Market commentary has recently focused on Hedera (HBAR) and Remittix (RTX) as Q3 draws to a close. Hedera has highlighted enterprise partnerships and public-sector use cases, while Remittix has reported more than $26.4 million in funding related to its cross-border payments concept.

Both projects are presented by supporters as aiming to connect blockchain infrastructure with real-world payments and settlement use cases, though outcomes remain uncertain.

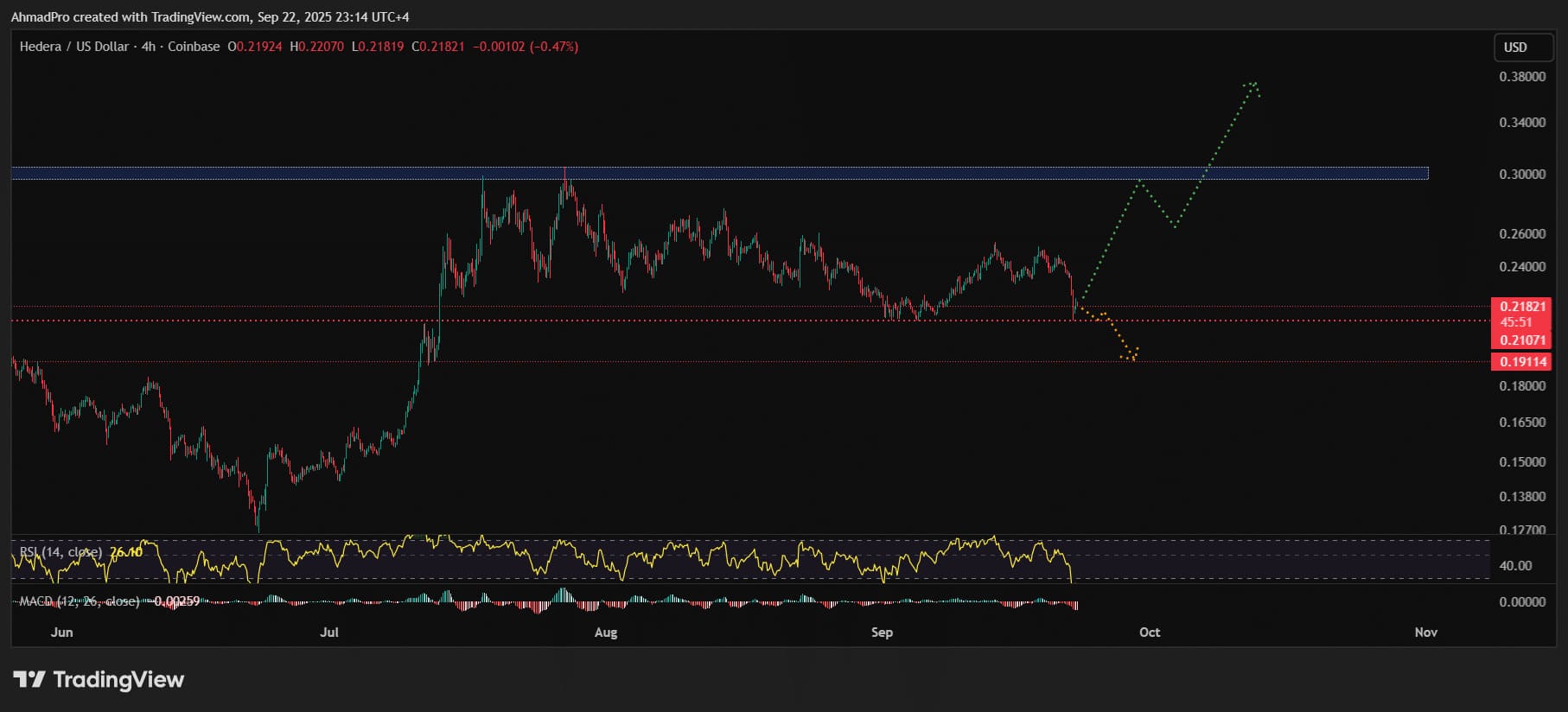

HBAR technical levels traders are watching

HBAR has drawn renewed attention amid announcements tied to Hedera’s network. Hedera has said it was selected as the blockchain infrastructure for Wyoming’s Frontier Stable Token, described as a state-issued stable token initiative in the U.S. As with similar initiatives, the broader implications for adoption and market impact are difficult to quantify.

Separately, Hedera-related updates have referenced the project’s presence at the World Economic Forum in Davos, where Chief Policy Officer Nilmini Rubin is expected to represent the organization. Hedera has also discussed work related to AI governance through the AI Governance Alliance. Previous market moves around major events are historical and do not predict future price performance.

Currently, HBAR Price today has been trading around the $0.21–$0.22 area, which some traders treat as a support zone. If price rebounds, market participants may watch levels around $0.30 and $0.35 as potential resistance areas, but these are not guarantees and technical setups can fail.

More broadly, Hedera’s public-sector and institutional collaborations are often cited by observers as differentiators, although the token’s performance will still depend on market conditions and execution risk.

Remittix: project claims around payments and funding

Remittix (RTX) markets itself as a payments-focused project aimed at cross-border transfers. According to project materials, it uses a “PayFi” model intended to reduce costs and settlement delays compared with some traditional channels, though real-world performance depends on liquidity, compliance constraints, and counterparties.

The project also reports that its ongoing token sale has been priced at $0.1130 and that it has raised more than $26.4 million while selling more than 668 million tokens. These figures are project-reported and may change.

- Project-reported funding: over $26.4 million, with 668M tokens sold (as claimed by the team)

- The team says a wallet beta is being tested with community participants

- The project has mentioned potential exchange listings; timing and confirmation can change

- The team has described marketing incentives (such as referrals); terms may vary and are not independently verified

The project has also referenced third-party security-related work (including CertiK) and promotional rankings; readers should treat such claims as marketing statements unless independently verified.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.