TL;DR

- An unidentified hacker behind the Infini exploit has laundered around 3,000 ETH using Tornado Cash, spotlighting once again the double-edged sword of privacy tools in crypto.

- With Infini’s leadership silent so far, regulators are sharpening their focus on mixer protocols.

- Meanwhile, Ethereum’s price climbs, showing that blockchain’s promise of decentralization and user freedom still fuels optimism despite mounting pressure from global watchdogs and increasing legal actions worldwide.

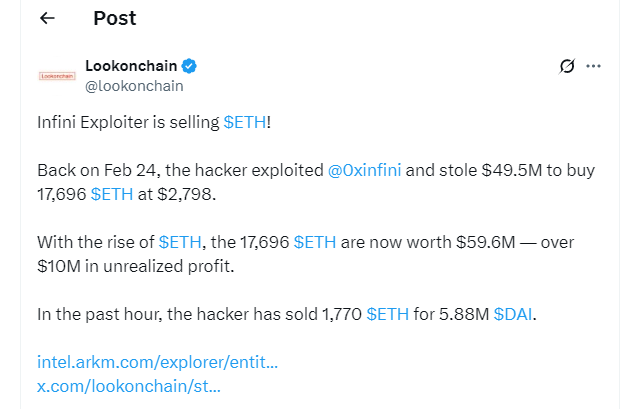

On July 17, 2025, the Infini hacker discreetly moved 3,000 ETH through Tornado Cash, a decentralized mixer on the Ethereum network, after converting another portion into nearly 5.9 million DAI. This marks another bold move after Infini’s major security breach in February that drained about $49.5 million. The maneuver underlines how privacy-enhancing protocols like Tornado Cash remain essential yet controversial in the crypto sphere.

Regulators worldwide are now zeroing in on mixer services, citing their alleged misuse by bad actors. U.S. authorities have renewed legal action against Tornado Cash developers, arguing that mixers enable criminals to cover their tracks too easily. Statements from top Treasury officials stress that existing controls have failed to prevent illicit flows, igniting debates about how much regulation should intervene in decentralized finance.

Privacy Tools Play Vital Role In Blockchain Freedom

While critics demand tighter supervision, many crypto advocates insist that privacy protocols defend fundamental user rights in blockchain ecosystems. Tornado Cash and similar mixers allow ordinary users to protect their transaction data from intrusive surveillance, a core principle that originally inspired cryptocurrencies like Bitcoin and Ethereum.

Privacy does not equate to criminality. Many everyday users rely on mixers to secure legitimate financial privacy in an increasingly monitored world. Removing these tools altogether could weaken personal freedom and hamper broader crypto adoption.

Ethereum Shows Resilience Despite Scrutiny And Regulatory Challenges

Interestingly, Ethereum has maintained an upward trend amid the regulatory storm surrounding Tornado Cash. According to CoinMarketCap, ETH trades around $3,460.55, gaining over 8% in the past day, with a market dominance near 11%. Analysts interpret this as a sign that the crypto community remains confident in decentralized networks’ resilience and evolution.

The Infini exploiter’s movements also shed light on lingering security gaps in DeFi platforms. Security experts urge platforms to double down on robust auditing, bug bounties, and community vigilance rather than banning privacy tools outright.

As regulators and innovators clash over how to tackle crypto laundering without suffocating blockchain’s open nature, the Infini incident reminds the industry that freedom and responsibility must advance together to preserve progress.