Identifying early-stage meme coin projects is a common focus for market participants, particularly when tokens have not yet started trading on exchanges.

Market attention can shift quickly across narratives and categories. Some participants also track early-stage token sale ecosystems, focusing on how projects present transparency, narrative, and intended utility.

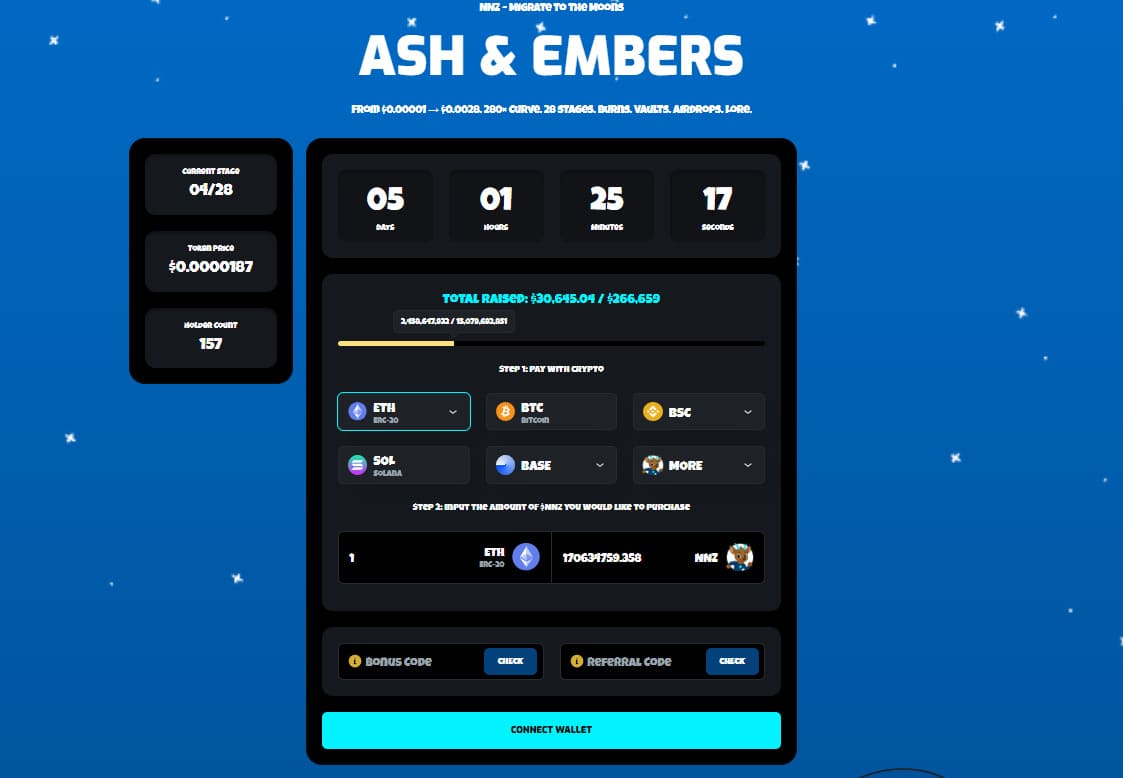

One project that has recently drawn attention is Noomez ($NNZ), which the team describes as a staged token sale.

According to its published materials, Noomez uses a 28-stage token sale model and references token burns, a roadmap, a reward mechanism, and a narrative-driven holder system.

Why New Meme Coins Are Getting More Attention in 2025

Some staged token sales attract interest because pricing and supply mechanics are defined in advance by the project. However, these structures do not remove market risk, and post-listing price formation can differ materially from token sale pricing.

Two features often highlighted by projects that use staged models include:

- Stage-by-stage price changes (which can create time sensitivity in marketing)

- Supply-reduction mechanisms such as burns (which may affect circulating supply, depending on implementation)

More broadly, meme coins can experience high volatility driven by social interest and liquidity conditions. Evaluating any early-stage token involves reviewing documentation and understanding that outcomes are uncertain.

How to Judge Early-Stage Token Sales Before Listing

When comparing early-stage token sales, commonly reviewed items include:

- A clearly described multi-phase token allocation

- Supply terms (fixed, capped, or deflationary) and how they are implemented

- Documentation that outlines intended pre-launch and post-launch utility

- Any ongoing rewards program and its rules (if applicable)

- Fair-access measures (for example, anti-bot claims) and whether they are verifiable

- On-chain data that supports community growth claims

Noomez publishes project-reported figures on its dashboard, including Holder Count: 156 and Total Raised: $30,645.04 at the time of writing. These figures may change and should be independently verified where possible.

Project Overview: Noomez Features Described by the Team

In project materials, Noomez presents two components it says are central to its ecosystem: The Noom Vault and The Noom Engine.

The Noom Vault (Stage 14 and Stage 28 Events)

The project describes “Vault” milestones that combine rewards and supply-related actions tied to participation and engagement.

Stage 14 is described as the first Vault, which may include:

- USDT rewards (as described by the project)

- $NNZ token distributions

- Lore-related content

- A supply burn

Stage 28 is described as the final Vault event and may include:

- 28M $NNZ airdrop

- First Edition NFTs

- A burn event

- An Engine partner reveal

- A countdown timer referenced by the project

As with similar campaigns, readers should treat these items as project plans rather than guaranteed outcomes.

Stage-Based Pricing and Timing Considerations

Projects that use staged token sale pricing typically communicate upcoming stage changes and corresponding price adjustments. This information is part of the project’s marketing and does not indicate future market performance after listing.

- The project states that the token sale price changes as stages progress

- The project also indicates stage numbers for its current and upcoming phases

Noomez’s site has listed figures such as $0.0000187 for a stage price and the project-reported dashboard totals referenced earlier. Any interpretation of these figures as “demand” or a signal of future returns is speculative.

Given the nature of meme coins and early-stage token sales, participants typically consider factors such as liquidity, token distribution, lockups/vesting (if any), smart-contract risk, and the possibility that a token may not list or may trade below token sale prices.

Referral System (Project-Described Incentive)

The project also describes a referral program in which purchases made through a referral code trigger a 10% bonus for both parties. Incentive programs like this can influence participation and should be understood as marketing mechanics rather than indicators of investment quality.

Overall, Noomez presents a staged token sale structure, supply-related mechanics, and a roadmap-driven narrative. Readers should independently verify claims and assess risks associated with early-stage tokens.

For More Information:

Website: Visit the Official Noomez Website

Telegram: NoomezOfficial on Telegram

Twitter: Follow Noomez ON X (Formerly Twitter)

This article contains information about a cryptocurrency token sale. This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. As with any initiative within the crypto ecosystem, readers should do their own research and carefully consider the risks involved.