TL;DR

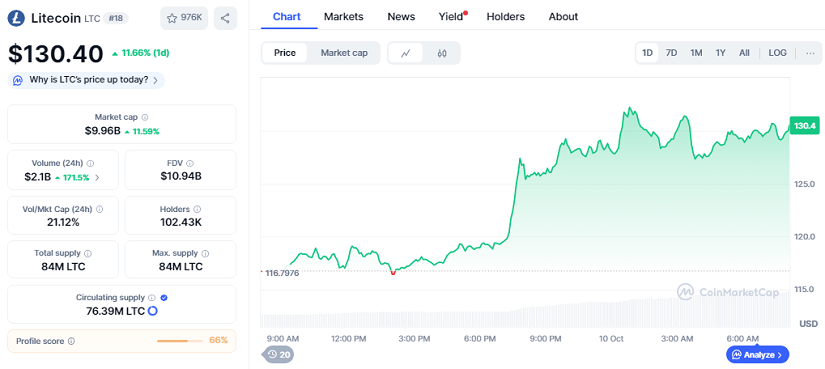

- Litecoin has surged to $130.40 with an 11.66% gain in just 24 hours, driven by growing institutional interest.

- Daily trading volume has surpassed $2.1 billion and the market cap sits just under $10 billion, signaling strong capital rotation.

- If spot ETFs gain approval, analysts are projecting a bullish range between $350 and $400, putting Litecoin back in the spotlight for traders seeking legacy altcoins.

Litecoin has reclaimed ground after climbing from $115 to above $130, now retesting levels unseen since late 2024. On-chain data shows a 15% increase in large wallet accumulation and a 170% surge in daily trading volume, now reaching $2.1 billion. The market cap of $9.96 billion highlights that the asset is back on the radar for investors rotating profits from higher-cap coins. Analysts note that renewed interest is attracting both retail and institutional buyers, creating a broader foundation for potential long-term growth.

Renewed institutional inflows and active speculation have boosted momentum. The Litecoin Foundation reported over three million transactions processed in just two weeks, showing tangible network activity. Traders view this combination of strong on-chain metrics and renewed demand as a potential springboard for further gains. Additional network improvements and consistent miner activity continue to support confidence in Litecoin as a reliable altcoin choice.

Institutional Momentum Builds

Market sentiment is being driven by the imminent regulatory decision on spot Litecoin ETFs, expected once full U.S. government operations resume. Bloomberg analysts James Seyffart and Eric Balchunas point out that Canary Capital filings include the final details typically seen right before approval, further raising expectations.

ETF speculation aligns with a more positive tone from the Federal Reserve, encouraging risk-on positioning across digital assets. Some corporate treasuries are reportedly considering exposure to established altcoins, with Litecoin standing out for its consistent uptime and transaction volume. Combined with favorable macroeconomic conditions, these factors are reinforcing confidence in LTC as a strategic investment option.

Price Targets And Market Outlook

To sustain momentum, Litecoin needs to break above $140 and turn that level into a strong support zone, allowing for continued accumulation. Surpassing $200 could trigger technical buying that pushes toward $350 and eventually toward $400, following projections from multiple analysts. The all-time high of $412, reached in May 2021, remains a critical psychological level.

The 24-hour gain of 11.66% and surge in volume suggest this is not just a short-lived spike. Legacy altcoins are returning to focus as profits from Bitcoin rotate into assets with lower perceived downside and strong ETF potential. If regulatory signals align with market expectations, Litecoin’s next major test could arrive sooner rather than later.