Canary Capital has taken a decisive step toward launching its proposed Litecoin (LTC) and Hedera (HBAR) spot ETFs, filing final amendments that signal readiness for SEC review. Market watchers see this as a pivotal moment for institutional crypto adoption, with Polymarket assigning a 96% probability of approval by the end of 2025.

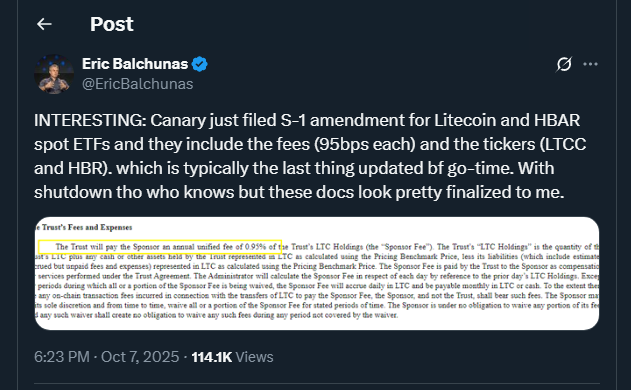

The filings, updated on October 7, introduce a 0.95% management fee for both ETFs and confirm ticker symbols LTCC for Litecoin and HBR for Hedera. Analysts note that these tweaks typically mark the final stage before regulatory approval, and could pave the way for significant inflows from institutional investors.

Litecoin’s chart shows an encouraging inverse head-and-shoulders pattern, while historical Q4 performance suggests strong potential for a year-end rally. If the SEC greenlights the ETFs, Litecoin could see renewed momentum, combining seasonal tailwinds, bullish technical setups, and institutional interest to fuel a robust finish to 2025.