TL;DR

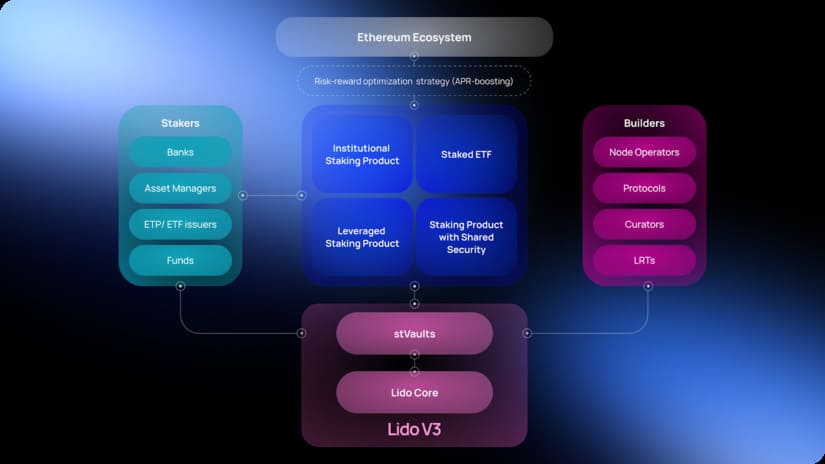

- Lido V3 introduces stVaults, a modular feature that allows users to customize staking strategies on Ethereum, adjusting fees, validators, and risk profiles.

- This update is specifically designed for institutions, node operators, and asset managers, providing greater control and flexibility.

- Lido strengthens decentralization and competition among validators, while stVaults enable leveraged staking strategies.

Lido has announced the launch of V3, an update that introduces a new feature called stVaults, designed to offer greater flexibility in Ethereum staking.

This advancement will allow users to create customized staking strategies, adjusting factors such as fee structures, validator configurations, and risk-reward profiles. The novelty is especially aimed at institutional investors, node operators, and asset managers, who will now be able to develop staking products tailored to their specific needs.

The introduction of stVaults is crucial for the evolution of Lido’s liquid staking infrastructure, as it provides greater customization capabilities. This feature will allow institutions to meet their regulatory and operational requirements, ensuring more control over the staking process, without compromising the security and decentralization that characterizes the Ethereum network.

Node operators will be able to create specific products that attract large participants, diversifying their income and increasing their share of the total value locked (TVL) and the rewards generated.

Lido: The Most Important Protocol Within the Ethereum Ecosystem

stVaults also offer the possibility of implementing leveraged staking strategies, enabling users to earn higher rewards through automated smart contracts. This makes it easier to access the liquidity of stETH, Lido’s staking token, without having to resort to centralized solutions. Additionally, a risk-tracking mechanism is incorporated, allowing users to explore innovative strategies like restaking, without compromising the overall security of the ecosystem.

Lido also explicitly focuses on the importance of decentralization, as stVaults allow each user to configure their own rules, such as fees or validator configurations. This modular design promotes competition among validators and encourages diversification, which in turn improves the security and stability of the network.

With a TVL of $25 billion in assets, Lido is the leading protocol on Ethereum. The V3 update will be rolled out in three phases, starting with an early adopter program, followed by a testnet deployment, and finally the mainnet launch