TL;DR

- The IMF warns that dollar-pegged stablecoin adoption in developing countries undermines local monetary policy and domestic currency demand.

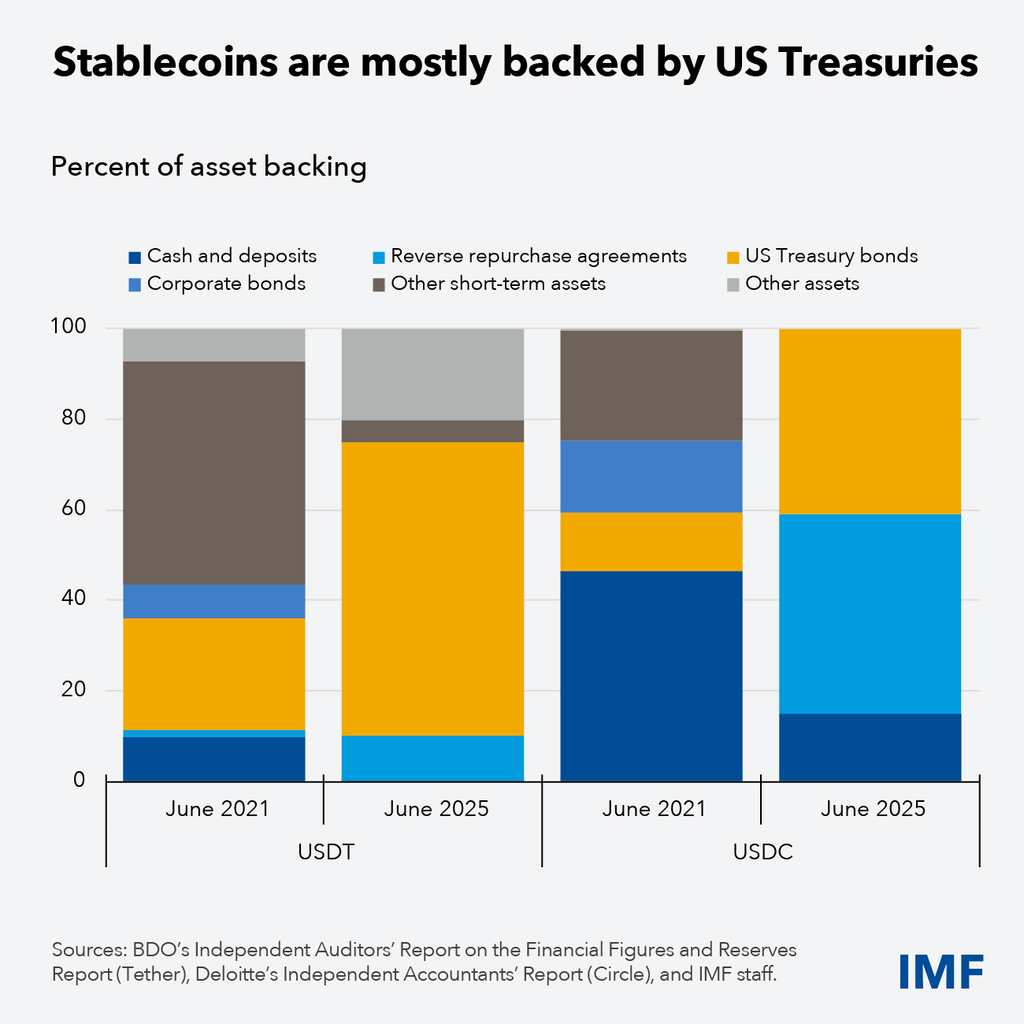

- These digital currencies create parallel channels for cross-border capital flows, bypassing traditional controls and accelerating capital flight.

- Emerging economies are especially vulnerable due to pre-existing informal dollarization and weak regulatory oversight.

The International Monetary Fund published a warning about dollar-pegged stablecoins and the pressure they put on economies in developing countries. The concern does not center on speculation or price volatility. It centers on what happens when households and businesses in high-inflation countries start using dollar stablecoins as their preferred store of value and unit of account — and stop trusting local currency altogether.

The IMF calls the pattern “cryptoization.” When residents of a country shift savings and transactions into foreign-currency stablecoins, demand for the local currency drops. Central banks lose traction over lending conditions because changes in interest rates no longer reach the segments of the population operating in digital dollars. The more widespread the shift, the harder monetary policy becomes to execute, and the more aggressively central banks need to act just to produce the same result.

Beyond monetary policy, stablecoins open a parallel channel for cross-border capital flows. In countries with capital controls, residents can now move value across borders through stablecoin transfers rather than traditional banking.

Stablecoins have the potential to reshape cross-border payments and capital flows. They offer opportunities, but also bring new risks—financial integrity, regulatory oversight, consumer protection, capital flow management, monetary sovereignty, and more. Learn more:… pic.twitter.com/AysA8nVd6K

— IMF (@IMFNews) February 10, 2026

During stress periods, that channel can accelerate capital flight at a speed that existing policy tools were not built to contain. Model simulations run by the IMF for small emerging markets show the downstream effects: domestic bank deposits fall sharply, bank net worth shrinks, credit spreads widen, and any external shock triggers a deeper recession than it would have otherwise.

Why Developing Economies Face a Different Kind of Exposure

Emerging markets do not arrive at this problem from a neutral starting point. Many already carry shallow domestic capital markets, partial dollarization, and low institutional confidence in central banks. The habits and infrastructure for informal dollarization exist in a large number of developing economies. Stablecoins slot directly into pre-existing behavior — people already know how to move outside local currency when confidence breaks down. The new element is speed and accessibility.

Retail adoption of crypto assets for inflation hedging and remittances already runs high in several emerging market and developing economies (EMDEs). The IMF points out that supervisory and anti-money-laundering frameworks in many of these countries also lag behind, which means foreign stablecoin issuers can operate without full oversight.

On the regulatory side, authorities should treat systemic stablecoins as payment instruments subject to requirements on reserves, redemption rights, governance, and disclosure. Capital-flow management frameworks need explicit coverage of crypto-asset channels to stay effective. International coordination through bodies like the FSB and FATF reduces the chance that issuers escape oversight by operating from lightly regulated jurisdictions.

Some countries are also exploring central bank digital currencies or tightly regulated tokenized deposits as a way to offer digital payment efficiency without surrendering control over money supply.

For traders and analysts covering EM assets, the IMF’s message places large-scale stablecoin adoption squarely inside the macro-financial risk framework. On-chain stablecoin flow data, local regulatory progress, and proxies for cryptoization — such as the share of commerce or savings denominated in stablecoins — are becoming relevant inputs for assessing capital-flight risk, bank funding stability, and exchange-rate pressure in vulnerable economies.

Stablecoins that remain unregulated by governments and banks represent a transformative opportunity in the financial market, enabling near-instant cross-border payments at minimal cost, genuine financial inclusion for millions of people without access to traditional banking services, and effective resistance to arbitrary censorship or asset freezes.

These stablecoins promote personal financial sovereignty, drive permissionless innovation in DeFi—such as lending, yield generation, and automated payments through smart contracts—and serve as an accessible gateway to widespread crypto adoption, especially in emerging economies affected by inflation or capital controls.

Crypto Economy, as a platform dedicated to cryptocurrency news and crypto ecosystem development, strongly supports this vision by actively advocating for the deregulation of cryptocurrencies, championing an environment where decentralized innovation and individual sovereignty take precedence over centralized interventions that restrict the potential of these technologies.