TL;DR

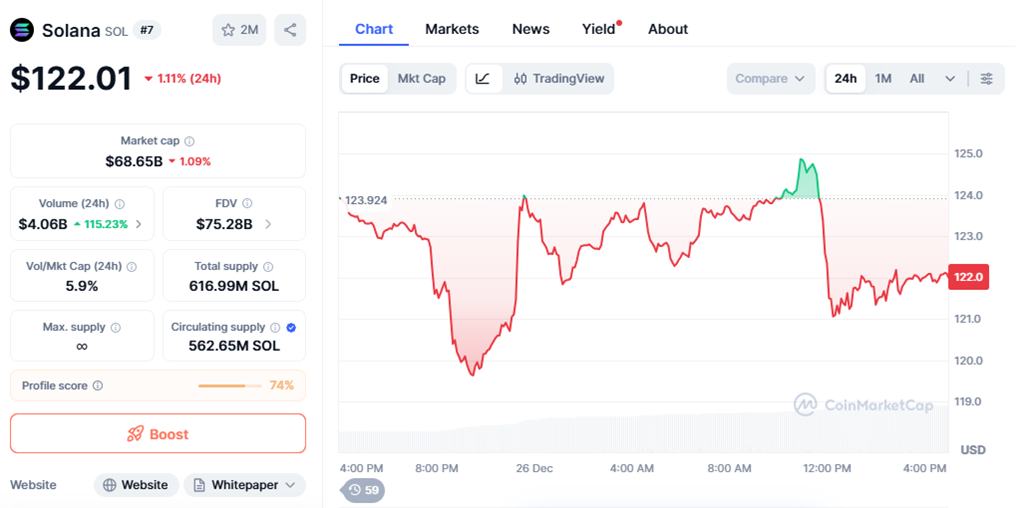

- Solana trades at $122.01 after a 1.11% decline in the last 24 hours, while market indicators suggest selling pressure is easing.

- The RSI holds near 41.82 as trading volume jumps to $4 billion, signaling active repositioning.

- Strong support between $118 and $120 remains intact, keeping the $140 level relevant amid steady ecosystem growth and institutional participation.

Solana remains a key question for traders as large-cap altcoins consolidate after recent volatility. Solana (SOL) shows short-term weakness in price but stronger signals in volume and momentum indicators, suggesting that downside pressure may be moderating. As capital rotates within the crypto market, SOL continues to draw attention due to its liquidity profile and expanding role in decentralized infrastructure.

According to current market data, SOL changes hands at $122.01, down 1.11% over the past 24 hours. Despite this pullback, trading volume rose sharply to $4 billion, marking a 115% increase on the day. Elevated volume during periods of price stability often reflects accumulation and active trading interest rather than broad distribution.

Technical Market Signals

Technical indicators provide additional context. The Relative Strength Index stands at 41.82, a level that sits in neutral-bearish territory but remains well above oversold conditions. In previous market cycles, Solana has shown price stabilization when RSI levels flatten and volume expands near key demand zones.

The $118 to $120 range continues to serve as a critical support area. Buyers defended this zone during earlier corrections, and recent price action shows SOL holding above it once again. Failure to break below this level suggests sellers are encountering resistance, which often precedes short-term rebounds in trending assets.

From a structural perspective, a move toward $140 would require an advance of roughly 13% from current levels. Given Solana’s historical volatility and its previous peak near $295, such a move aligns with typical recovery patterns seen during consolidation phases.

Network Activity And Broader Crypto Conditions

Beyond price metrics, Solana’s network fundamentals remain supportive. The blockchain continues to attract decentralized finance and NFT projects due to its high throughput and low transaction costs. Ongoing development and cross-chain initiatives expand its utility across multiple ecosystems.

Broader market conditions also influence SOL’s outlook. Bitcoin posts modest gains, and major altcoins often mirror shifts in BTC liquidity. Investment products linked to Solana, including exchange-traded vehicles introduced in late October, have recorded steady adoption, reinforcing institutional interest.