The XRP price is struggling to recover as selling pressure weighs on the asset. Litecoin is also showing weakness with slower mining activity. This shift in sentiment is drawing more attention to Unilabs Finance, as hedge funds see fresh opportunities for growth.

Market experts believe UNIL could be the prime destination for hedge fund inflows this August. Its rapidly growing presale and innovative tools add weight to projections that as much as $20 million could flow into the project.

XRP Price Recovery Stalls as Hedge Funds Trim Positions

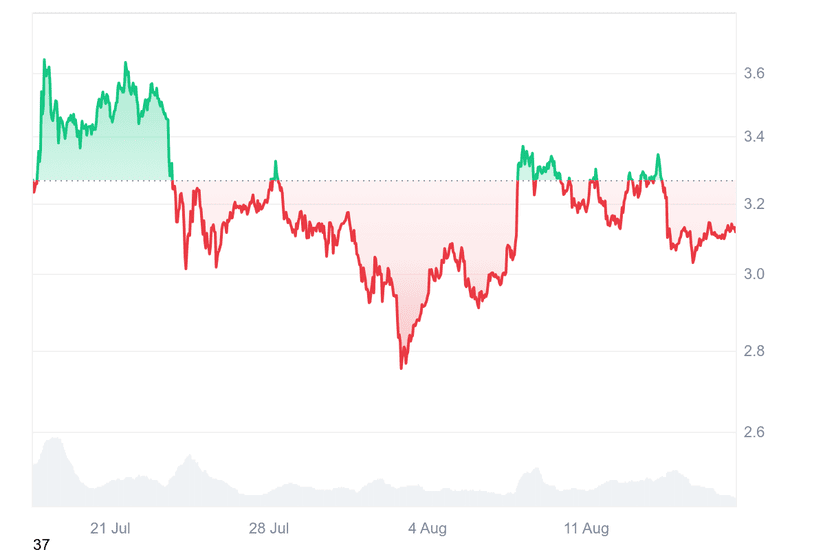

The XRP price is trading at $3.12, showing signs of downward pressure fueled by headwinds from hedge fund activities. A decisive move above $3.55 could open the door to new record levels.

Source: CoinMarketCap

Meanwhile, analyst Ali Charts noted that institutional investors have been building positions around the $2.81 mark, with nearly 1.7 million XRP accumulated at that price. In fact, this shows that big players see this zone as a support level.

However, the XRP price slipped under $3.13 earlier this month before quickly recovering. This sluggish performance is one reason hedge funds are reportedly shifting millions away from XRP and even Litecoin mining positions, looking for better opportunities.

Market watchers now believe that Unilabs Finance could be the destination for these outflows. They believe that as much as $20M might rotate into the project in August.

Litecoin Mining Slump Puts LTC Under Pressure

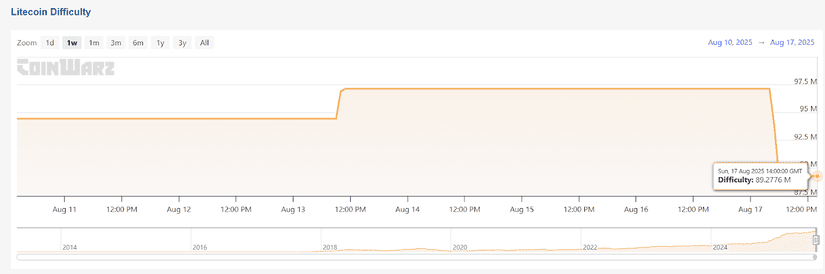

Similar to the recent XRP price movement, Litecoin (LTC) has also struggled to gain momentum. Analysts point to weaker Litecoin mining activity as one of the reasons behind the slowdown.

Recent data shows that Litecoin mining difficulty has slipped from a peak of 97 million on August 13 to about 89.27 million. This drop signals that fewer resources are being committed to securing the network, often a sign of slowing interest from miners.

Source: CoinWarz

Since mining rewards are a key source of supply, reduced participation could affect both sentiment and price action. Analysts warn that the current Litecoin mining trend may trigger selling pressure as more coins are easily mined.

In that case, the LTC price, much like the XRP price, could face additional downside. With hedge funds already trimming exposure to Litecoin mining, investors are watching whether these outflows could spill over into other assets like Unilabs Finance.

Unilabs Finance Gains Hedge Fund Attention: Can UNIL Attract $20M Outflows in August?

With the XRP price facing continued downward pressure, hedge funds are beginning to shift their focus toward Unilabs Finance. At the same time, challenges around Litecoin mining have also raised concerns, leading investors to search for stronger opportunities in the DeFi space.

Unilabs is gaining attention because it offers user friendly and AI tools that aim to improve trading for everyday investors. Below are some of the tools Unilabs offers:

- Tools like Market Pulse and the Memecoin Identification Tool can help users discover digital assets with real growth potential.

- The Early Access Scoring System (EASS) can rate new projects based on listing potential, credibility and overall market trends.

- For diversified exposure, Unilabs provides unique funds covering different areas of crypto, including Bitcoin, AI, Mining and RWA sectors.

- The passive income program appeals to users who prefer long-term gains without needing to actively manage their portfolios.

Currently trading at just $0.0097, the UNIL token has rallied on growing investor interest and upcoming milestones. Compared to the XRP price and the costs tied to Litecoin mining, this low entry point makes it attractive to both retail and institutional investors.

The project’s presale has already raised over $13 million, selling nearly 1.9 billion tokens as it nears the end of stage 6. Given this strong performance, analysts believe Unilabs could pull in as much as $20 million this month.

Conclusion

With the XRP price struggling to maintain momentum and Litecoin mining activity slowing, hedge funds are clearly seeking alternatives that offer both growth and stability. Experts suggest Unilabs Finance could capture this redirected capital.

If current trends hold, August could mark a turning point where Unilabs secures up to $20 million in hedge fund inflows. Investors should act now to potentially benefit from the platform’s long-term growth.

Those seeking increased returns should use the code “UNIL40” to receive a 40% benefit on all purchases.

Discover the Unilabs (UNIL) presale:

Presale: https://www.unilabs.finance/

Telegram: https://t.me/unilabsofficial/

Twitter: https://x.com/unilabsofficial/

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice