TL;DR

- Goldman Sachs and BNY Mellon will issue tokenized money market funds on the blockchain, using GS DAP as the foundation and maintaining traditional custody.

- The goal is to use these funds as collateral in derivatives and loans, streamlining transfers and lowering costs between major institutions.

- BlackRock, Fidelity, and other asset managers are joining the pilot. McKinsey projects a $2 trillion tokenized fund market by 2030.

Goldman Sachs and BNY Mellon have launched a joint initiative to issue tokenized versions of money market funds, using blockchain technology as the primary ledger.

The project aims to enable these instruments to be used more efficiently as collateral in financial transactions and to enhance their liquidity through faster transfers. Both banks will rely on GS DAP, Goldman’s proprietary platform, which has previously been used for blockchain-based settlements.

The core idea is to make BNY Mellon-managed funds available in digital format without changing the operational structure of custody. The bank will continue to act as the traditional custodian, while the blockchain will serve as an additional layer to track ownership and facilitate real-time transfers. According to representatives from both institutions, this setup will cut down on time, costs, and complexity in collateral movement across financial entities.

Goldman Sachs and BNY Mellon Merge Traditional and Blockchain Finance

In this initial phase, other firms like BlackRock, Fidelity, Federated Hermes, and the asset management divisions of Goldman and BNY are also joining. The shared objective is to explore how tokenization can improve the operational use of financial assets that currently have limited mobility. Meanwhile, McKinsey forecasts that the tokenized fund market could grow to $2 trillion by 2030, driven by increasing interest from large asset managers looking to integrate blockchain into their internal processes.

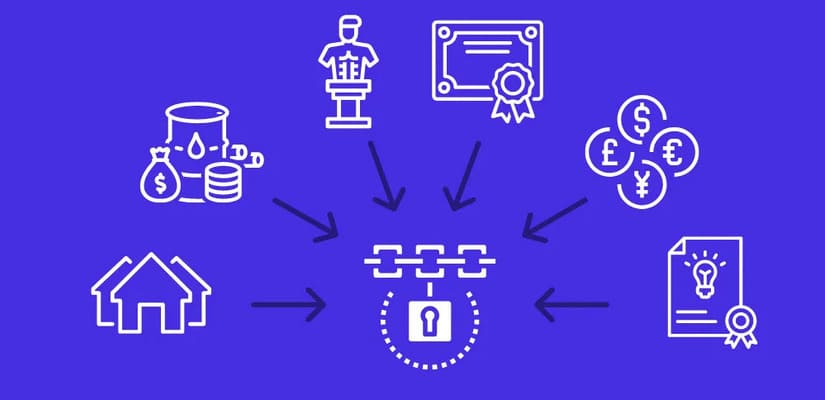

Tokenization doesn’t alter the financial characteristics of the funds, but it does open the door to new use cases in digital ecosystems — including use as collateral in derivatives, loans, or instant settlement. JPMorgan conducted a similar experiment in 2023, when BlackRock tokenized shares of a money market fund and used them as collateral in an over-the-counter transaction with Barclays.

According to Mathew McDermott, head of digital assets at Goldman, interoperability between blockchain and traditional systems is essential for tokens to be practical and scalable. The initiative aims to build long-term infrastructure that allows tokenized funds to move frictionlessly between banks, asset managers, and financial counterparties