TL;DR

- Hyperliquid compensated affected traders with nearly $2 million in USDC after a sudden API disruption halted trading for 37 minutes last week.

- The decentralized exchange confirmed that the issue stemmed from a surge in traffic, not a security exploit.

- This prompt refund and transparent communication could enhance trust in decentralized platforms competing with traditional exchanges.

After last week’s unexpected service interruption, decentralized derivatives exchange Hyperliquid moved swiftly to calm user concerns by reimbursing $1.99 million in stablecoins. The outage, which lasted just over half an hour, prevented traders from executing orders and prompted speculation about a possible hack. However, Hyperliquid quickly clarified that the cause was an overwhelming spike in user activity that overloaded its API servers, rather than any exploit or breach.

The reimbursement process was straightforward for most affected traders. On-chain data confirmed that funds were sent directly to users’ wallets, demonstrating how decentralized platforms can handle crisis management without lengthy legal procedures. Traders with claims above $10,000 must complete KYC verification to receive the full balance, with a deadline of August 18. So far, partial payments have been issued to those large-claim accounts while they finalize the identity check.

Decentralized Exchanges Compete With Centralized Giants

Hyperliquid’s decisive action sets a standard for other decentralized exchanges. Despite suffering a $6.26 million loss from an unrelated exploit involving the Jelly my Jelly memecoin in March, the platform has rebounded impressively. Recent CoinGecko data ranks Hyperliquid as the world’s seventh-largest derivatives exchange, handling over $10.6 billion in 24-hour open interest, up five spots since April.

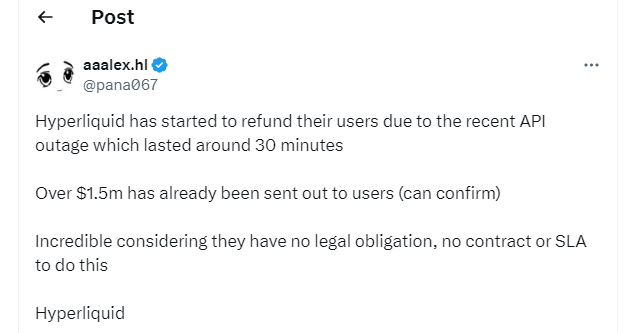

Many traders see this rapid reimbursement as proof that decentralized models can offer reliability and user protection comparable to traditional centralized exchanges. Hyperliquid trader aaalex praised the move on social media, emphasizing that the company had no contractual obligation to refund traders yet did so voluntarily, reinforcing its credibility.

Record Traffic Pushes Platform To New Heights

The API bottleneck occurred soon after Hyperliquid hit a record $14.7 billion in total open interest. According to the team’s Telegram update, the sudden rush in traffic overwhelmed the API servers, resulting in delayed order processing and error messages despite transactions reaching the blockchain.

The crypto space keeps evolving, and Hyperliquid’s quick response demonstrates that decentralized solutions can adapt just as effectively—sometimes more so—than their centralized counterparts. By owning up to operational challenges and compensating users fairly, Hyperliquid aims to solidify its reputation among traders seeking transparent, self-custodial alternatives for high-volume derivatives trading.