TL;DR

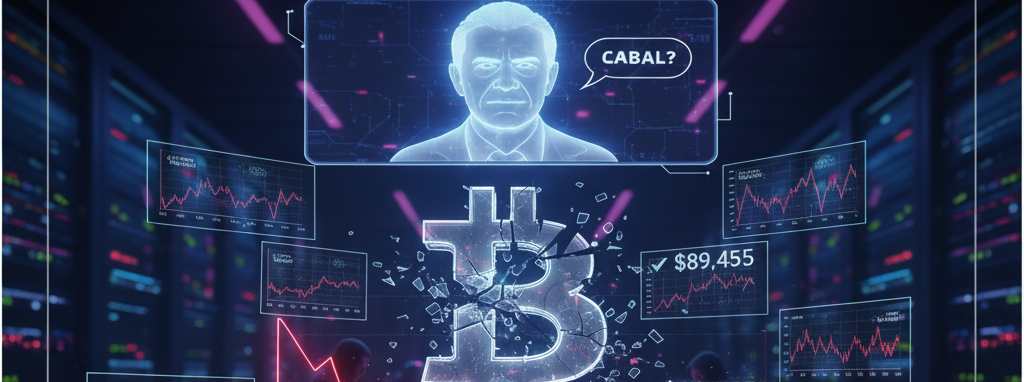

- Bitcoin hit its lowest level in seven months, briefly falling to $89,455 on November 18.

- Jim Cramer’s comment on X sparked speculation about manipulation surrounding a key psychological level.

- The Fear & Greed Index remains at “Extreme Fear” as the market evaluates a bearish death cross signal.

November is proving to be one of 2025’s most turbulent months for Bitcoin; in fact, this Wednesday it fell into the $90,000 range and sunk slightly to $89,455, marking its lowest level in the last 7 months. Amidst all this anxiety, television host Jim Cramer fueled the market debate.

The host used his X account to post that, “it almost feels like a cabal is trying to keep Bitcoin above $90,000.”

Almost feels like a cabal is trying to keep Bitcoin above $90,000. I like Bitcoin but i do not like any of the derivatives created to play it or game it or mine it.

— Jim Cramer (@jimcramer) November 19, 2025

Although Cramer reaffirmed his support for Bitcoin as an asset, he made it clear that he is not a fan of derivatives products, ETFs, or mining stocks built around it. His comment instantly generated debate among traders and fed the tense atmosphere, suggesting that coordinated actors might be intervening to defend a key price level, right at a moment of extreme fragility.

Macroeconomic Pressure and Fear Indicators

Bitcoin’s drop accelerated after the confirmation of a death cross, a bearish signal that occurs when the 50-day moving average falls below the 200-day moving average. This is a historic pattern that suggests a prolongation of the trend into the red, especially when macroeconomic conditions are uncertain, with the Federal Reserve debating whether to cut interest rates in December or maintain caution due to persistent inflationary pressures.

In this context, the Crypto Fear & Greed Index remains in the “Extreme Fear” zone, reflecting the generalized indecision in the market. While some analysts view the pullback as a standard reset phase, Jim Cramer’s warning of Bitcoin $90K manipulation adds to the concerns of those who believe the market has not yet fully processed the liquidity crisis or the profit-taking that followed the October peak.

With Bitcoin struggling to stabilize near $91,000, the asset’s ability to hold this range will be crucial in defining whether the market is on the verge of a rebound or a more prolonged correction.