TL;DR

- JPMorgan predicts only $1.5 billion in net inflows for Solana ETFs in their first year, a low level compared to BTC and ETH.

- The low projection is based on a 1:7 ratio relative to Ethereum and the perception that Solana has a weaker smart contract ecosystem.

- The bank, nevertheless, sees the approval of the Solana ETF as “highly probable” due to the existence of futures contracts on the CME.

Experts from JPMorgan, the financial giant, estimate that while spot Solana ETFs will surely be approved, they will have significantly lower inflows than those triggered by Bitcoin and Ethereum.

JPMorgan has issued a new report that put the brakes on the high expectations revolving around Solana ETFs. Although the bank’s analysts, led by Nikolaos Panigirtzoglou, consider the approval of spot Solana ETFs by the U.S. Securities and Exchange Commission (SEC) to be imminent—taking into account the existence of a futures contract on the CME—demand estimates are considerably modest.

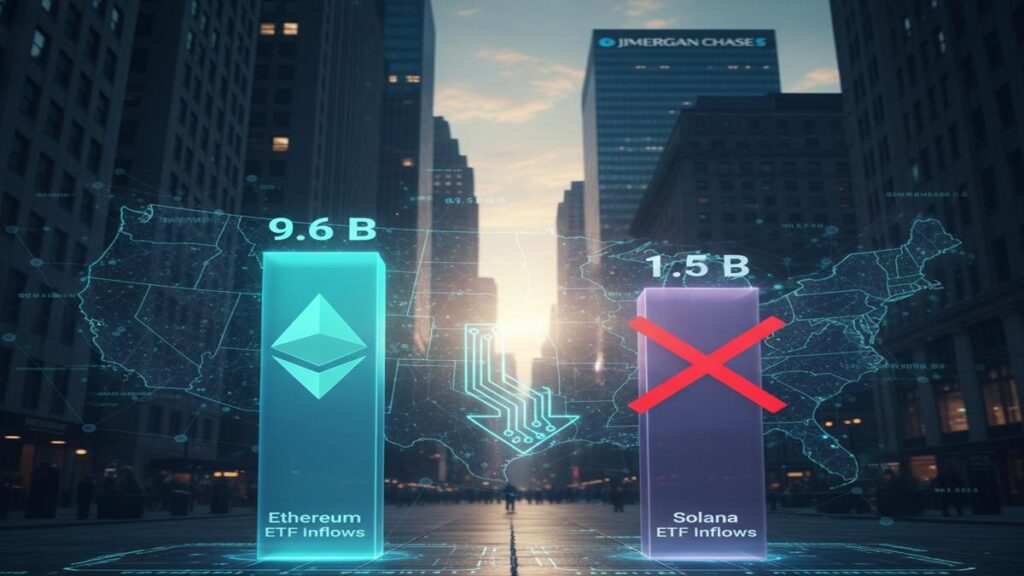

The JPMorgan report forecasts that Solana ETF inflows will reach a net $1.5 billion during their first year of trading. This figure represents only one-seventh of the inflows recorded by Ethereum ETFs in their first year ($9.6 billion), and it is notably lower than the initial projections for Bitcoin funds.

Why the Caution in the Inflows Projection?

JPMorgan’s justification for its conservative forecast is based on various factors, although the imminent ETF approval is already reflected in the reduction of the Grayscale Solana Trust (GSOL) discount.

- Activity Comparison: The analyst team compared Solana’s activity against Ethereum, and the estimation was based on those results. That is, the $1.5 billion estimate is based on the proportion of Solana’s on-chain activity and Total Value Locked (TVL) relative to Ethereum, where a 1-to-7 ratio is observed.

- Investor Fatigue and Competition: They point to the possibility of “investor fatigue” given multiple spot ETF launches and the growing competition from diversified index funds.

- Network Perception: JPMorgan’s report highlights a weaker network perception for Solana, noting a decrease in active addresses since late 2024 and the prevalence of memecoin trading on the network, which could discourage more serious institutional investors.

It should be noted that this forecast that Solana ETF inflows will reach $1.5 billion contrasts with a previous estimate from another JPMorgan team, which had projected flows between $2.7 billion and $5.2 billion for the same period. This new figure underscores a downward adjustment in Wall Street’s expectations for the product’s initial adoption.