TL;DR

- LayerZero Foundation has put forward a proposal to acquire Stargate and integrate its token economy into the LayerZero ecosystem.

- The plan would see all STG tokens converted to ZRO at a fixed rate, ending STG’s independent governance model.

- Both tokens have surged over 20% in the last 24 hours amid record trading volumes, signaling strong market interest despite some community concerns over valuation.

LayerZero Foundation is aiming to consolidate two of the most closely connected projects in the cross-chain space by absorbing Stargate Finance into its own structure. If approved, the move would merge the governance, utility, and revenue flows of both protocols under the ZRO token, creating a unified infrastructure for cross-chain transactions and potentially improving operational efficiency across the ecosystem.

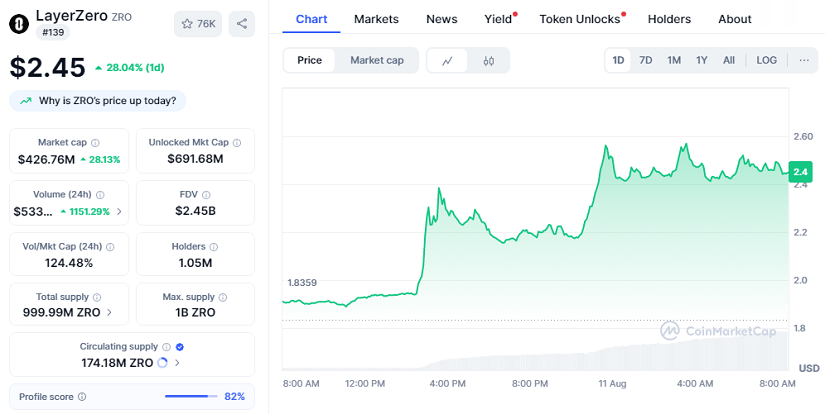

Currently, ZRO is trading at $2.45, up 28.04% in the past 24 hours, with a market cap of $426.76 million and an impressive daily volume exceeding $533 million, a 1,151% increase. Meanwhile, STG is priced at $0.1961, climbing 20.47% in the same period, with a market cap of $129.67 million and over $114 million in 24-hour volume, representing a 1,780% spike in trading activity.

Strategic Shift Towards Unified Governance

The proposed acquisition would convert all STG tokens into ZRO, removing Stargate’s separate governance structure and rewards mechanism. Revenues from Stargate’s bridge operations — which recently delivered nearly $939,000 in payouts to STG stakers over three months — would be redirected to the LayerZero Foundation. ZRO holders could see potential token buybacks fueled by these revenues, centralizing the value proposition within one asset and enhancing long-term sustainability.

However, the merger would also end Stargate’s fixed-yield staking program, which has been a steady source of returns for many holders. Instead, former STG investors would integrate directly into LayerZero’s broader token economy, with no dedicated staking yield mechanism available to them in the new framework.

Market Reaction And Long-Term Implications

Early community responses have been mixed. Some investors welcome the streamlined model and potential for greater liquidity concentration, while others question the swap ratio and fear it undervalues STG compared to historical prices and ongoing earnings potential from cross-chain bridge operations.

Despite the debate, the market’s reaction suggests optimism. Both assets have seen significant price and volume increases, positioning this proposal as one of the most notable token mergers in the current cycle. The decision could influence how interconnected protocols approach governance and value distribution in future consolidations, potentially setting a new standard for similar strategic moves in the crypto sector.