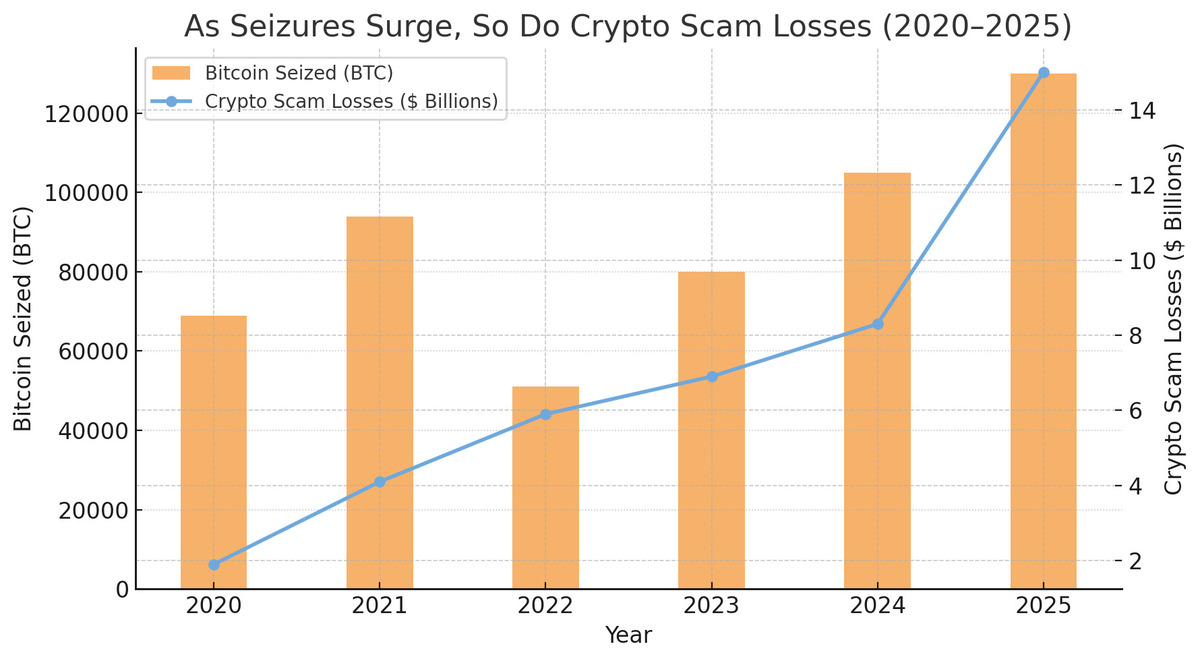

On October 14–15 2025, authorities announced one of the largest criminal takedowns in cryptocurrency history.

A coordinated investigation between the U.S., U.K., and Southeast Asian governments exposed the Prince Group, a sprawling pig-butchering ring that scammed thousands of victims and laundered more than 130,000 BTC (≈ $15 billion) through shell companies, mixers, and fake trading apps.

The bust stunned the crypto world. Not just for its scale, but for what it revealed: a global, industrial-sized network built on deception, human trafficking, and exploitation.

How the Scam Worked

Pig-butchering scams aren’t your average phishing attack. They mix romance, manipulation, and fake investments to “fatten” victims before the final cash-out.

The Prince Group perfected that model. Operatives built trust on social media or dating apps, posing as traders who promised easy crypto profits. Once the targets started sending money to “investment platforms,” the group siphoned the funds into Bitcoin wallets they controlled.

Investigators later found that hundreds of trafficked workers were forced to run these scams in compounds across Myanmar and Cambodia – guarded, monitored, and threatened if they refused.

Authorities traced transactions across thousands of wallets, eventually freezing addresses that led to two major centralized exchanges. The operation, coordinated by Interpol, the FBI, and the U.K.’s National Crime Agency, seized nearly 130,000 BTC and dozens of luxury assets.

A Turning Point for Crypto Crime

This case is about more than one syndicate. It marks a new era of international enforcement.

For years, scammers relied on the myth that “crypto can’t be traced.” That illusion is gone. Blockchain analytics, cross-border cooperation, and pressure on exchanges have made hiding billions nearly impossible.

At the same time, it’s a reminder that crypto’s transparency cuts both ways. The same technology that empowers decentralization also leaves a permanent trail – one that regulators are finally learning to follow.

The human cost adds urgency. Wired and Al Jazeera both reported that many workers were effectively enslaved to run the scheme, forced to text victims around the clock. The moral outrage guarantees governments will pour more resources into tracking similar operations.

Why It Matters to Everyday Crypto Users

Most crypto holders won’t encounter a billion-dollar scam. But they can easily fall into smaller traps – especially in the booming world of online betting and investment “opportunities.”

A growing number of scam operators now use fake crypto casinos as fronts. They advertise enormous bonuses, rig games, then vanish with deposits. Others mimic legitimate gambling sites but manipulate odds behind the scenes.

If you ever decide to gamble or game with crypto, treat your tokens like cash: verify everything first.

Start by checking trusted comparison resources like LuckyHat’s list of Bitcoin Casinos, which highlights regulated, transparent operators.

And before you play anywhere, make sure the platform supports provably fair gaming – a blockchain-based system that lets players verify every game outcome through cryptographic proofs. It’s one of the few tools that truly protects users in a largely unregulated space.

As Coindoo recently warned in its investigation of rogue casinos, many sites “mask as safe while operating without audits or withdrawal guarantees.” Those words ring especially true after the Prince Group’s revelations.

Five Red Flags to Watch For

- Unrealistic returns – If someone promises “guaranteed” crypto profits, assume a scam.

- Anonymous ownership – Reputable sites list founders, licenses, or at least transparent contact details.

- No provably-fair system – If you can’t verify the math, don’t trust the game.

- Pressure tactics – Scammers create urgency: “Bonus expires tonight.” Slow down and verify.

- Romance or friendship angle – Pig-butchering always starts with “getting to know you.” Keep personal and financial lives separate.

What the Crackdown Signals for the Industry

- Regulation is accelerating. Expect tighter KYC requirements and audits for any platform handling crypto deposits.

- Blockchain analytics is maturing. Firms like Chainalysis and Elliptic now feed data directly to law enforcement, turning on-chain transparency into a forensic weapon.

- Reputation will matter more than ever. Legitimate projects and casinos will emphasize licenses, audits, and provable fairness to earn user trust.

- Cross-border collaboration is here to stay. The Prince Group case united dozens of agencies, and proved crypto crime can’t hide behind national borders.

What This Means for You

If you trade, invest, or play in crypto, this story is your wake-up call.

- Do your due diligence. A five-minute search can reveal whether a platform is legitimate.

- Stick to verified operators. Guides like LuckyHat’s Bitcoin Casinos page list sites with actual track records.

- Value transparency. Choose platforms that show provably fair audits or publish wallet data.

- Protect your identity. Use hardware wallets and never share private keys on any “investment portal.”

- Report suspicious activity. If something feels off, flag it – law enforcement is finally paying attention.

The Bottom Line

The $15 billion Prince Group takedown shows both sides of crypto’s evolution: the dark underbelly of exploitation and the maturing power of blockchain transparency. For honest users, it’s a warning and a reassurance rolled into one. Scammers can still manipulate people – but they can’t hide their money forever.

Crypto’s next chapter will be written by those who learn from stories like this one; staying alert, playing smart, and insisting on fairness before they stake a single satoshi.

This article provides information about gambling platforms or casinos operating with cryptocurrencies. Crypto Economy is not affiliated with any of the mentioned services. We remind our readers that the use of crypto casinos involves inherent financial and legal risks, which may vary depending on the jurisdiction. This content is for informational purposes only and should not be interpreted as an investment or participation recommendation.