-stated)

- Identity-verified borrowing for tokenized real-world assets, with safeguards described by the project

- Staking mechanics that the project says may offer up to 6% APY (variable and not guaranteed)

- Governance voting on proposed upgrades (project-stated).

Paydax (PDP): security and transparency claims

Paydax has highlighted security and operational controls in its public materials. For example, it links to a smart-contract audit and names third-party providers it says are involved in various parts of the stack. These references should be independently verified by readers where possible.

- Audit referenced by the project (Assure-DeFi)

- Chainlink for real-time asset pricing (project-stated)

- Brinks for securing high-value collateral (project-stated)

- Sotheby’s for validating tokenized real-world assets (project-stated)

- Onfido for identity (KYC) verification (project-stated)

- Gnosis Safe multi-signature wallets (project-stated)

- Bug bounty programs (project-stated)

The project also states that it operates as a registered company with a verified leadership team. These details are presented as part of its positioning, and readers may wish to review primary sources directly.

Project links (for reference)

Website: https://pdprotocol.com/

X (Twitter): https://x.com/Paydaxofficial

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.