Across the past week, the majority of the cryptocurrency market has remained optimistic, with green candlesticks commonplace throughout the top 100. While there are inevitably some outliers to this bullish trend, the losses amassed by these assets have primarily remained below 1%, suggesting that the trend of recovery appears to be extending itself into this week and potentially the next.

Across the past week, the likes of Bitcoin, XRP, Solana, and Cardano have all been privy to growth spurts of up to 21%, which has begun to restore some faith in the current trajectory of the market. However, in spite of this positive price outlook, the institutional side of crypto has remained very bearish and controversial. With BlockFi’s bankruptcy proceedings in full swing, it has been reported that they are set to sell over $4.7 million worth of tangible mining equipment. On another institutional note, Coinbase’s CEO, Brian Armstrong, has taken to Twitter to air his frustrations regarding the SEC’s regulation of cryptocurrencies in the United States. Additionally, a recent Hindenburg report has shed light on Jack Dorsey’s Block (a payment service provider) calling it a ‘safe haven for criminals’.

The Latest News

BlockFi To Sell $4.7M Worth Of Mining Equipment During bankruptcy

With BlockFi’s bankruptcy proceedings in full swing, a bankruptcy judge has approved the sale of BlockFi’s crypto mining equipment and similar physical assets, amassing $4.7 million. On Thursday, these assets were sold to a party under the name U.S. Farms, who partook in a ‘very competitive’ auction process that yielded five bids for the mining asset package in its entirety, as well as seven additional partial bids, in accordance with an attorney statement.

Having been one of the prime providers of lending in the Bitcoin mining space and formerly looking to sell $160 million in mining loans, it is believed that due to the substantial decline in ASIC machine prices, the loans may now be severely undercollateralized. This came in light of Bitcoin prices plunging late last year which occurred as power costs began to shoot up internationally. As a result, firms such as BlockFi have been forced into liquidation.

Brian Armstrong Takes To Twitter To Slam US Crypto Regulation

In a ‘Twitter Space’ hosted by Coinbase earlier this week, CEO, Brian Armstrong kicked off the space by referencing the Wells Notice, initially stating: “we didn’t think this was unexpected, to be honest”. He then iterated that Coinbase is keen to adhere to the rules through their “compliance first approach” as they support the bridging of crypto and fiat. However, Armstrong stated that “the SEC is one where we’ve really struggled over the past few years” in reference to Coinbase’s attempts to discuss the regulatory landscape, with the exception of the SEC calling upon the firm last year.

Armstrong disclosed that Coinbase has allegedly held over 30 meetings “over the last nine months” with the SEC in an attempt to culminate in a meeting where regulatory feedback would be given. However, Armstrong alleged that the SEC had canceled the meeting the day before and subsequently filed a Wells Notice a week later. Armstrong implored that “we’ve been asking for them to file official rules” and affirmed that Coinbase had attempted to preemptively acquire compliance licenses, but the licenses remain dormant. In a bold statement, Armstrong suggested that the US is the furthest behind in terms of crypto regulation, as other countries are actively promoting the growth of crypto firms, while the US is not.

Hindenburg Report Reveals Block Is A ‘Criminal Safe Haven’

A recent Hindenburg report claims to have uncovered some shocking truths regarding Jack Dorsey’s payment provider, Block Inc., after conducting a two-year investigation. Hindenburg alleged that Block inflated user metrics and that insiders sold the top. As a result, Hindenburg branded the firm as facilitating ‘frictionless’ fraud, as insiders cashed out a reported $1 billion.

According to Block’s 2022 annual report, they have over 51 million monthly ‘transacting active users’, however, former employees told Hindenburg that 40-75% of these accounts are fake, involved in fraud, or additional accounts of existing users. Hindenburg has alleged that the cash app is a ‘safe haven’ for criminals, further supported by an alleged statement from an employee who stated that “every criminal has a Square Cash App account”. Hindenburg claims that pressure from upper-level management has resulted in disregarding anti-money laundering (AML) and know-your-customer (KYC) laws.

Current Project Trends

Based on data provided by CoinMarketCap, the top-gaining project across the past week was Aion, a token used to securely access The Open Application Network (OAN), which is a Canadian public network available to all. As a result, Aion has accelerated by 521% in the past 24 hours and a staggering total of 329.69% across the past week.

The Current BTC Trend

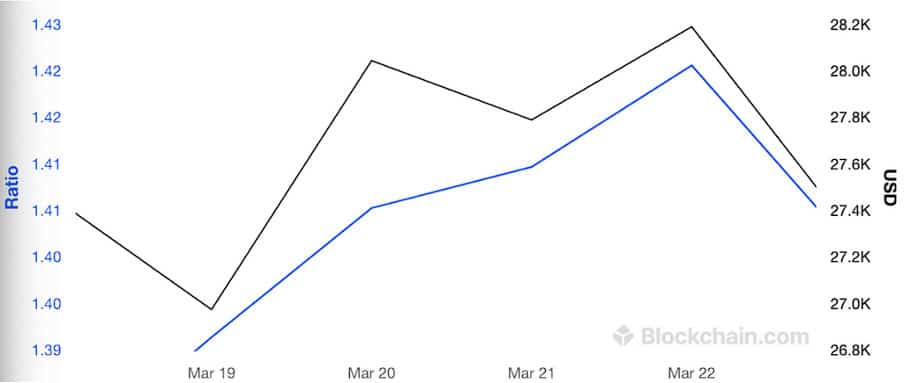

Across the past week, Bitcoin has continued to trade along an upward trajectory, resulting in a 12.88% increase. Starting the week at 24.97k, Bitcoin immediately shot up into the $26k region throughout the 17th and began to move into the $27k region throughout the 18th and 19th. On the 20th, Bitcoin price began to push through the $28k threshold, leading it to volley between $27.5k and $28.3k until the 22nd, when it then plummeted to $26.7k. However, BTC quickly began to regain some ground, leading it to shoot up once again on the 23rd back into the $28k zone. This has led BTC to reach $28.73k as of writing.

In light of this, Bitcoin’s MVRV (market value to realized value) has accelerated throughout this week. Beginning the week at 1.391, BTC’s MVRV moved at a steep incline for the entirety of the week, leading it to peak at 1.421 on the 22nd, before it began to dip. This suggests that BTC’s valuation is continuing to move away from the undersold territory and that its true value is being realized.

The Situation of ETH Staking

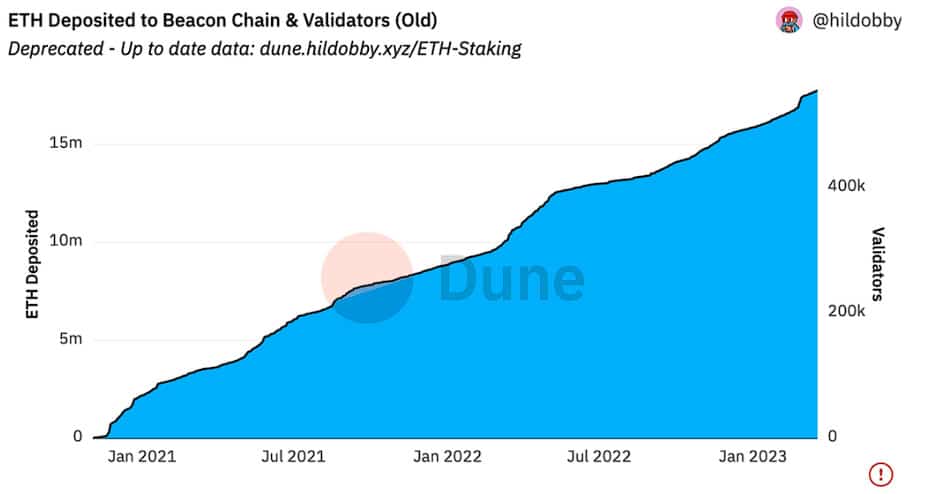

As of the 24th of March, the state of Ethereum staking remains positive, primarily due to the upcoming deployment of the Ethereum Shanghai upgrade, which will allow all validators who have staked Ethereum to progressively redeem their tokens and subsequent yield earnt. In addition, the volume of Ethereum deposited to the Beacon Chain has continued to grow at a steep rate since the start of 2023, with this beginning to see an uptick throughout March.

Here are some key figures from across the past week to consolidate this:

- Total validators: 512,657

- Depositor Addresses: 90,200

- Total ETH Deposited: 16,353,927

- Liquid Staking Percentage: 35.63%

- Staked Share Of ETH Supply: 14.81%

The Current Macro Situation

China Set To Make Up 40% Of The Rise In Global Oil Demand In 2023, Says Wood Mackenzie

In a recent Wood Mackenzie report, it was noted that a ‘return to normal mobility in China is the single biggest demand driver, accounting for 1 million barrels per day (b/d) of the 2.6 million b/d increase this year’. This comes in light of the slowdown of interest rate hikes, leading China to potentially make up roughly 40% of the world’s recovery in demand for the commodity.

What Could Be Coming In The Week Ahead?

As the crypto market continues to improve in terms of valuation and volume, it is likely that this momentum will carry into the coming week. However, with the outpour of bearish institutional news, it is plausible that this collation of data and news reports could begin to leech into the market and create a bearish sentiment.

Press releases or guest posts published by Crypto Economy have sent by companies or their representatives. Crypto Economy is not part of any of these agencies, projects or platforms. At Crypto Economy we do not give investment advice and encourage our readers to do their own research.