Every crypto cycle has its “missed moment.” In 2020, it was DeFi summer. In 2023, it was the stealth rise of Hyperliquid (HYPE) — a project that turned early conviction into triple-digit returns. Back then, traders debated whether Ethereum had topped before the alt season rotation began. Those who spotted the shift didn’t just ride ETH — they caught the next wave.

Now, with Ethereum hovering near its highs again, analysts see history repeating. They say Digitap ($TAP), a privacy-first omni-bank bridging crypto and fiat, sits where HYPE did at around $6 — just before its breakout run to $59.

How Hyperliquid’s 2023 Surge Set the Pattern for 2025

Back in early 2023, traders thought the big money had already been made on Ethereum. It had doubled off its lows, and sentiment felt tired. But in the background, money was starting to flow somewhere new — into projects that actually worked.

One of them was Hyperliquid. Its on-chain derivatives exchange found traction fast, offering low fees and near-instant trades when most DeFi platforms were still clunky.

By September 2025, HYPE had climbed from about $3–$6 to more than $59, according to CoinMarketCap data. That’s roughly a 1,400% move in under a year.

Ethereum, by comparison, inched up from roughly $3,300 to $4,500 in the same stretch — solid, but nowhere near explosive. The shift was familiar: once ETH cools off, liquidity looks for the next thing with real utility. In 2023, that thing was HYPE. In 2025, Digitap seems to be in focus.

Market Signs Show a New Altcoin Rotation Has Begun

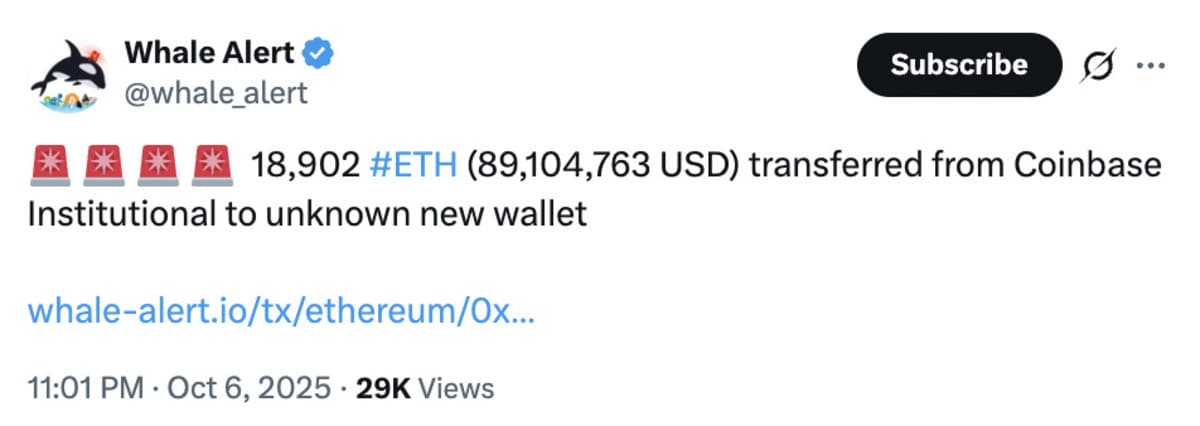

Fast-forward to October 2025. Ethereum is strong but slowing, hovering near its local top, and on-chain data shows increasing flows into smaller-cap assets. According to Whale Alert, large wallets have started redistributing ETH holdings into multi-asset exposure — a behaviour last seen before the 2023 rotation.

What’s different this time is the theme. Back then, it was DeFi infrastructure. Now, it’s real-world finance — bridging crypto into daily payments. Digitap ($TAP) is built for that shift. Its No-KYC Visa Card is already in beta, letting users spend crypto through Apple Pay and Google Pay with instant conversion from any supported asset.

So while Ethereum consolidates near its highs, capital is starting to hunt for practical plays again — projects that already work, not ones still in whitepapers.

Why Digitap Could Be 2025’s Next Breakout Utility Token

Digitap’s structure is straightforward but powerful. The deflationary tokenomics model turns every card swipe into activity for the token: 50% of the platform’s profit buys and burns $TAP, while users get cashback in return. Every transaction tightens supply and reinforces the ecosystem.

That loop — real usage feeding value — echoes how Hyperliquid’s trading volume drove HYPE’s rise. But Digitap adds a real-world twist: instead of traders, it’s everyday users swiping cards.

The numbers back up the interest. The project has raised $632,967, about 88% of its first presale stage, priced at $0.0125. Once the stage closes, the next tier opens higher. In other words, this early-entry presale advantage won’t last long.

Analysts already list it among the top crypto altcoins to watch this quarter — not because of speculation, but due to the fundamental connection between platform activity and token price action.

What’s Different This Time — And Why It Still Matters

Cycles never play out the same way twice. Hyperliquid took off when DeFi volumes were booming; Digitap is riding a different wave — payments. And that wave is huge. The cross-border payments market is on track to pass $250 trillion a year by 2027, yet more than 1.4 billion people still don’t have access to basic banking.

At the same time, most of Gen Z and Millennials already live on their phones — over 70% prefer to manage money through apps — and crypto has more than 560 million users worldwide. That’s a lot of people looking for easier ways to move and spend value.

All of that plays to Digitap’s strengths. Ethereum’s run has stalled, stablecoins are piling back onto exchanges, and on-chain activity is picking up again. The difference is that Digitap actually earns from every transaction, not from speculation. It’s early, yes, but the risk-to-reward balance feels tilted in the right direction.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

The Cycle Is Turning — Don’t Miss the Digitap Window

Crypto doesn’t repeat, but it rhymes — and the verse sounds familiar. Ethereum’s strength has slowed, whales are rotating, and traders are rediscovering utility tokens. In 2023, that setup powered HYPE’s meteoric rise. In 2025, the same logic could lift Digitap.

The project’s presale advantage is narrowing, its first stage almost filled, and its burn-based tokenomics give it built-in scarcity as usage scales. If the next altcoin season is driven by real adoption, not speculation, Digitap’s model puts it right at the centre of that shift.

For early investors, this is the kind of pattern that rarely appears twice in a single market cycle — and when it does, timing decides everything.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.