TL;DR

- The CZ Statue memecoin collapsed 86% shortly after launch, following a public warning from Binance founder Changpeng Zhao urging users not to buy it.

- The token attempted to capitalize on a golden statue created by fans, raising concerns about profiteering and low-quality celebrity-themed assets.

- Despite the crash, interest in speculative memecoins on BNB Chain remains intense, showing traders are still attracted to high-risk, high-reward crypto opportunities.

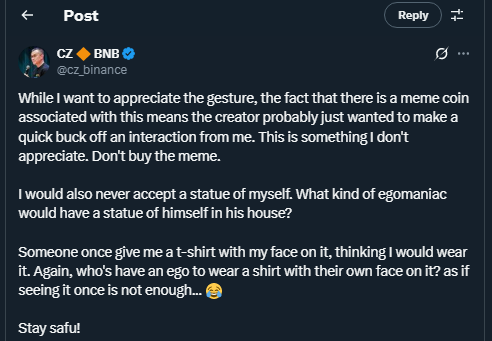

A new memecoin built around a golden statue of Changpeng Zhao faced a dramatic fall only hours after debuting. The asset had briefly reached a valuation above five million dollars before momentum vanished. Zhao publicly discouraged buying the coin, emphasizing that it had no meaningful project behind it and appeared designed purely for short-term profit extraction. His message resonated widely across X, drawing mainstream attention and echoing ongoing debates around the sustainability of celebrity-inspired tokens, especially those lacking transparent roadmaps or long-term developer involvement.

Fan Creation Turns Controversial

The story began when a fan page unveiled photos of a handcrafted golden statue of Zhao and offered to send it to him as a token of admiration. The gesture quickly shifted into controversy once a memecoin tied to the statue surfaced. Zhao stated he appreciated the creativity but disapproved of attempts to monetize the interaction. Data firms reported that over fifteen percent of the token supply was concentrated in a single new wallet, fueling speculation of insider positioning and undermining trust among retail traders who initially supported the launch.

The event follows a pattern seen throughout 2025, with memecoins increasingly tied to influencers or cultural figures. While some have delivered massive gains, many collapsed just as quickly, leaving late entrants with heavy losses. Analysts warn that such speculative coins often lack transparency, fundamentals, and developer accountability. Still, they draw substantial liquidity as traders chase rapid upside and viral exposure through platforms such as X, Telegram, and TikTok.

Speculative Appeal Remains Strong

Despite the steep drop, interest in BNB-based memecoins has not disappeared. Earlier this month, a small trader reportedly transformed three thousand dollars into two million after a separate token linked to a social post from Zhao experienced an explosive surge. This reinforces how social exposure continues to act as a catalyst in decentralized markets.

Pro-crypto observers argue that speculative tokens, while risky, can encourage experimentation and broaden blockchain participation when developed responsibly. They highlight that community-driven projects with clear utility, fair token distribution, and transparent teams can evolve into more robust ecosystems rather than short-lived hype cycles, especially when aligned with constructive engagement instead of opportunistic trends.