TL;DR

- Kraken and Mastercard are launching a crypto debit card in Europe that allows direct payments with cryptocurrencies without prior conversion.

- The card displays clear fees before each transaction, sets usage limits, and complies with strict security standards.

- Kraken aims to align with the EU’s MiCA regulation, while Mastercard continues integrating cryptocurrencies into the traditional financial system.

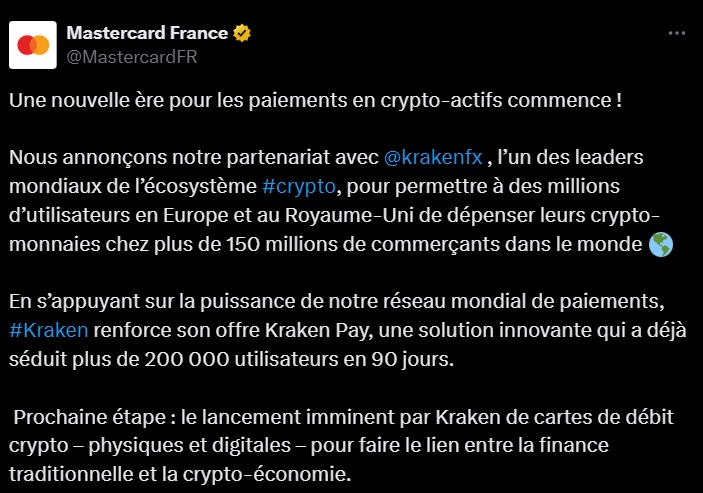

Kraken announced a new partnership with Mastercard to launch crypto debit cards in Europe. This initiative will allow users to spend their cryptocurrencies directly at the point of payment, without needing to convert them into fiat currency first. The feature will become available in the coming weeks for users in eligible regions, who will be able to join a waitlist to request the card.

How the Kraken and Mastercard Card Works

Kraken’s card is designed to simplify the everyday use of cryptocurrencies, focusing on ease and transparency. Each transaction will clearly display the applied fees before confirmation, with no hidden charges.

Additionally, in certain cases, a spread built into the price may apply, depending on the type of asset, the amount involved, or the chosen payment method. All transactions are final and non-refundable.

The card also includes operational limits to ensure security and facilitate spending management. Purchases must exceed a minimum amount, and weekly spending caps are set, including payments through Apple Pay and Google Pay. Users are allowed up to four successful attempts to save a card within a 30-day period. All information is stored under strict security protocols in compliance with PCI standards.

New Regulations in Europe

Kraken has worked extensively on this product to adapt to the European Union’s new regulatory framework. The company is seeking a license under the MiCA regulation, which sets common criteria for operating services related to digital assets across the region. Getting ahead of these regulations allows Kraken to operate with more predictability and tailor its offering to meet the legal requirements that will soon come into effect.

As for Mastercard, this partnership further strengthens its approach to the crypto sector. The company has launched several initiatives with Web3 platforms and exchanges, aiming to progressively integrate cryptocurrencies into the traditional payment system.