Zero Knowledge Proof (ZKP) and Hyperliquid’s HYPE token are increasingly appearing in market discussions as analysts evaluate different models shaping decentralized finance heading into 2026. While ZKP is being assessed through its presale auction structure and privacy-focused infrastructure design, Hyperliquid represents a mature decentralized derivatives platform measured through live trading activity and fee generation.

Together, these two projects highlight contrasting approaches within the crypto ecosystem. ZKP reflects early-stage experimentation around zero-knowledge cryptography, AI-related computation, and alternative token distribution mechanisms, while Hyperliquid is evaluated based on operational scale, capital efficiency, and sustained user activity.

Hyperliquid’s Performance Metrics and Capital Efficiency

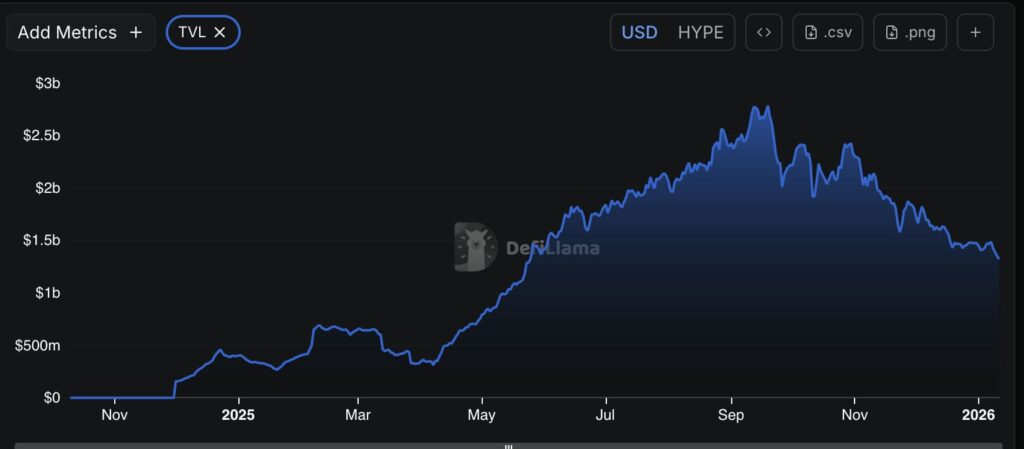

Hyperliquid has drawn analyst attention due to the scale of its trading activity relative to locked capital. According to publicly available data, total value locked (TVL) is estimated between $530 million and $550 million, while monthly perpetual trading volume has exceeded $165 billion.

This produces a notably high volume-to-TVL ratio when compared with other decentralized trading platforms. In addition, protocol fee generation has remained elevated, with recent estimates placing annualized fees above $1 billion. These figures point to strong usage, though they do not guarantee long-term sustainability, as volumes may fluctuate alongside broader market conditions.

Analysts also highlight rising average revenue per user, suggesting deeper engagement among active traders. However, these metrics remain sensitive to shifts in liquidity cycles and competitive pressure from both centralized and decentralized alternatives.

Fee Buyback Model and Supply Dynamics

One of Hyperliquid’s most discussed design features is its fee allocation structure. The protocol directs a substantial portion of collected fees toward token buybacks, gradually reducing circulating supply.

Available data indicates that a significant quantity of HYPE has already been repurchased through this mechanism. Some analysts view this structure as aligning token supply with protocol performance, while others note that buyback-driven models remain dependent on sustained trading activity.

From an analytical standpoint, this approach introduces characteristics sometimes compared to equity-style value capture, though it remains subject to regulatory uncertainty and changing user behavior across the DeFi sector.

Zero Knowledge Proof (ZKP): Presale Structure and Infrastructure Focus

Zero Knowledge Proof (ZKP) is being evaluated primarily through its presale distribution model and technical design rather than live market performance. The project is currently distributing tokens via a structured daily auction, where a fixed allocation is released every 24 hours and distributed proportionally based on total participation.

According to project disclosures, ZKP’s development team allocated internal funding toward infrastructure before initiating token distribution. The network emphasizes zero-knowledge cryptography as a foundational element, targeting use cases related to privacy-preserving data verification and AI-oriented computation.

Participation outcomes depend on aggregate demand during each auction period rather than predefined pricing tiers, positioning the presale as a price-discovery mechanism rather than a fixed allocation sale.

Infrastructure Development and Early Network Activity

Project materials reference active testnet components and specialized hardware devices designed to support verifiable computation workloads. These elements are presented as part of an effort to demonstrate technical readiness prior to public market trading.

ZKP has also cited external collaborations and community-based incentive programs aimed at encouraging early engagement. As with all presale-stage initiatives, the longer-term relevance of these efforts will depend on execution quality, adoption, and evolving regulatory considerations.

Market Perspective

Zero Knowledge Proof and Hyperliquid occupy different positions within the crypto ecosystem. ZKP is assessed based on development progress, transparency, and the structure of its early distribution model, while Hyperliquid is evaluated through live trading metrics and protocol-level performance.

For market participants, this contrast highlights the range of risk profiles present in digital assets—from early-stage infrastructure projects still in formation to established DeFi platforms with measurable activity.

Final Thoughts

ZKP’s visibility reflects growing interest in privacy-focused blockchain infrastructure and alternative presale mechanisms, while Hyperliquid’s HYPE token continues to attract attention due to strong usage metrics and a distinctive fee allocation model.

As 2026 approaches, observers increasingly emphasize execution quality, transparency, and sustainability over short-term narratives. Across both projects, long-term outcomes will ultimately be shaped by adoption, regulatory clarity, and real-world usage rather than early-stage attention alone.

For More Information (Informational Links Only)

Auction: https://auction.zkp.com/

Website: https://zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.