TL;DR

- Core Innovation: Huma Finance introduces PayFi, merging DeFi with real-world payments through tokenized assets and stablecoin liquidity.

- Token Utility: The HUMA token drives governance, incentivizes liquidity, and incorporates a deflationary buy-and-burn mechanism.

- Future Outlook: Price forecasts for 2025‑2030 suggest steady growth potential, with varying scenarios from conservative to highly bullish.

Huma Finance is a blockchain-based protocol pioneering the concept of PayFi, a financial infrastructure designed to merge DeFi with real-world payment systems. Unlike traditional DeFi platforms that focus primarily on lending or yield farming, Huma Finance emphasizes global payment settlements, invoice financing, and credit access through tokenized real-world assets.

By leveraging stablecoins and decentralized liquidity pools, the platform enables businesses and individuals to access instant liquidity while reducing inefficiencies in cross-border transactions. This positions Huma Finance as a bridge between traditional finance and the emerging decentralized economy.

The HUMA Token

At the core of the ecosystem lies the HUMA token, which serves multiple purposes within the protocol. It functions as a governance token, granting holders the ability to participate in decision-making processes that shape the platform’s evolution. Additionally, HUMA incentivizes liquidity providers and aligns the interests of participants across the network.

With a total supply of 10 billion tokens, the protocol incorporates a buy-and-burn mechanism that uses a portion of protocol fees to reduce circulating supply, creating deflationary pressure over time. The token is actively traded on major centralized exchanges such as Binance, KuCoin, and Bitget, as well as decentralized exchanges on Solana, ensuring accessibility for a wide range of investors.

Why Huma Finance Matters

Huma Finance stands out in the competitive DeFi landscape by integrating real-world asset tokenization into its payment and credit solutions. This approach allows businesses to convert invoices into collateral, unlocking upfront liquidity while offering stablecoin yields to liquidity providers. By combining compliance-ready institutional services with permissionless retail access, Huma Finance appeals to both enterprises and individual users seeking efficient financial tools.

Opening the Door to Price Predictions

As Huma Finance continues to expand its ecosystem and adoption grows, the question of its long-term value becomes increasingly relevant. The following sections will explore Huma Finance price predictions for 2025 through 2030, analyzing potential growth drivers, market challenges, and broader industry trends that could shape its trajectory.

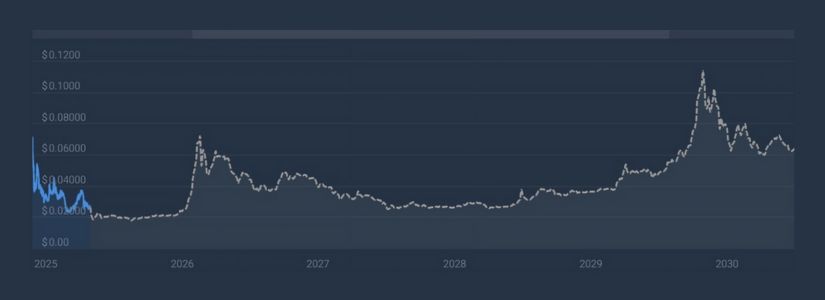

Huma Finance 2025 – 2030 Price Prediction

Huma Finance Price Outlook for 2025: Early Growth Potential

For 2025, CoinCodex projects that HUMA could trade within a relatively narrow channel, ranging between $0.0193 and $0.0276. This forecast suggests an average annualized price of approximately $0.0219, which would translate into a modest potential return on investment of around 0.75%. Such a projection highlights a conservative outlook.

On the other hand, alternative analyses present a more optimistic scenario for HUMA’s 2025 performance. According to technical forecasts, the token could reach a minimum price of $0.0403, with potential highs climbing to $0.0437 and an average trading value of $0.0418. This outlook nearly doubles the price range suggested by CoinCodex.

Youtubers Prediction for HUMA

Crypto With James, a popular YouTube channel, has shared an interesting price prediction video about HUMA, analyzing multiple key metrics and on-chain market performance.

Huma Finance Forecast 2026: Market Trends and Adoption Signals

According to DigitalCoinPrice, there is a possibility that HUMA could break through the $0.0697 barrier and sustain its position in the market by the end of 2026. The forecast suggests that the lowest price range for HUMA may fall between $0.0589 and $0.0697, while the most likely trading value is expected to stabilize around $0.0648. This projection reflects a steady upward trajectory.

Complementing this outlook, technical analysis points to an even more ambitious trajectory for HUMA in 2026. As the halving event approaches, the token is projected to potentially reach a peak price of $0.077094, supported by historical market data and technical indicators. The analysis further estimates an average price of $0.068834, with a minimum forecasted level of $0.060574.

Huma Finance 2027 Price Projection: Mid-Term Opportunities

CoinDataFlow’s experimental models suggest that HUMA could experience a notable upswing in 2027, with projections pointing to a potential 32.84% increase. In the best-case scenario, the token may reach $0.036578, while trading throughout the year is expected to fluctuate between $0.013923 and $0.036578.

In contrast, AI-driven forecasts for 2027 paint a more bullish picture for HUMA/USD. Analysts anticipate the token could climb to a peak of $0.057972 in December, with a low of $0.028148 in May, averaging around $0.043601 across the year.

HUMA Price Trajectory 2028: Evaluating Market Momentum

In 2028, HUMA is projected to trade within a channel ranging from $0.0261 to $0.0391, with an estimated average annualized price of $0.0288. Based on this outlook, investors could see a potential return on investment of approximately 42.45%. While the range suggests moderate volatility, the forecast highlights the possibility of steady gains for those holding HUMA through the year.

However, deeper technical analysis of historical price data paints a far more ambitious picture for HUMA in 2028. Projections indicate a minimum value of $0.1347, with the potential to climb as high as $0.1571, and an average trading price of $0.1384. This outlook significantly exceeds the earlier estimates.

HUMA Valuation Trends 2029: Signals from the Crypto Cycle

Analysts anticipate that HUMA could experience significant growth in 2029, potentially setting new highs in both price and market capitalization. Projections suggest that the token may surpass the $0.13 threshold, with estimates placing its maximum value at $0.13 and its minimum around $0.11 within the five-year outlook leading into 2029.

Building on the bullish momentum of the previous year, 2029 is expected to deliver even stronger performance for HUMA. Forecasts indicate that the token could average $0.10785 throughout the year, with price swings ranging from a low of $0.066941 in May to a high of $0.15958 in December.

HUMA Long-Term Projection 2030: Shaping the Future of PayFi

Experimental simulations suggest that HUMA could experience substantial growth by 2030, with projections indicating a potential increase of 392.92% under ideal conditions. In this scenario, the token may reach as high as $0.135732, while trading throughout the year is expected to fluctuate from $0.046945 to $0.135732.

At the same time, technical analysis points to an even more bullish outlook for HUMA in 2030. Forecasts suggest that the token could achieve a maximum price of $0.187228, with an average trading value of $0.178968 and a minimum of $0.170708. These figures imply that a strong bull market trend may dominate the cryptocurrency sector during this period.

Conclusion

Huma Finance’s innovative PayFi model positions it as a transformative force in bridging DeFi and real-world finance. With its tokenized asset approach, governance-driven ecosystem, and expanding adoption, HUMA shows potential for long-term growth. While forecasts vary, its unique value proposition underscores its relevance in shaping the future of decentralized payments.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.