TL;DR

- Goldman Sachs and BNY Mellon are joining forces to offer tokenized shares of money-market funds, a move JPMorgan calls a major step to keep cash competitive against stablecoins.

- Major fund families like BlackRock and Fidelity are involved in the rollout.

- Analysts say this expands how investors can use money funds, including as collateral, which could reshape liquidity management in the traditional financial system.

The decision by JPMorgan to publicly back Goldman Sachs and BNY Mellon’s plan to tokenize money-market fund shares underscores how seriously Wall Street is embracing blockchain innovation to safeguard cash’s role as a prime asset. The initiative, announced this week, will let institutional investors buy digital representations of regulated money funds, broadening how these assets can be used in modern portfolios and enhancing overall efficiency across the market.

Participating managers include giants such as BlackRock, Fidelity, Dreyfus, Federated Hermes, and Goldman Sachs itself. Combined, these firms manage nearly half of the taxable money-market fund market, making the pilot especially influential. The funds will remain fully compliant with current regulatory frameworks, with BNY Mellon continuing to handle record-keeping and settlements to ensure maximum security for participants.

Tokenized Funds Offer Fresh Use Cases

Beyond simply holding cash, tokenized money-market fund shares can now be posted as collateral, which could transform how institutional players manage margin requirements. According to JPMorgan’s Teresa Ho, the flexibility of tokenized funds means investors may not need to tie up cash or Treasuries when covering margins, avoiding the loss of yield in the process and gaining greater capital efficiency in their daily operations.

This shift comes at a time when investors have already poured billions into money-market funds, drawn by their yields amid shifting Federal Reserve policies. So far this year alone, over $270 billion has flowed into these instruments. Even with a softer interest rate environment ahead, money funds remain attractive for their relative stability, predictable income streams, and liquidity for institutional portfolios.

Regulatory Developments Encourage Blockchain Integration

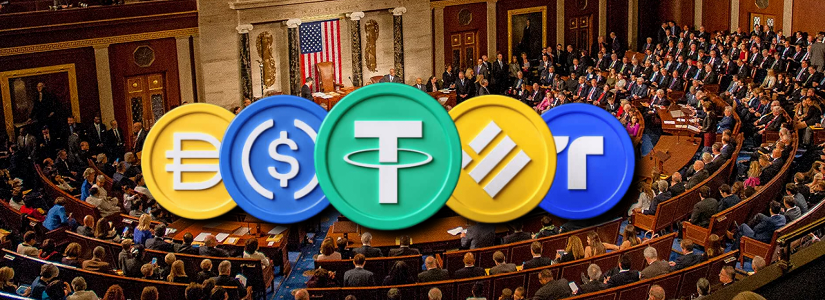

The launch coincides with the recent passage of the GENIUS Act, which clarifies pathways for issuing payment stablecoins backed one-to-one by traditional reserves. While stablecoins can’t offer yield, tokenized money funds do, presenting an edge for traditional institutions to retain depositors seeking yield with blockchain benefits and more transparency.

JPMorgan’s endorsement signals that large banks increasingly see tokenization as an opportunity rather than a threat. Analysts expect more financial institutions to experiment with stablecoins and tokenized deposits, aiming to blend digital assets with traditional systems. This strategy may ensure cash stays relevant in an era of rapid blockchain innovation and evolving global financial infrastructure.