TL;DR

- Jupiter distributed 700 million JUP tokens worth $500 million to over 2 million wallets, generating high volatility in the market.

- JUP’s price dropped 11.22% in the last 24 hours, accompanied by a 166% surge in trading volume, reaching $609 million.

- Technical analysis indicates a clear bearish trend, with predictions of a drop to $0.63 or a potential rally to $0.95 in the coming weeks.

On Wednesday, Solana-based decentralized exchange Jupiter launched its much-anticipated “Jupuary” airdrop, distributing 700 million JUP tokens worth approximately $500 million across over 2 million eligible wallets. While the event generated high expectations within the crypto community due to its scale and potential impact, it also triggered a wave of massive selloffs that significantly pressured the token’s price, catching many traders by surprise. Speculation about short-term profits quickly spread across social media, further fueling the intense activity around JUP and creating heightened market volatility.

Jupiter Airdrop Triggers Massive Selloff

Following the distribution, JUP’s price dropped 11.22% over the last 24 hours, trading at $0.7708 at the time of writing. This sharp decline coincided with a notable 166% increase in trading volume, reaching $609 million in just one day. The combination of falling prices and rising trading volume indicates that many holders opted to liquidate their newly acquired tokens for immediate profit, amplifying selling pressure in the market.

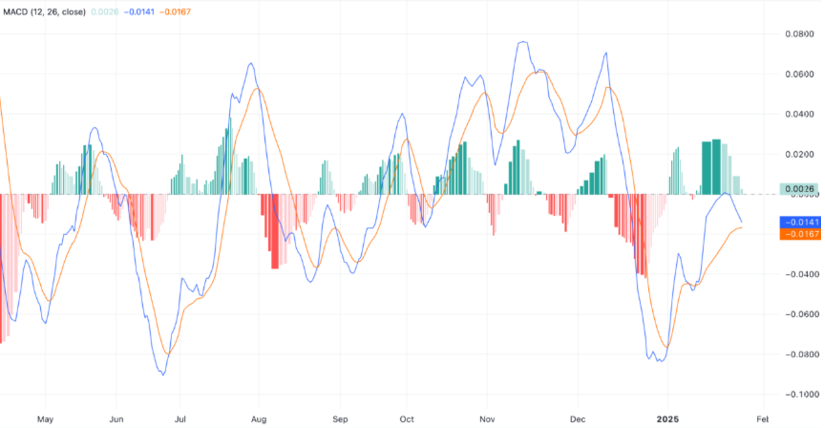

Technical indicators support this bearish outlook. The Moving Average Convergence Divergence (MACD) indicator for JUP shows the signal line (orange) is about to cross above the MACD line (blue), potentially confirming a bearish trend. This crossover typically signals increasing selling pressure and suggests that the token’s price may continue to decline in the short term.

However, not all hope is lost. Some analysts point to a possible rebound if buying activity picks up, which could help the token regain ground from its current levels.

JUP Price Prediction: Will It Drop to $0.63 or Rally to $0.95?

If the bearish trend persists, JUP’s price could fall to $0.63, a level last seen in July of last year, representing an additional 18% decline from its current value. On the other hand, if buyers regain control, the token could break resistance at $0.81 and potentially rally to $0.95 in the coming weeks.

This event highlights the risks and volatility associated with large-scale airdrops, which often create instability in the market. Investors should remain cautious and carefully analyze trends before making decisions in this high-uncertainty environment.