TL;DR

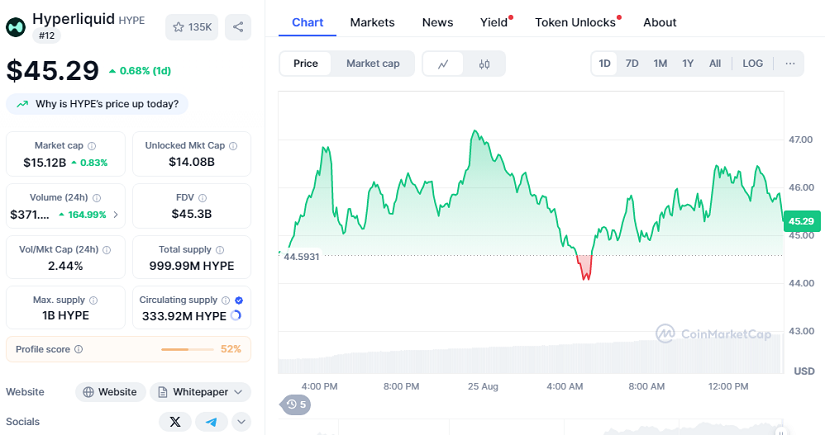

- Hyperliquid’s token HYPE briefly surged 4% to $47.18 before settling at $45.29, with a 24-hour performance of +0.68%.

- The project now commands a $15.12 billion market cap and daily volumes exceeding $372 million, up 165% compared to the previous day.

- Arthur Hayes’ forecast of a possible 126x price increase has fueled optimism as Hyperliquid consolidates nearly 80% of the decentralized perpetuals market.

Arthur Hayes, co-founder of BitMEX, created excitement at WebX 2025 in Tokyo by predicting that Hyperliquid’s token HYPE could grow 126 times in value over the next three years. The bold forecast came just hours before HYPE reached $47.18, a 4% intraday increase, before stabilizing at $45.29. As of now, the token shows a 24-hour gain of 0.68%, backed by over $372 million in trading activity, representing a 165% surge in daily volume. With a $15.12 billion market cap, HYPE is standing out as one of the most resilient assets in today’s volatile market.

Hyperliquid, a decentralized exchange focused on perpetual futures, has steadily strengthened its position as a leader in decentralized finance. While many cryptocurrencies have struggled during recent market pullbacks, Hyperliquid continues to attract capital and users, benefiting from its efficiency and community-driven model.

Record Metrics Reinforce Growth

Platform data underscores its rise. On August 25, Hyperliquid recorded an all-time high of 198,397 open positions with open interest surpassing $15 billion and wallet equity over $31 billion. Daily spot volumes climbed as high as $3 billion, including $1.5 billion in Bitcoin, confirming its growing role as a trading hub for both centralized and decentralized markets.

Revenues are also expanding, with August generating $87 million, its strongest monthly performance so far. Unlike rivals that struggle to monetize trading activity, Hyperliquid reinvests 97% of fees into HYPE buybacks, creating a sustainable feedback loop for holders. Analysts highlight this approach as one of the reasons behind the project’s enduring momentum.

Stablecoin Expansion And Regulatory Signals

Hayes’ optimism rests heavily on the growth of stablecoins, which power the majority of DeFi activity. Their increasing adoption, combined with regulatory clarity in the United States, provides fertile ground for platforms like Hyperliquid. SEC Chair Paul Atkins has emphasized “proper guardrails” that would allow retail investors greater access to private tokens, potentially unlocking new capital for the sector.

Despite these favorable developments, Hyperliquid still faces risks, such as validator concentration and dependence on sustained trading volumes. However, its track record of converting user engagement into measurable revenue sets it apart.